As good as gold?

"We have gold because we cannot trust governments." - Herbert Hoover // "Gold is money. Everything else is credit." - J.P. Morgan

After appreciating at the beginning of the year, the price of gold has dropped sharply since April and, on 15 August, reached its lowest level since January 2017. The main reason behind this fall is the strength of the dollar. Since mid-April, the dollar has gone from 1.24 to 1.14 against the euro and it has appreciated against most of the other currencies. The dollar’s strength is partly due to the good performance of the US economy and the Federal Reserve’s monetary policy tightening, and partly to the context of an increase in risk aversion which has helped the US currency recover its safe-haven status. In this regard, the current problems in Turkey are indicative: investors fear a contagion effect to other emerging market countries as well as to eurozone countries because of the interconnection between European countries and Turkey.

Gold generally (but not always) exhibits an inverse correlation with the dollar. Depending on circumstances, the yellow metal and the greenback can both take on the role of safe haven. In the dollar’s case, the determining factor is linked to the state of the US economy, especially in relation to that of other regions. The Asian financial crisis and that of the emerging markets in general in 1997-98, a time when the US economy was riding high, spurred the dollar's strong appreciation. More recently, ongoing doubts about the European construction and the weakness of eurozone growth have contributed to the dollar’s general rising trend over the last seven years. The factors enabling gold to be considered as a safe haven relate to the geopolitical situation, inflation and, more generally, confidence in paper money and in the financial system. More simplistically, you could say that for gold to be seen as a safe haven, confidence in the dollar needs to be low.

A new mentality at the Fed?

As mentioned above, the dollar's current strength is largely based on the divergence between the monetary policies of the leading central banks. The Federal Reserve started tightening its monetary policy under its former Chair, Janet Yellen. However, she was viewed by the markets as being ‘dovish’, in other words ready to stop tightening at the slightest sign of weakness on the financial markets. In contrast, her successor, Jerome Powell, has made it clear that he has no intention of letting the markets influence his monetary policy. Tightening the monetary conditions in the United States – at a time when USD-denominated debt worldwide has increased substantially – is liable to create a shortage of dollars, especially in emerging market countries.

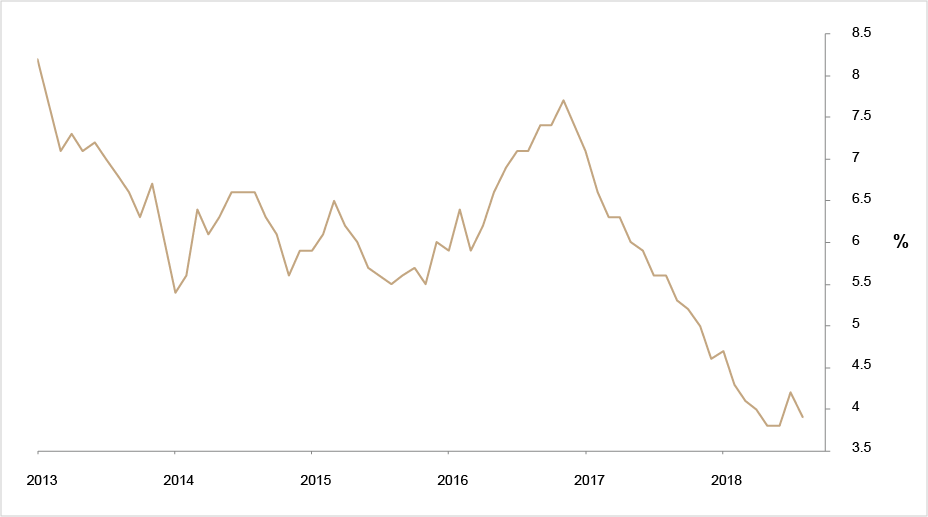

Annual change in the M2 money supply in the United States

Source: Bloomberg

In the short term, the Federal Reserve is set to take advantage of the solidity of the US economy to continue tightening its monetary policy and, thereby, give itself ammunition in case of an economic slowdown. This would logically support its currency. For the longer term, however, we should be aware that the dollar’s current strength is not based on solid fundamentals. The US budget deficit is widening again following the Trump administration's tax reform. The Congressional Budget Office estimates that, as a percentage of GDP, the US budget deficit will increase sharply in the next few years, whereas the opposite is expected in practically all the other member countries of the OECD. The US is also running a large current account deficit. From this perspective, the dollar's current strength conflicts with the US administration's trade policy and the President has already vented his discontent. We cannot therefore rule out the possibility of concerns arising over the independence of the central bank.

Arguments in favour of gold

Irrespective of the dollar's prospects, there is no shortage of arguments in favour of gold over the longer term:

- In an environment of excessive debt, there is a strong possibility of another financial crisis. Such a crisis would further weaken the financial system. In this scenario, there is every likelihood that the central banks would embark on an even steeper set of unconventional measures and thereby accelerate the loss of confidence in paper money.

- In contrast to what happened in the three decades leading up to the 2008 crisis, the central banks now seem determined to create inflation. We should not discount their chances of success in this mission.

- Notwithstanding the Federal Reserve's current monetary policy tightening, real interest rates (i.e. adjusted for inflation) are still very low or even negative. A sharp increase in real interest rates in a context of excessive debt would have very negative consequences on the global economy.

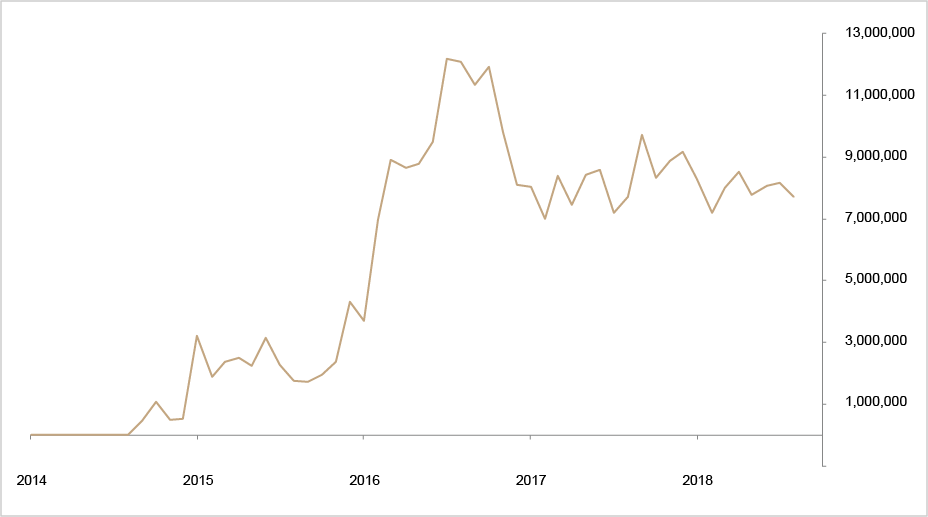

Total value in USD of negative yielding debt (in millions of USD)

Source: Bloomberg

- The geopolitical situation is not particularly reassuring. The confluence of significant social inequalities, the rise of populism, a change in the global order with the progressive decline of the United States as the dominant power, and trade tensions between the United States and some of its partners are among the biggest risks.

- Traditional financial assets are trading at high valuation multiples. Gold is negatively correlated to most of these assets.

- The risks related to the increase in passive investment strategies have been significantly underestimated. A number of these strategies rely on technologies which work in bull markets but have not yet been tested in crisis situations. They offer an illusion of liquidity which could rapidly prove to be false.

- The supply of gold will not increase much in the next few years given the decline in the average lifetime of the mines and under-investment in the development of new fields. Apart from the problem of financing, there is the fact that political and environment-related obstacles are likely to limit the development of new mines.

- More and more countries, starting with China, are challenging the hegemony of the dollar and the competitive advantages that the dollar as a reserve currency gives the United States – what the French economist Jacques Rueff called the ‘imperial privilege’ of the United States. Some observers even think that in the longer term, China could offer convertibility of its currency to gold as a way of ‘de‑dollarising’ Asia and getting the renminbi accepted as an alternative to the dollar. In any case, there is no denying that physical gold is migrating from the West to the East.

In conclusion, gold is in some way an insurance against the risk that things will not turn out as expected. An investment in gold should not be considered as a short-term speculation. Its price will pick up when investors realise that the central banks cannot normalise their monetary policies and undo what they have created through their unconventional monetary policies and manipulation of interest rates. Artificially low interest rates have the effect of bringing forward future consumption and delaying the elimination of unprofitable companies, as well as encouraging speculation. Gold is also a protection in the event of a financial market crash.

Act of faith

It is nevertheless important to be aware that the investment case for gold is inevitably based on an act of faith. Basically, gold belongs to the category of assets that, as Warren Buffett said, will never produce anything, but are purchased in the buyer’s hope that someone else — who also knows that the assets will be forever unproductive — will pay more for them in the future. As such, gold is a sterile asset. Moreover, unlike other commodities, it is never consumed (although that could be considered one of its advantages). Since the early 1970s and the end of the Bretton Woods system (which provided for the convertibility of the dollar to gold), gold’s function as a monetary asset ceased. Anyone investing in gold must therefore be convinced that the historic significance of gold remains valid and that the yellow metal, unlike paper money free of any counterparty risk, will remain a safe haven in times of crisis or great uncertainty, just as it has been in the past.

At the end of the day, gold has two different aspects: a commodity that doesn’t produce any income and a safe haven. In normal times, it is the first aspect that takes precedence and the price of gold is essentially determined by supply and demand trends arising from its individual use (electronics, jewellery, dental care etc.). In times of crisis or at least major uncertainty, the second aspect comes to the fore and the price of gold increases on the back of the additional demand.

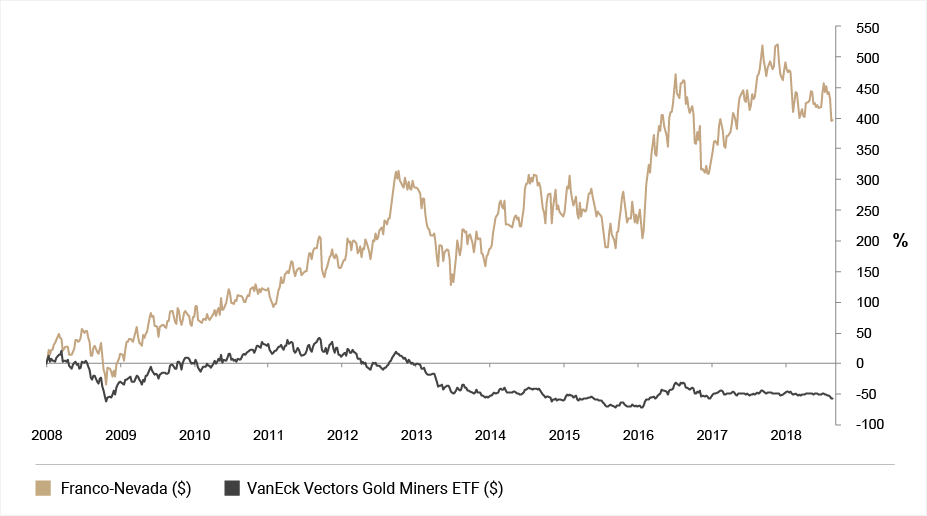

Slump in gold-mining shares

Having held out for a long time against the fall in the gold price, the gold mines index slumped by nearly 13% in the first half of August. In two years, it has fallen by around 40%. Gold-mining companies represent a more aggressive means of investing in gold given the leverage effect they offer on the price of gold. Today, the gold mines index is trading below its October 2008 level, when the price of gold was below $750/ounce. Valuing gold-mining companies is difficult and rather unreliable in that their value ultimately depends on the price of gold. On top of this is the fact that gold-mining companies did not cover themselves with glory in the years from 2008 to 2013, when they put production increases ahead of profitability, and many of them ended up heavily indebted. But the fact is that certain studies show that, based on the current price, the valuation of gold-mining companies is now at its lowest for more than 30 years.

Within this segment, royalty companies (companies which are specialising in the financing of mines and are not, strictly speaking, mining companies themselves) are the better investment due to their superior business model. They are generally better diversified and not exposed to a rise in production costs. The main selection criteria for producers include the quality of the management team, financial position, the lifetime of the fields, production costs, and geopolitical risks in a context in which resource nationalism is starting to rear its head.

Share price of Franco Nevada (royalty company) and the Producers Index since Franco Nevada's IPO

Source: Bloomberg