From risk aversion to capital preservation (part 1)

The terms risk, volatility and return are often linked in finance. This inter-connection has its roots in an academic financial theory on portfolio management that has become widespread in the professional sphere. It uses volatility as a measurement for risk which diverts attention away from the principal risk of any investment: the risk of permanent loss of capital.

Risk aversion

An old concept used as a model for the smooth functioning of the financial markets: risk aversion. This is an economic approach based on the idea that people prefer a relatively sure gain over a bigger but more uncertain one, as per the adage: "a bird in the hand is worth two in the bush".

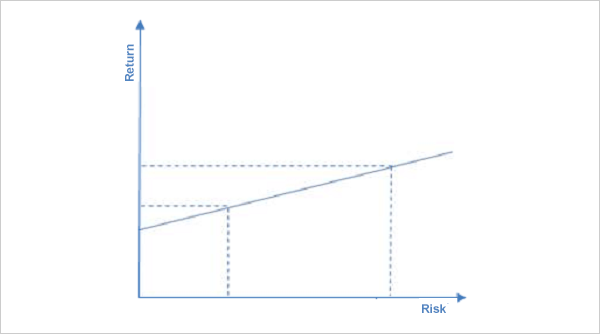

Transposed to the financial markets, risk aversion is about the relationship between a financial asset's risk and its expected yield: to offset the additional risk incurred by an investor, a more risky investment needs to generate a higher expected return to attract capital. This relationship is illustrated in the following graph.

The academics' stranglehold

With risk being an essential parameter for understanding an investment process, the risk/return ratio has attracted plenty of attention in the academic world, which tries to understand stock market returns and suggest ways of optimising portfolio management.

In this respect, the work of economists at the University of Chicago, developed since the middle of the last century, has been predominant. They have defined a way of measuring risk which lays the foundations for a more global theory of portfolio management and return forecasting for a financial asset as a function of this risk. Although a controversial subject, this theoretical framework is still widely referred to and applied in the world of academics and financial institutions.

In its research, the Chicago School used the volatility of a financial asset as the way to measure risk. As an asset's volatility represents the dispersion of its returns around the mean, it is deemed to reflect the predictability or lack of predictability of the asset's future return. Following this logic, the more volatile an asset is, the more risky it is deemed to be, and the higher the expected yield required by the investor.

Based on this link between risk and volatility, Harry Markowitz developed the Modern Portfolio Theory (1952). Among others continuing Markowitz's work, William Sharpe introduced the Theory of Market Equilibrium (1964).

Markowitz's approach was motivated by the idea that an investor must make coherent choices and therefore seek to minimise the portfolio's risk, i.e. its volatility, at the same time trying to achieve the hoped-for level of return. Faced with the multitude of possible choices on a market, it highlights the need for an investor to take advantage of covariances between different assets presenting the same expected profitability to reduce the portfolio's volatility. By diversifying the portfolio through a great number of securities with little correlation, it should be possible to reduce its volatility without reducing the potential return. His theory therefore advocatesdiversifying investments, in the broadest sense, as a basis when creating a portfolio and for risk control.

The Theory of Market Equilibrium takes this thinking further and formalises it, introducing the idea of expected return for a financial asset. While it is possible, as Markowitz claims, to create an efficient portfolio that minimises, or even eliminates, the risk inherent in an individual asset - its volatility - this risk should then no longer be remunerated. The Theory of Market Equilibrium thus proposes that the expected return of a financial asset is solely a function of its volatility in relation to the market, called systematic risk, which cannot be eliminated by diversification. An asset's level of risk can then be measured purely by this systematic risk and its volatility expressed as a function of the market: a riskier asset is likely to amplify the market's movements, while a less risky asset is likely to moderate them.

Unrealistic assumptions

The picture drawn up by the Chicago School finds a chosen ally in the fact that the markets follow a random walk. But it suffers from using working assumptions that have little bearing on reality.

First, confining the risk of a financial asset solely to its volatility oversimplifies the reality of an investment and the complexity of the financial markets. Obviously that is a very academic conception of risk. It is a choice that facilitates the use of statistics and mathematical modelling in the study of stock market returns. Volatility is a variable that can be easily calculated using actual, objective and historic data and the risk of an investment synthesised by a figure that can be easily interpreted. In practice, its application reveals a number of inconsistencies:

- a sudden increase in volatility does not in itself indicate that an asset has become more risky. A share whose price increases in a straight line from €30 to €100 would be considered as not very risky, whereas if its price suddenly fell from €100 to €50, it would be considered as having become more risky;

- using historic volatility as a measure of risk means extrapolating the past and comes down to presuming that a company remains static, as it does not take into consideration a change in that company's production tool or markets;

- systematic risk does not reflect the future behaviour of an asset in different market phases: a market rise does not signal the outperformance of shares with a high systematic risk.

Secondly, as a prerequisite to their approach, the Chicago School has to adopt the false idea that stock market returns can be described by normal law, a statistical distribution of stock market returns which assigns a symmetrical probability to returns around their mean and which attributes scant importance to extreme events.

Thirdly, the theory relies on the assumption that markets are efficient. This stipulates that in a large market where information spreads instantly, investors react identically and instantly to information, and that every asset is at all times valued at its correct price. It is not consistent with the price-setting process which results from the interaction of the behaviour of individual people who are subject to cognitive and emotional errors.

As a result, a number of professionals and academics (like mathematician Benoît Mandelbrot, philosopher of uncertainty Nassim Taleb or Charlie Munger from Berkshire Hathaway) have called the validity of this approach into question. Eugene Fama, a mathematician and one of the fathers of the theory of the efficiency of the financial markets, recognises that the results are not as expected.

Unfavourable spinoffs

Notwithstanding this, the stable, powerful and intuitive framework offered by this theory, and its numerous adaptations to try and mitigate its initial weaknesses, have assured it of wide circulation in the world of financial institutions.

From an empirical point of view, sticking to a line based on the Chicago School's thinking and on volatility as a measurement of risk could have direct and indirect consequences, unfavourable to the management of a portfolio invested in equities:

- a predominant role is assigned to the market index which becomes a fixed reference for an optimal risk/return ratio and hence often defines the investor's investment universe;

- significant diversification of the portfolio is considered as the norm and the understanding of the variables affecting an individual asset can be relegated to second place compared to exposure to a given market segment;

- in the context of indexed portfolio management, the geographic and sector allocations of a portfolio are the result of temporary deviations from an index;

- often, they are the fruit of short- and medium-term macroeconomic and financial scenarios aimed at anticipating market trends in order to increase or reduce a portfolio's exposure to certain market segments. For example, "risk on" and "risk off" strategies often refer to systematic risk management in order to increase a portfolio's sensitivity if a market rally is expected ("risk on") or reduce it if a downturn is anticipated ("risk off"). This is a particularly hazardous exercise. Anticipating the economy and the financial markets overexposes a portfolio to the probability of making errors and suffering from major unexpected swings.

(to be continued)