Brazil and the Philippines: contrasting situation within emerging markets

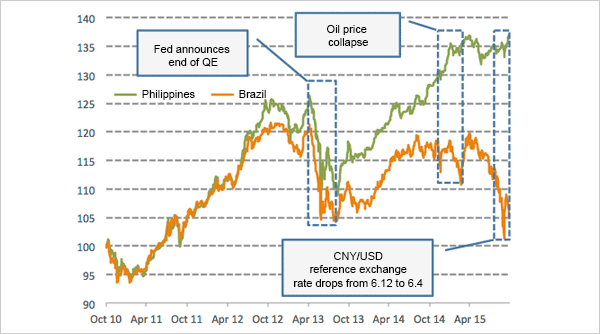

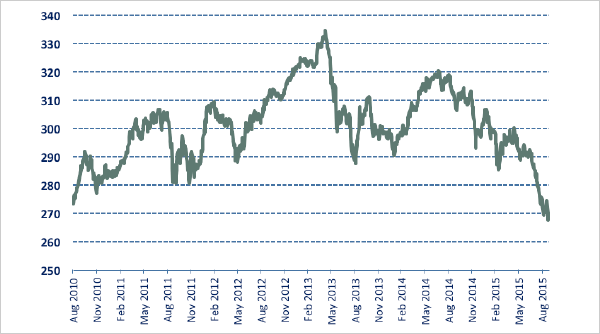

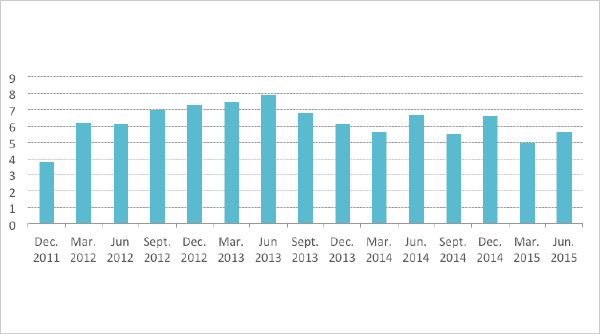

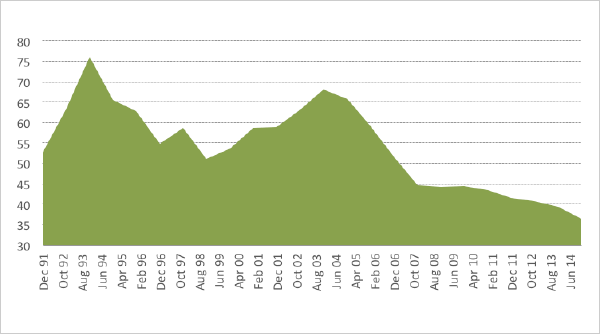

Following the 2008 financial crisis, emerging market debt enjoyed two years of positive performance. Since then, a number of factors specific to this asset class but also independent of it, have intervened to derail its progress. First there was the crisis of confidence that affected all the eurozone peripheral countries in 2010, and particularly Greece in 2011. Two years later, on 22 May 2013, Ben Bernanke announced the end of quantitative easing through an upcoming reduction in the amount of cash injections. In the wake of this "QE tapering", the index representing the emerging markets' local debt, the GBI EM Broad Diversified, lost 14% within three months.

A more difficult environment

JPMorgan local debt index (GBI EM Broad Diversified Index)

Source: Bloomberg

At the end of 2014, new pressures arose in the wake of the Chinese economy's slowdown. Commodities, especially oil, were hit hard. The WTI (West Texas Intermediate) crude oil price plummeted by 59% between June 2014 and January 2015. The local debt market correction gathered pace. Some emerging markets, particularly oil-producing countries, had trouble supporting their currency. Nigeria, for example, decided to devalue its currency by 8% at the same time as raising its interest rate by 100 basis points to 13%.

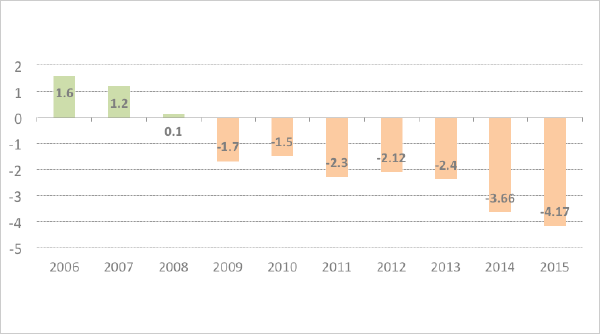

The deterioration of its fundamentals reflected the difficulties encountered in the universe. In September 2015, S&P cut its rating for Brazil to BB+, which is in the speculative grade. Over the same period, the ratings for Nigeria and Angola were slashed to B+, for Ghana to B-, for Venezuela to CCC+ and for South Africa to BBB-.

Differentiation is still possible

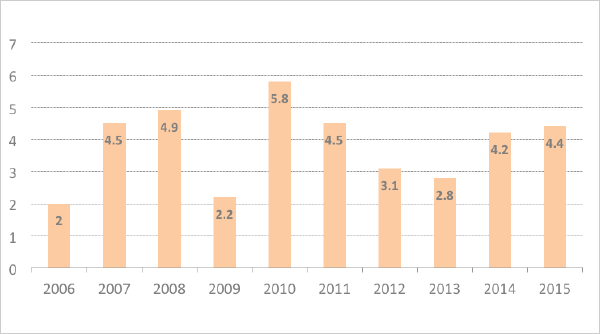

In contrast to countries like Brazil and Russia, other economies have managed to hold out and even profit from the current situation. Generally speaking, these are net importers of commodities like South Korea, Morocco, India and the Philippines. For example, the latter's rating has risen steadily since 2009.

Brazil's current account deficit

Source: Trading Economics

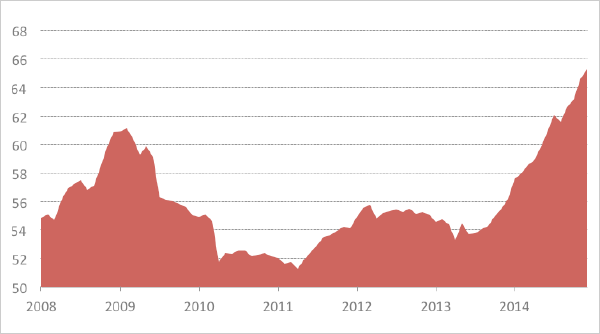

Brazil's debt to GDP ratio

Source: FMI, Bloomberg

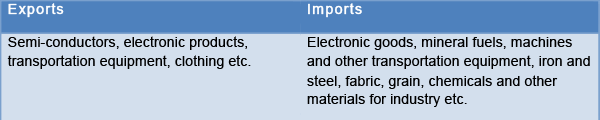

In fact, the rating for the Philippines, a country with a population of nearly 100 million, climbed from BB- in 2005 to BBB in May 2014. This improvement was confirmed by the direction of its debt (falling constantly for ten years), the dynamism of its economy, and its resilience to the slowdown of the Chinese economy.

Coface lists the main strengths of the Philippines' economy as follows:

- successful economy in electronics (40% of exports)

- exports from the country to emerging Asia constantly increasing

- household consumption and external accounts benefit from expatriate workers' remittances

- corporate services outsourcing sector is booming (1)

Philippines: annual growth rate

Source: Bloomberg

Philippines: current account as % of GDP

Source: Trading Economics

Philippines: debt/GDP

Source: FMI, Bloomberg

Philippines: trade balance extract

The markets have naturally taken account of these relative strengths and weaknesses. The following graph shows this. It traces the evolution, from a base of 100, of the JPMorgan sub-indices for the debt of Brazil and the Philippines in USD. Apart from the fact that Brazil, the former market star, was already underperforming in the first half of 2012 (it was then that its debt started to get out of control and the real began its long depreciation), we can draw two main observations from this graph:

- in 2013, Ben Bernanke's announcement of tapering (see above) weighed indiscriminately on both issuers,

- on the other hand, at the end of 2014 and during 2015, both the slump in oil prices and the depreciation of the yuan affected the Brazilian index without excessively disrupting the Philippines' debt.

Brazil vs. Philippines JPMorgan indices