The friendly merger of Covidien and Medtronic: A real life case study for Business-Like Investing

The manufacturers of cardiovascular and orthopaedic medical instruments are continuing to see a slowdown in growth in all market segments. Ongoing reforms to healthcare systems all over the world will continue toimpact the power of companies to negotiate prices and limit their potential to improve margins. In an environment where the economic aspects of healthcare services are becoming increasingly significant, manufacturers of medical instruments are more than ever in need of portfolios of innovative and high-added-value products.

In this regard, we are particularly pleased with the news of Medtronic's acquisition of Covidien, a US company domiciled in Ireland for tax reasons. In addition to the positive impact on the performance of our funds, the fact that the world leader in medical services and technology wants to add Covidien's business portfolio to its catalogue of existing products highlights the quality of Covidien's assets.

In the management of our equity funds, we apply an entrepreneurial approach to selecting our investments, which we call "business-like investing". We consider every investment as a long-term stake in a company's activities. We therefore focus our investments on companies that have a sustainable competitive positioning, a clear business model and a relevant industrial approach that should reinforce the company's dominance across economic cycles. Such is the case for Covidien which has been in our portfolios since 2008 and hascontinuously figured among the leading positions of the BL-Equities America fund.

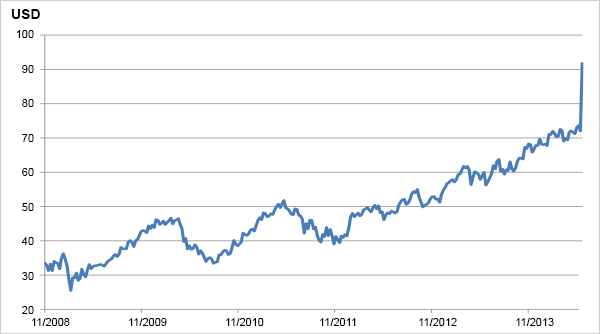

Covidien share price since its entry in the portfolio of BL-Equities America

Source: Bloomberg

Covidien

Covidien was created on the dissolution of the activities of the former conglomerate Tyco. Covidien inherited Tyco's healthcare activities. Over the years, Covidien's new management has transformed the group's product portfolio by selling off the less competitive businesses with low margins and strengthening its presence on very profitable and fast-growing high-added-value products and markets. This has enabled Covidien to become the clear leader in surgical and medical devices and supplies, focusing on non-invasive surgery (endoscopy, laparoscopy etc.). Unlike many other companies in the sector, Covidien's products and services fit perfectly with the new operating environment for healthcare. Healthcare reforms in the United States and worldwide mean that payments are increasingly linked to the performance of services and products offered, a trend that matches Covidien's activity.

An acquisition based on sound commercial logic

On 16 June, Medtronic was prepared to pay a 29% premium on the closing price of the Covidien share to acquire Covidien's portfolio of activities. Medtronic has a triple interest in this acquisition. From an industrial point of view, this merger will enable Medtronic, which specialises in the manufacture of cardiovascular and orthopaedic devices, to consolidate its world-leader position in medical technology and services and add an additional growth component to its range. But over and above this industrial logic, Medtronic will be able toreinvest the bulk of its 14 billion dollars cash pile, which is mainly held abroad. If Medtronic were to repatriate this money to the US, the company would be taxed at 35%. Additionally, as Covidien is headquartered in Ireland, it enjoys a much more attractive tax regime than companies in the US. In Ireland, the corporation tax rate is 12.5% compared to 35% in the US. This transaction will therefore enable Medtronic to reduce its tax burden by transferring its tax domicile to a low-tax country.

Asset portfolio quality is key

Many international companies now have sound financial structures with very low leverage and a high level of cash on their balance sheet. Added to this is an environment of low interest rates and investors seeking asset portfolios offering an attractive return. This creates a favourable environment for raising large amounts of capital on the bond market and is driving the trend to consolidation and mergers and acquisitions seen in recent months. In a global economic environment marked by weak demand and strong competition, theacquiring companies are increasingly alert to the quality of their target assets. In exploiting the benefits of "Business-Like investing", our investment approach ensures that our investment choices will continue to align with those of companies.