In the wake of various crises in developing countries, certain key development principles established in the 1980s have been seriously challenged, foremost being the Washington Consensus (WC). Governments in Latin America and Africa, along with a number of respected economists, have denounced the structural adjustment programmes the WC advocated, even describing them as structural impoverishment programmes.

Unsustainable debt

In sub-Saharan Africa, in the immediate aftermath of their independence, public debt increased in most countries to the point of being unsustainable. In 1996, the World Bank and the IMF launched the Heavily Indebted Poor Countries (HIPC) Initiative. This provided for the creation of a reference framework in which all creditors, including multilateral creditors, could grant relief to the very poorest and most heavily indebted countries in the world and thus reduce the constraints imposed by the debt service charge on these countries' economic growth and efforts to combat poverty. (1)

Photo: Ozumba Mbadiwe Way, Victoria Island

Source: African Development Bank

A favourable environment and new realities

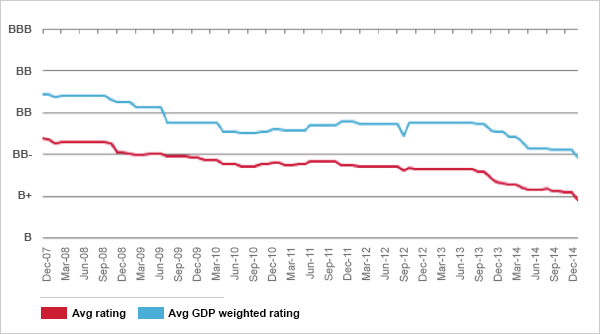

Of the countries concerned, many of those in the sub-Saharan region have increased their debt in recent years. However, rather than contracting multilateral debt, these governments have issued their own debt directly on the financial markets, thereby further ratcheting up their external debt. Quantitative Easing measures in the United States, Japan and Europe together with declining bond yields worldwide fuelled a global quest for higher yields. This created a historic window of opportunity for countries wanting to take advantage of a low interest rate environment. In addition to a favourable economic situation, the better relative health of these various developing economies encouraged them to increase their external debt without unduly damaging their debt-to-GDP ratio even though, generally speaking, it led to a reduction in their average credit rating.

Change in sovereign debt rating of sub-Saharan African countries

Source: Standard & Poor's

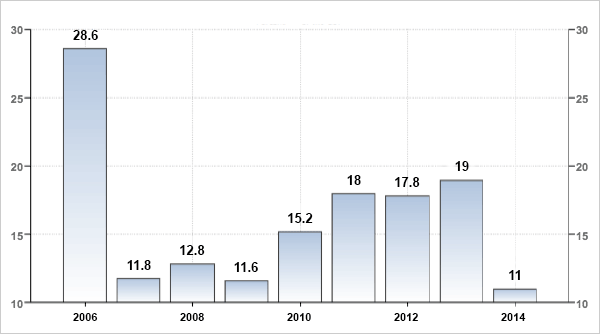

In April 2014, Nigeria revised the way it calculates its GDP. The new methodology showed a more diversified economy that does not only depend on oil and agriculture. The Nigerian economy appears to be dominated by the service sector and non-oil industry. Following this revision, the country became the biggest economy on the African continent, overtaking South Africa and posting GDP of US$510 billion. Its debt-to-GDP ratio dropped to 11% in 2014 compared to 19% previously. Since then, 37 other African countries have decided to revise the way they calculate their GDP.

Nigeria's debt-to-GDP (in %)

Source: Trading Economics

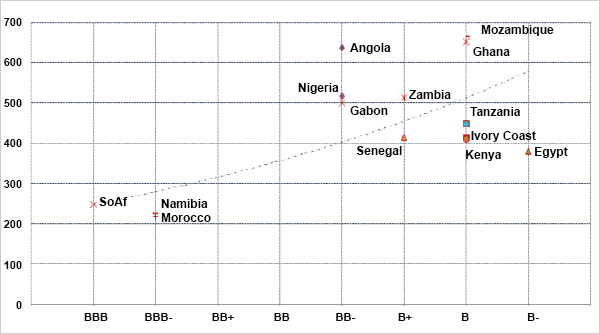

Increasing number of issuers on the markets

For all these reasons, and others specifically related to the dynamism of the various economies concerned, a growing number of governments in sub-Saharan Africa moved to seek finance on the markets, often for the first time: Namibia in 2011, Angola in 2012, closely followed by Kenya, Ghana and Senegal, have gradually appeared in the various indices listing emerging country issues. In 2014, Ivory Coast's US$750 million issue attracted orders amounting to nearly US$5 billion. At the start of the year, the JPMorgan EMBI Global Diversified index posted a yield of around 360 basis points (i.e. 3.6%) higher than US Treasury debt's one. Within the index, Senegal was 410 points above the US yield curve, Nigeria, Zambia and Gabon 500 points, and Angola, Ghana and Mozambique more than 600 basis points above it. These levels prove howvery attractive these "new" debtors are in relative terms.

In 2014 alone, various issuers in the region raised credit of US$8 billion on the international markets, which, according to Standard & Poor's, is a record. In the majority of cases, the issues were oversubscribed.

Yield spreads compared to US Treasury notes (100 basis points = 1%)

Source: JPMorgan, Standard & Poor's and BLI

Risks and uncertainties

Given this situation, the main challenge for the continent is to make the different economies more diversified and their growth more inclusive. Otherwise, there is a danger this increase in debt will produce a new wave ofinsolvent states. For example, Ghana, where government debt has more than doubled to 55% of GDP in the last 7 years, disappointed expectations not just on the markets (the premium is the highest in the region) but also its population. Between 2012 and 2015, inflation rose from 9% to over 16% and GDP growth shrank from 14% to 5%. Added to this are various infrastructure problems including those concerning energy supply. Lastly, to top it all, in the US, the Federal Reserve has announced it will soon start to normalise its interest rates. Such an interest rate rise coupled with the dollar's sharp appreciation would have a significant effect both on debt servicing and capital movements.

(1) "The World Bank: a never-ending coup d'état. The hidden agenda of the Washington Consensus" by Eric Toussaint (originally published in French, 15 March 2006)