Are dividend stocks overvalued?

Through their monetary policy, the central banks have created an environment in which investors seeking regular income are obliged to look for alternatives to traditional fixed-income investments. Initially, this caused a run on the more risky segments in the bond universe, i.e. corporate bonds, emerging market bonds and 'high yield' bonds. As money flowed into these segments, prices were pushed up and yields declined. Interest was then increasingly channelled towards equities paying decent dividends.

Dividends - a key barometer

Although interest in the dividend theme would appear to be linked to low interest rates, these stocks have always had their merits. Stock market history shows that, over the long term, dividends represent around 50% of equity returns. Furthermore, dividend stocks tend to be considerably less volatile than the market as a whole, if only because these companies usually generate more stable earnings. It should also be noted that companies are generally reluctant to reduce their dividend as any such reduction would likely be interpreted as a sign that the company is in difficulty. The dividend therefore contains important information about a company's future performance.

Identifying speculative bubbles...

A question often asked is whether high-dividend shares are in bubble territory. The reason behind this question seems to be that various statistics show that funds investing in this segment have recently attracted sizeable inflows. However, I find it difficult to see how the price of a company paying a high dividend could be in a bubble. Let's imagine, for example, that a company has a dividend yield of 4%. This means that its dividend/price ratio is 0.04 (4%), which is the same as saying that it has a price/dividend ratio of 25. Since the dividend is usually lower than or equal to earnings (a company does not generally distribute all its earnings), its price/earnings ratio will therefore be a maximum of 25. In this case, you could say that the company is quite expensive, but that doesn't make it a bubble.

A universe in perpetual motion

Obviously, the price of a company initially offering a high dividend yield could increase irrationally so that the company becomes extremely overvalued. However, as its price goes up, its dividend yield will steadily decline and at a certain point, the company will cease to have a place among dividend stocks. In other words,the universe of dividend stocks is never static, as stocks whose prices are too high in relation to their dividend exit the universe, while others, which were not part of it initially, may enter it if their prices become low enough in relation to the dividend they pay out. The question of a speculative bubble is not therefore relevant, unless you consider the universe of dividend shares to be a closed one, in which case the advent of significant inflows into this universe could indeed trigger a bubble.

It is worth noting that for dividend shares, the inverse phenomenon could also arise. Sometimes a company offers an unusually high dividend yield. Such a situation should nevertheless raise alarm bells for the investor. In these cases, the share price has often fallen due to problems that are not yet reflected in the dividend as the dividend is usually only adjusted once a year. The example of financial stocks in 2008/2009 or more recently certain telecommunication stocks, should serve as a useful lesson here.

Regularity: a safe haven!

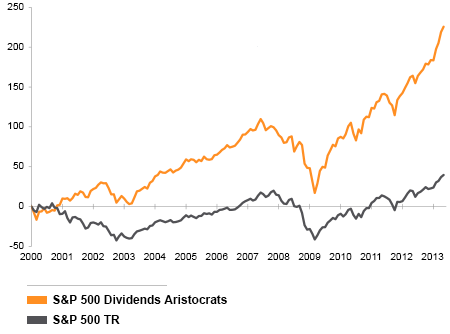

Stock market history also shows us that the best performance is not posted by the companies with the highest dividend yields but by those companies whose dividends are reliable and regularly increasing. Indices covering these companies have been created for different countries. For the US market, the following graph shows the clear outperformance of the 'dividend aristocrats' index versus the S&P 500.

Dividend stocks: the attraction is not wearing off

The attraction of dividend stocks is not about to disappear, if only because of demographic trends. The proportion of 25 to 49 year olds in the population of industrialised countries is declining, while the 50-74 bracket is on the rise. For financial markets, this means that for a growing number of investors, preservation of capital and the need for regular income will take precedence over the search for long-term capital growth.

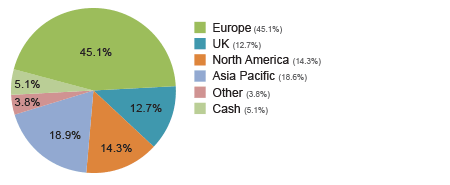

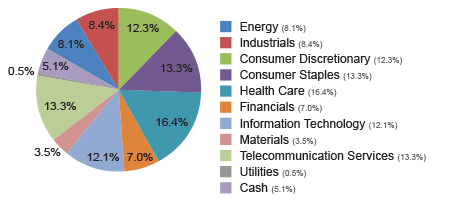

We launched a new fund BL-Equities Dividend (ISIN: LU0309191657) at the end of October 2007. The following graphs show the fund's regional and sector allocations at the end of April. Compared to its benchmark, the MSCI World High Dividend Yield index, the fund is considerably less invested in the United States which is a market with relatively low appeal in terms of dividend yield. This is partly explained by the clear outperformance of this market in recent months and partly by the fact that American companies generally prefer to buy back their shares rather than increase their dividend. (The high weighting of this market in the MSCI index is due to the US market's high market capitalisation.) In terms of sector allocation, the main differences are due to the fact that the fund does not invest in utilities, banks or insurance companies.

Regional allocation of BL-Equities Dividend

Sector allocation of BL-Equities Dividend

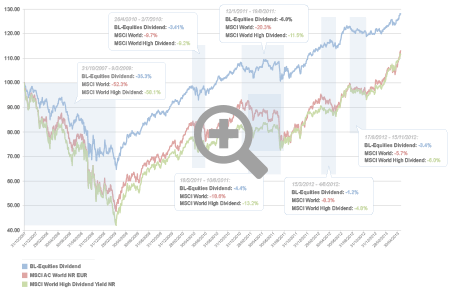

The following graph shows the performance of the fund since its launch. It has succeded in outperforming its benchmark by limiting its losses during thoses periods where stock markets fell.