BL-Global Flexible - 2016 Positioning

Presentation of the investment strategy of BL-Global Flexible.

Asset Allocation

Including various transactions in process, the fund's asset allocation as flollow:

- equities: 70%

- gold mining: 7.5%

- bonds: 15%

- cash: 7.5%

This allocation is based on the following premisses:

Scenario 1: moderated but positive growth (base scenario)

Implications in terms of asset classes:

- equities: neutral to positive

- bonds: neutral to negative

- gold: neutral to negative

Scenario 2: disappointing growth, deflationary trends intensify

Implications in terms of asset classes:

- equities: negative

- bonds: positive

- gold: ?

Scenario 3: loss of confidence in the central banks, currency wars, fears for the stability of the financial system

Implications in terms of asset classes:

- equities: negative (but excellent quality stocks could become safe havens)

- bonds: neutral to positive (if high quality government bonds)

- gold: positive

Obviously there could be a scenario unfavourable to all these asset classes – for example one in which the Federal Reserve would tighten its monetary policy much more sharply to reflect a robust economy and higher rate of inflation. If this happened, the fund would rely on stock-picking and currency allocation to limit the downside.

Equity allocation

The current allocation may seem high, especially in light of recent stock market falls. But it should be seen in perspective:

- Over half theequities currently in the portfolio have already corrected by more than 20% since their peak of the last three years. While this does not of course mean they won't fall further, it does suggest that some of the bad news (real or imagined) has been factored into their share price. These stocks account for around 40% of the fund.

- The remaining 30% of the equity allocation is invested in shares like Roche (5%), Nestlé (3.5%) and Novartis (2.5%). These have suffered a smaller correction but we cannot see a compelling reason to sell them at present. Although they are not necessarily cheap in absolute terms, their valuation is not so high as to prevent them from delivering a decent return (better than a fixed income investment) over the medium to long term.

In terms of sector allocation, the fund aims for a good balance between defensive sectors (consumer and healthcare) that are currently more expensive, and more cyclical sectors (luxury goods, industry, energy) whose valuation is much lower.

It is also worth noting that given the extremely low yield offered by two of the three principal asset classes in which the fund can invest (money market investments and investment-grade bonds), a neutral allocation in equities would currently be close to 70% (with occasional hedging of the equity portion).

Consequently, the fund's volatility is likely to be higher than in the past. But as we have pointed out on many occasions, higher volatility is the price to pay for protecting purchasing power in the long run in this environment.

Currency allocation

After allowing for currency hedging, exposure to the US dollar comes to 14%. In addition, the Hong Kong dollar accounts for 3%.

The negative correlation between the dollar and falling markets (dollar up when markets fall and vice versa) seems to have been broken so that the dollar no longer constitutes a natural hedge against equity risk. We will have to wait and see if this correlation is reestablished. It will mainly depend on the reasons behind the strengthening or weakening of the US currency, bearing in mind that the dollar's depreciation due to a slowdown in the US economy would not be positive for equity markets.

Some comments on the markets

The reasons cited to explain the markets' performance in the first few days of the year are:

- China economy: there is no denying the slowdown in China's economic activity although the latest published indicators were not particularly bad. They show that the transition towards an economy based more on domestic demand (in which the primary and secondary sectors of agriculture and industry are reduced in favour of the services sector) is proceeding well. But it would be a mistake to think that this will be a seamless transition or that the Chinese economy could continue to keep up the same pace of growth as in the last few years.

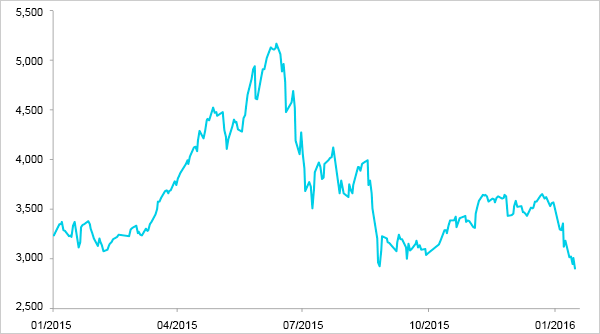

- Chinese stock market: in the last 12 months, the Shanghai Composite index rose from 3,000 (beginning of 2015) to over 5,000 (June), dropping back to 3,000 (August), climbing again to 3,600 (November/December) then reverting to its current level of 3,000. Certainly lots of volatility but no real reason to sell high-quality stocks on other markets.

Shanghai Composite Index over 1 year

Source: bloomberg

- The Federal Reserve monetary policy: the interest rate hike that was announced in December had been in the pipeline a long time and was well received by the markets. Since then, there have been no indicators to suggest that the US central bank will adopt a more aggressive attitude to tightening its monetary policy.

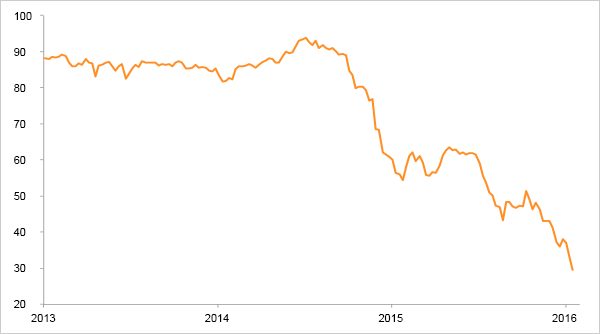

- The weak oil price: this fear is well founded (even though cheaper oil also creates winners) and oil price stabilisation would be welcome. The main risk derives from the problems that the fall in oil prices creates for certain emerging markets and companies in the sector, given that there are many highly leveraged players in these two categories who will be unable to honour their debt commitments if oil prices continue to fall. Hence there is a risk of contagion. It is obviously impossible to predict just how far the oil price will fall and when it will stabilise. But it is worth remembering that the drop in price is mainly due to oversupply (which has increased significantly), not to a slump in demand. In this respect, early signs of a reduction in supply (excluding OPEC) are encouraging.

Oil price over 3 years

Source: Bloomberg

- Geopolitical risks

Lastly , a major part of the current market fall is driven by psychological factors. The most recent example of such a bad start to a year was in 2008 and this is still uppermost in some people's minds. Numerous comparisons with 2008 have been evoked and used as a reason for getting out of the stock markets. However the situation is different today in many respects:

- Less complacency: the majority of today's investors are aware of the structural problems and market sentiment could hardly be called euphoric.

- The decline in the oil price has a positive impact on major parts of the economy.

- The size of the high yield energy segment is small.

- A very different situation concerning alternatives to shares, i.e. money market and bond yields. At the beginning of 2008, the ECB's key interest rate and 5- and 10-year bond yields (Germany) stood at around 4% (in fact the ECB raised its rate further in June and bond yields also rose in the first half of 2008). In the United States, the fed funds rate was 3% and bond yields were around 4%.

But the above is not intended to suggest that we are minimising the risks looming over the financial markets. The global economy is facing a great many structural problems which are undermining the trends that have dominated the economic and financial environment in recent decades: credit-fuelled growth, globalisation and an increase in world trade. However, we are not convinced that the best strategy to deal with this is to sell shares indiscriminately on the basis that they are risky. This does not mean that the downward trend won't continue or even gather pace. It could be the case that investors liquidate positions for marketing reasons (in order to reassure their clients), to manage risk, or because they are forced to sell them (forced liquidations). But it would be unwise to base a long-term investment strategy on such considerations.

It is worth remembering that investors in this fund need to have a sufficiently long investment horizon (and be prepared for a certain degree of volatility). This is especially important in the current context which is dominated by heightened volatility and in which certain investments, which may weigh on performance in the first half of the year, could subsequently come good.