A ratio is worth a thousand words

Strong sales or earnings per share growth, consensus beat, attractive dividends, regular share buybacks, big mergers & acquisitions, ... Numerous companies, investors and journalists use all sorts of proofs of value creation. However only one measurement exists: the return on capital employed (compared to the cost of capital).

Il buono, il brutto, il cattivo

Just as Sergio Leone expounded in 1966 with a subliminal message delivered through Blondie: “You see, in this world there's two kinds of people, my friend: those with loaded guns and those who dig…”, there are also two categories in the corporate world: those with a high return on capital employed and those which dig (the loss of stakeholders)…

Even though nowadays many investors in equities tend to forget this point (between 1960 and 2016 the average holding time of a share listed on the New York Stock Exchange went from over 8 years to just a few months…), buying a share means owning part of the underlying company’s capital; and companies which create value are those which invest their capital to generate cash flows with a high rate of return on capital employed – which must be greater than the cost of that capital.

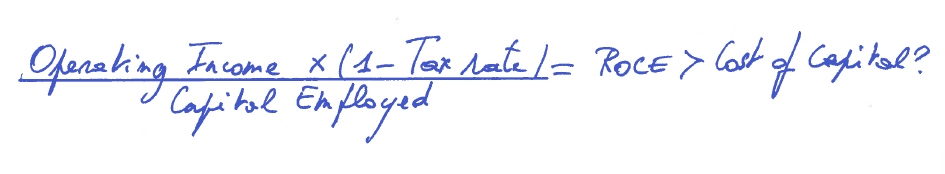

A little formula never hurt anyone

Return on capital employed (ROCE) measures the efficiency with which companies use the capital provided to them by shareholders and creditors. Competitive advantages and entry barriers (networks, licences, patents, vendor lock-in, quality, innovations, brands, etc.) enable some of them to grow and maintain an “abnormally” high ROCE over long periods, despite competitive pressures. This ratio is obtained by expressing the net operating income after tax as a percentage of capital employed.

In the numerator, operating income is earnings from the operating and investment process in the period. It reflects the wealth generated by the company’s industrial and commercial activity.

For the denominator, the capital employed corresponds to the sum of the fixed assets[1] and the working capital[2], i.e. the net sums used by the company for its investment and operating cycles, being the money it needs to function.

A high ROCE can come from high profit margins, i.e. high profitability per unit of turnover (Apple); or from a high capital employed turnover, i.e. high levels of sales per unit of capital invested (KONE); or a combination of the two (Colgate-Palmolive).

The cost of capital, or more precisely, the weighted average cost of capital (WACC), is the minimum level of profitability a company’s investments must achieve to satisfy the providers of capital so that they are prepared to bear the risks of financing the economic asset (by buying/holding the shares). It is an invisible but real cost: the cost of giving up the opportunity to invest their capital in other assets presenting a similar risk.

Logically therefore, to create value, a company must generate an ROCE in excess of its WACC.

The supreme number

“The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in EPS. In our view, many businesses would be better understood by their shareholder owners, as well as the general public, if managements and financial analysts modified the primary emphasis they place upon EPS, and upon yearly changes in that figure.”

Warren E. Buffett, Berkshire Hathaway’s Chairman’s Letter, 1979

As Warren stated decades ago, and despite many business leaders, investors and journalists refusing to admit it, ROCE is the one and only ratio to measure value creation (not growth in earnings per share, for example).

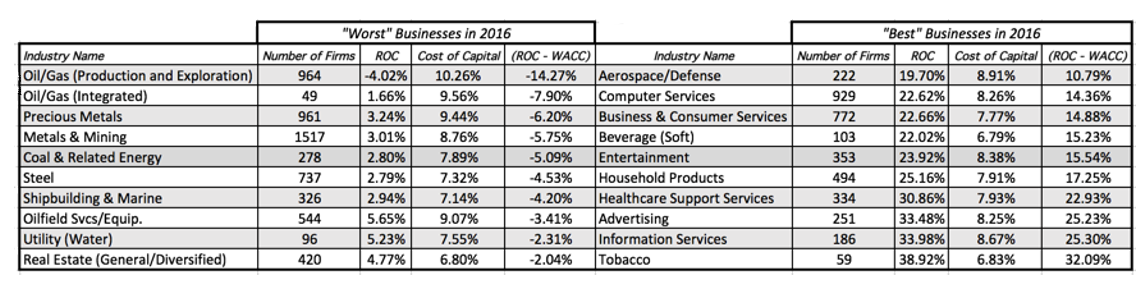

The respected Aswath Damodaran, Professor of Finance at the Stern School of Business in New York, analysed over 42,000 listed companies worldwide and showed that only around a third of them created value in 2016!

Of course, the goal is not to have the highest possible ROCE at any given moment by cutting back on critical investments and expenditures (in plants, R&D, marketing, recruitments, ...) to the detriment of future growth, but to achieve the best mix between growth, maintaining a high ROCE, and generating significant cash flows over the long term.

It is worth stressing that growth, however ginormous, does not change the value of a company if its ROCE does not exceed its WACC, and actually destroys value if it is lower. Profitable growth is the only way of creating value for stakeholders. At BLI - Banque de Luxembourg Investments, it is what we always look for.

ROCE of the least / most profitable sectors worldwide in 2016

Source: A. Damodaran

A friend for life

“We have really made the money out of high quality businesses... Over the long term, it is hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for 40 years, you are not going to make much different than a 6 percent return - even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you end up with one hell of a result. ”

Charles T. Munger, Speech for University of Southern California, 1994

As Charlie Munger, Warren Buffett’s renowned partner, asserts it, for a long-term investor a company’s return on capital is the essential determinant of the total return of its share.

Many investors, perhaps due to an anchoring effect, are satisfied with an ROCE that is close to the average. Our view, disconnected from the indexes, goes more like this: Why risk investing in companies that do not have a high ROCE? Because of their size? Because they are included in a particular index? Because they are the latest craze? For a promise made by Donald Trump? This is not our philosophy.

Investing in a company of average or poor quality, even if its valuation appears very attractive, entails very high risks, whether or not these are invisible and perhaps may never materialise. It therefore makes little sense to assess a performance without studying the methodology which led to it. As Nassim Nicholas Taleb puts it, the past will always be deterministic, since only one single observation took place.

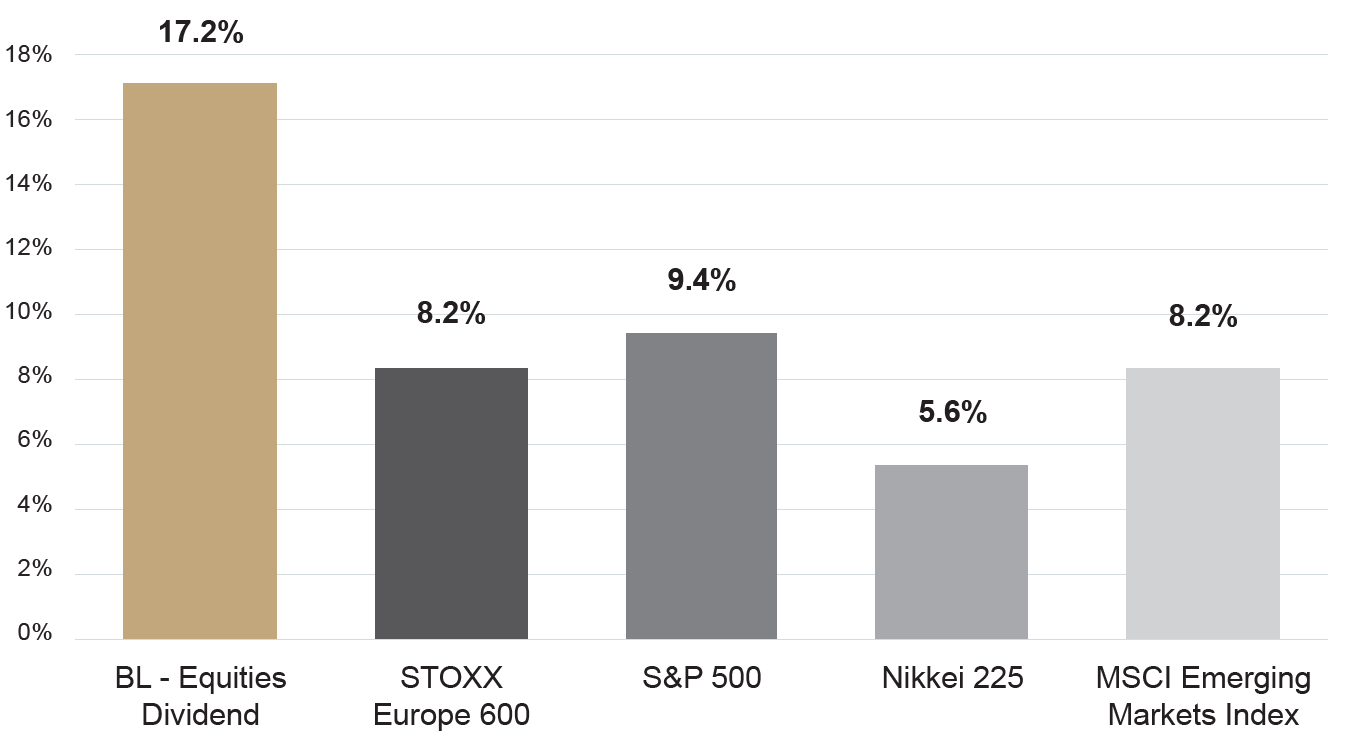

It is for these reasons that in our July 2017 article on “The power of dividends”, we explained that in our BL-Equities Dividend fund, first we select high-quality value-creating companies, then we apply our strict dividend filter to pick those which offer attractive and sustainable yields.

Return on Capital Employed

Source: Bloomberg, BLI

[1] Fixed assets may be tangible, intangible or financial. They serve the activity over a long period of time (sites, plants, machinery, IT equipment, patents, licences, goodwill linked to an acquisition, long-term investments, etc.).

[2] Working capital = inventories + accounts receivable – accounts payable. It is the short-term financing need resulting from lags in cash flows due to the timing of payments out and receipts in.