Earnings growth? What earnings growth?

The earnings season is coming to an end. Companies, especially in the United States, have become very adept at managing investor expectations and presenting their earnings in a way that makes it hard to judge the quality of these earnings or even work out whether these have in fact increased, stayed flat or declined. When a company announces 'better-than-expected' earnings, this does not mean that it is announcing strong or growing earnings. In many cases, it just means that its earnings were less bad than feared.

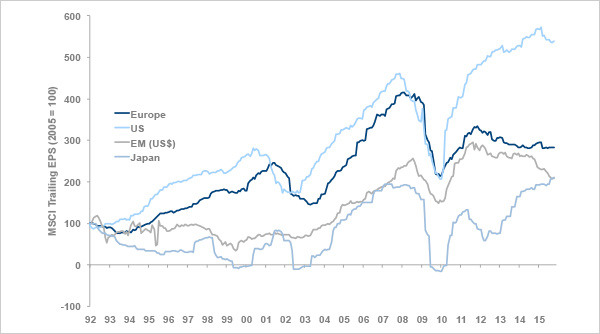

How have company earnings fared? The following graph shows the trend for the main regions, in local currency for the United States, Europe and Japan, and in USD for emerging markets. (Based on trailing 12 months earnings.)

Company earnings

Source: Morgan Stanley

Some observations:

- The United States is the only region in which earnings are significantly above pre-crisis levels.

- The increase in earnings in the United States is mainly due to good cost control and share buybacks, not to a strong increase in sales. As a result, profit margins are far above historical norms.

- Even in the United States, earnings are no longer growing. Compared to the third quarter of 2014, the sales and earnings per share of S&P 500 companies are on track to fall by respectively 5% and 1% (partly due to the dollar's appreciation).

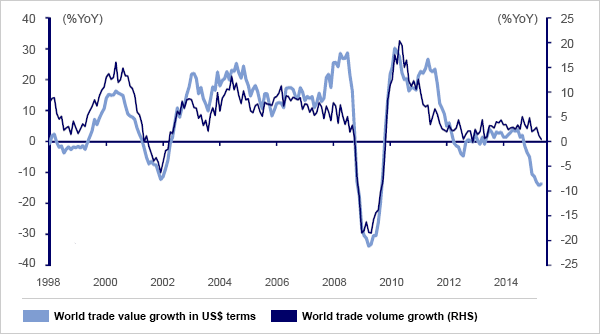

- The sales weakness comes as no surprise. It is a direct result of weak nominal economic growth. The following graph illustrates the weakness of global trade.

Growth in global trade (annual change)

Source: Bloomberg

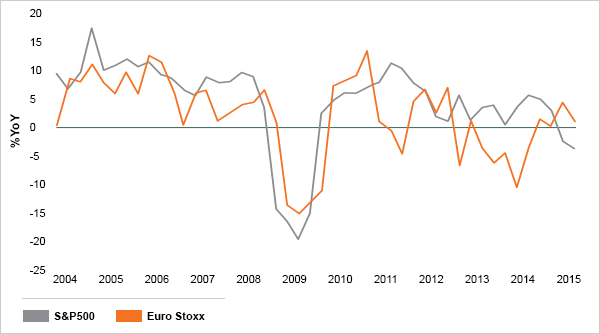

- Companies can take action on costs to improve their 'bottom-line' (earnings), but their 'top-line' (sales) is directly linked to nominal economic growth. The following graph shows that because of weak economic growth, the rise in sales per share is lower than before the financial crisis.

Growth in sales per share in the United States and the eurozone (annual change)

Source: CLSA

- For emerging markets, the downturn in earnings over recent quarters is partly explained by the depreciation of their currencies against the dollar (note that the earnings shown in the first graph are in USD). But the fact remains that equity markets in these countries are often dominated by exporting companies which have suffered from the weakness in world trade and from low growth in industrialised countries.

- Earnings growth in Europe is particularly disappointing and does not justify the rise in share prices. Earnings are now lower than they were three years ago while the market is some 40% higher.

- This could of course be seen as a glass half full, with Europe on the verge of a recovery in earnings, prompted by the euro's depreciation. However, recent announcements are hardly encouraging in this respect and analysts do no longer expect any earnings growth for this year.

- Meanwhile, earnings are continuing to rise in Japan. The Japanese market is thus alone in not having become more expensive in recent years since the rise in share prices reflects the rise in company earnings. Heavier pressure exerted by local institutional investors on companies to improve their profitability should favour a continuation of this favourable trend on earnings.

In conclusion, earnings and share prices have tended to diverge in recent years, especially in Europe. The rise in share price rises is largely due to an increase in valuation multiples, rather than higher earnings. Equities have become more expensive. This could be justified in a low-interest-rate environment where investors are often penalised if they focus too much on fundamentals. After all, in a theoratical model, the price of a long-term asset is infinity if the discounting rate is zero. Still, one cannot help but worry about this decoupling between earnings and share prices.