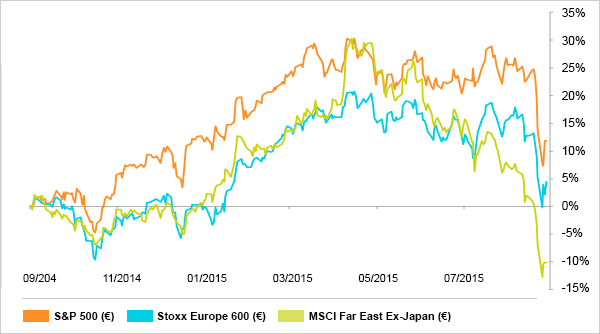

Situation on the stock markets

Since their recent record highs, the stock markets of developed countries have lost around 16% in euros. For emerging markets, the slump is closer to 30%. The slowdown in the Chinese economy and the Chinese authorities' decision to devalue their currency are considered to be the main drivers of this fall. But, the real reason lies more in the complacent attitude of investors who ignored the signs indicating that, despite the central banks' unconventional monetary policies, growth is anaemic. Also, as often happens in sharp declines, operators are not very discerning. Especially on the Asian markets, high-quality stocks have often dropped as much as those of lesser quality.

Stock markets over 1 year

Source: Bloomberg

The current correction can be considered as healthy. Although nobody knows where it will end, not everything has suddenly become bad for the stock markets. The stock market falls will undermine the Federal Reserve's intention to tighten its monetary policy. Basically, the US authorities' strategy to stimulate growth relies largely on a rise in the price of financial assets, a rise that would be followed by a positive effect on consumer spending and investment (the so-called ‘wealth effect'). They are therefore bound to react if the fall becomes too sharp. The same goes for the Chinese authorities. All this should help limit the damage, unless one believes that the authorities have lost their power to influence the markets.

On the economic front, the fall in prices of oil and commodities in general does not only create losers – it will benefit the American consumer and parts of Asia for example.

It is important to note, however, that when we talk about favouring equities in the current context, it is not because we expect an improvement in the economic situation. On the contrary, one of the risks that continue to weigh on stock prices is that investors have still not succumbed to the evidence of the growing downturn in global growth. The main argument for equities is that there is no alternative to equities in a zero-interest-rate environment - provided company profits don't collapse and the valuation of equities does not become unreasonable. This is not yet the case. But all the while we must be selective in stock-picking.

To sum up, in an environment dominated by weak growth and a stock market retreat, interest rates will remain low. In this context, one should continue to favour good quality shares paying regular dividends, as long as one can accept their volatility.