BL-Global Flexible: Situation as at end of April

The main problem for a balanced fund continues to be the low level of interest rates, which renders money market and bond investments rather unappealing, and makes equities the default investment. Stock market prices have already risen considerably since 2009. And for the last two years, the market rise has not - or only very marginally - been justified by growth in corporate profits. This gives it an increasingly speculative nature.

Asset allocation

BL-Flobal Flexible tries to address this problem by investing a large part of its assets in shares of high quality companies and by hedging part of the equity risk through the sale of futures and the purchase of quality government bonds with a long duration.

Equity portfolio

The fund's equity portfolio primarily adopts a bottom-up approach. This means that the companies in the portfolio are selected on the basis of their intrinsic qualities and valuation, not on the basis of macroeconomic or sector considerations. Despite that, the companies currently present in the portfolio mainly come from six sectors which offer favourable prospects.

Healthcare: 18%

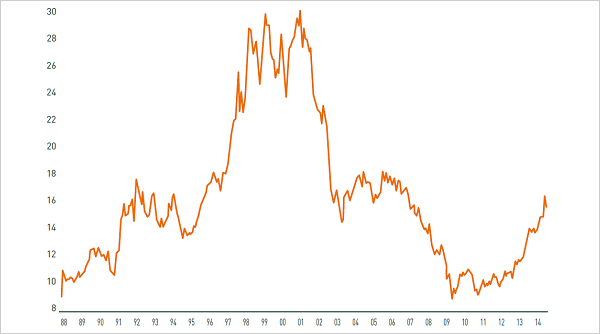

The pharmaceutical sector's good performance over the last two years should be seen in perspective. Between 2000 and 2010, pharmaceutical companies were substantially ‘de-rated' (valuation multiples cut) due to patents on flagship products expiring, low productivity of R&D (few new drugs), and uncertainties over the industrialised countries' intentions to cut their healthcare budgets. These concerns are now mostly behind us. ‘Re-rating' (an increase in valuation multiples) is set to continue, especially as the portfolios of pharmaceutical companies are now more focused on the treatment of unfilled medical needs and spending on healthcare is steadily increasing in emerging countries.

Companies in the sector have also recently demonstrated a better capital allocation and often pay attractive dividends.

'De-rating' of the pharmaceutical sector

Source: Bloomberg

Consumer staples: 17.5%

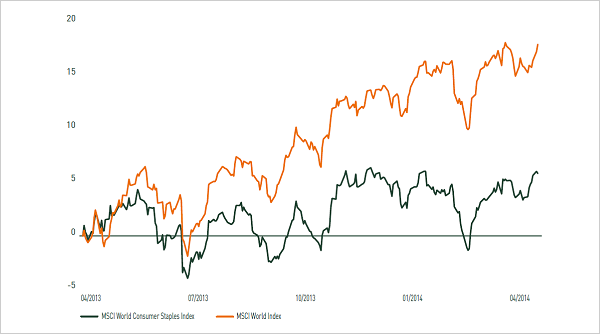

Fears of an upturn in interest rates and a slowdown in economic growth in emerging countries have weighed on non-cyclical consumer goods stocks.

The main factor in favour of the major companies in this sector is the high predictability they offer because of the relatively stable nature of their activities and the fact that their earnings are therefore less dependent on the global economic situation. The reputation of their brands as well as their distribution network represent major competitive advantages and strengthen their ability to raise their prices should costs rise.

These companies are also one of the best ways of investing in globalisation and, particularly, in the emergence of a middle class in developing countries. Pharmaceuticals also often pay attractive dividends.

Consumer staples' underperformance

Source: Bloomberg

Luxury goods: 6%

Like non-cyclical consumer goods, the luxury goods sector has suffered from fears of an economic slowdown in emerging markets. This offers the possibility of investing in certain luxury companies at relatively attractive prices.

The luxury market, although small compared to other markets, offers very favourable prospects in terms of supply and demand. As regards supply, the potential for expansion is limited by the inherent characteristics of luxury products, especially the fact that it generally takes several decades to develop a luxury brand. As regards demand, the sector is benefiting from an increase in disposable income in emerging countries and social inequalities in industrialised countries. The advent of the internet has also tilted the balance of power between content and distribution in favour of producers who are less and less dependent on major distribution chains.

Here too, brand strength gives producers a powerful competitive advantage, enabling them to raise prices if they need to. Also, the trend towards in-house manufacturing increases the profit margins of companies in this sector.

Technology: 15%

Major companies in the technology sector present very solid financial structures with very low leverage. Their valuations are attractive, especially considering the high level of cash on their balance sheets. As they become mature and their growth potential decreases, their capital allocation turns towards returning capital to shareholders through increasing their dividend or buying back their shares.

Within the sector, software and services are growing to the detriment of hardware. This has led to higher levels of recurring revenue and profitability, while providing some cushion to the risk of technology shifts.

Asian conglomerates: 6%

Although we tend to avoid conglomerates in Europe and the United States, Asian conglomerates have certain undeniable strengths. Their assets, which they have developed over several decades, or even centuries, are often among the best in Asia and managed by top-flight professionals. They generally have excellent political and economic relationships, which ensures their finger is on the pulse of their respective markets.

Through their assets, these groups also represent an excellent way of investing in the theme of an emerging middle class in developing countries. In terms of corporate governance, they are generally far above the average for Asian companies. And their balance sheets are extremely sound.

Gold mines: 7%

The relationship between supply and demand continues to be favourable for gold. In terms of supply, geological constraints on the one hand, and the profit margins of gold mining companies on the other hand, are increasingly jeopardising future production. However, demand should continue to benefit from geographic factors, with sustained demand from emerging markets, especially China and India, and from conceptual factors related to the fragility of the economic situation and the financial system, the geopolitical situation and monetary policies which are gradually reducing confidence in paper money.

As regards gold mining companies, the factors that have caused their production costs to spiral in recent years – rising wage bills and energy costs – are gradually subsiding. At the same time, practically all these companies have made the increase in their free cash flow (available to shareholders) a major objective and reduced their exploration budgets and investment spending. Among the main selection criteria used to identify companies in which the fund invests are financial structure, production costs and geopolitical risk.

As a whole, these sectors currently account for around 70% of the portfolio (out of 85% invested in equities). Added to this are several high dividend stocks. As described above, the theme of dividends is generally very present in the fund since, apart from gold mining stocks, companies in these sectors often pay high dividends. In addition to these, the fund is also invested in several other stocks mainly because of their dividend such as Oesterreichische Post, Royal Dutch and the RTL Group.

Currency allocation

The equities in our portfolios are generally those of international companies, realising a significant proportion of their revenues outside their home country. Accordingly, they offer a sort of natural hedge against the deprecation of the currency in which their shares are quoted. For example, a weakening of the dollar increases the profit (expressed in USD) of US companies, and a weakening of the yen the profit (expressed in JPY) of Japanese companies. We do not therefore hedge the currency risk of these positions.

On the other hand, we hedge (partially or totally) the foreign exchange risk on positions in bonds issued in currencies other than the euro unless the cost of such a hedge is excessively high.