Five questions to illustrate five years managing

BL European Small & Mid Caps

Tom Michels took over the management of the BL European Small & Mid Caps Fund in April 2018. We are marking this anniversary by discussing the past five years with him and looking ahead to the prospects for the asset class.

What are the highlights of your last five years at the helm of BL European Small & Mid Caps?

The past five years have been hugely eventful and we have learned a lot. During this period, the equity markets have had to deal with a number of unexpected crises and an unorthodox monetary environment. At university, people study a lot of economic scenarios and the different mechanisms available to central banks, but it is all very theoretical. A health crisis resulting in the almost complete cessation of economic activity, a war in Europe, negative interest rates, bloated central bank balance sheets and a very rapid transition from a deflationary environment to double-digit inflation... none of these scenarios, all of which we have experienced very recently, featured on the academic curriculum.

In other words, the last few years have been characterised by the emergence of several extreme situations within a very short period of time.

This turbulent environment has shown me that, with an asset class that is prone to large swings both up and down, it is crucial to have a deep understanding of the companies we invest in to ensure that they are able to withstand difficult times and add value to the portfolio over the long term.

What characteristics do you look for in the companies you invest in?

Firstly, although I have a great deal of freedom in the stock selection process, all BLI - Banque de Luxembourg Investements' ("BLI") equity strategies are based on the common investment philosophy of ‘Business-Like Investing’ which seeks to invest in quality companies. At first sight, this might seem something of a given, since nobody would say they are seeking exposure to poor-quality companies. The distinction lies in how each investor defines quality.

At BLI, a quality company is one that has a strong and sustainable competitive advantage, a healthy balance sheet, positive cash flow, and solid future earnings growth.

More concretely, within the universe of small- and mid-cap European companies, I particularly like companies that are ‘mission critical’ (i.e. whose products or services are indispensable to their customers) and companies that operate in a niche sector and whose market share in this limited sector is sufficiently large to make the arrival of a new player more difficult.

In a 100% equity fund that doesn't do market timing, it's not always easy to navigate through more turbulent times. What do you think is the best way to manage these more challenging phases?

Investing in equities is essentially a long-term investment. Once you keep that in mind, it’s natural not to get distracted by short-term trends. BLI's management style focuses on quality growth. While there are times when this management style will face headwinds, as was the case in 2022 for example, I remain convinced that, over the long term, the emphasis on quality companies with one or more tangible and sustainable competitive advantages is the key to a consistent investment approach. It is therefore essential to remain faithful to our methodology and not to vary our investment style when the slightest difficulty arises.

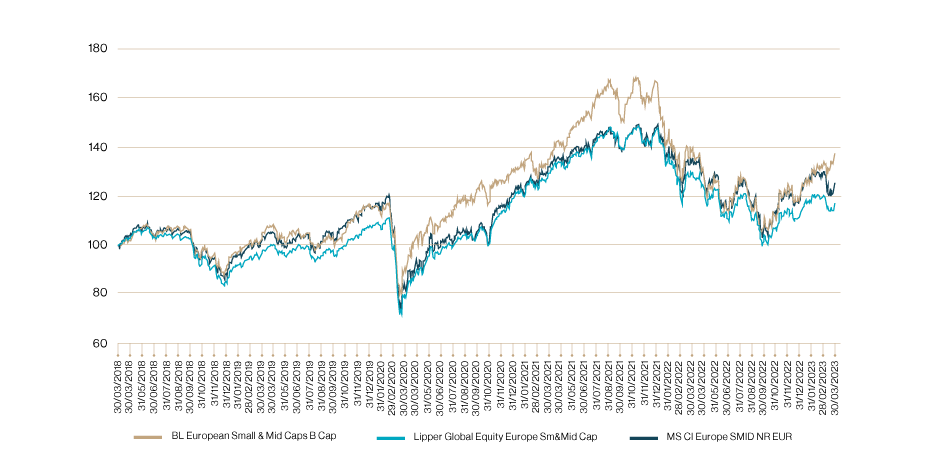

Past results tend to confirm the value of our approach since, over 5 years, BL European Small & Mid Caps has managed to outperform its reference universe (represented by the MSCI Europe SMID).

Performance of BL European Small & Mid Caps under current manager tenure

Note: Past performance is no guarantee of future results. Performance net of fees in euros of the retail accumulation share (B share). Source: Lipper

What makes the small and mid-cap market different? What do you find particularly interesting about this segment of the market?

Overall, everyone agrees that investing in small- and mid-cap European companies gives access to highly entrepreneurial companies and allows you to benefit from the positive long-term dynamics of this asset class. These companies tend to be in the strongest phase of their development and, by investing at this stage, investors can capitalise on this growth potential.

Another distinguishing factor for this asset class lies in the innovative capacities of small- and mid-cap companies, as they are often technological leaders in very specific sectors.

Finally, investing in European small- and mid-cap companies does not mean exposure solely to the European market – within BL European Small & Mid Caps, some 50% of the turnover of the companies in the portfolio is generated outside Europe, offering useful diversification of exposure.

At a more personal level, what I like most about the small- and mid-cap universe is that you can find ‘little gems’, by which I mean unique companies that are leaders in a specific field but are often little known to the general public. For example, during the health crisis, a small German company, Drägerwerk, was an indispensable supplier to hospitals as it is one of the largest producers of respirators. Another example is the Swedish company NIBE, the market leader in the production of heat pumps and therefore a critical partner for the energy transition.

What do you think are the key factors in the appeal of this asset class?

Investors often have a rather biased view of the universe, implying that small- and mid-cap stocks have a reputation for being riskier. This reputation is mainly due to the fact that these companies are often less widely known by the general public and to the higher volatility of their share prices. The latter stems mainly from technical factors: given their smaller market capitalisation, the volumes traded on the stock exchange are lower than for large-cap companies, which means that, in downturns, these stocks suffer more, but conversely, in upturns, they tend to appreciate more.

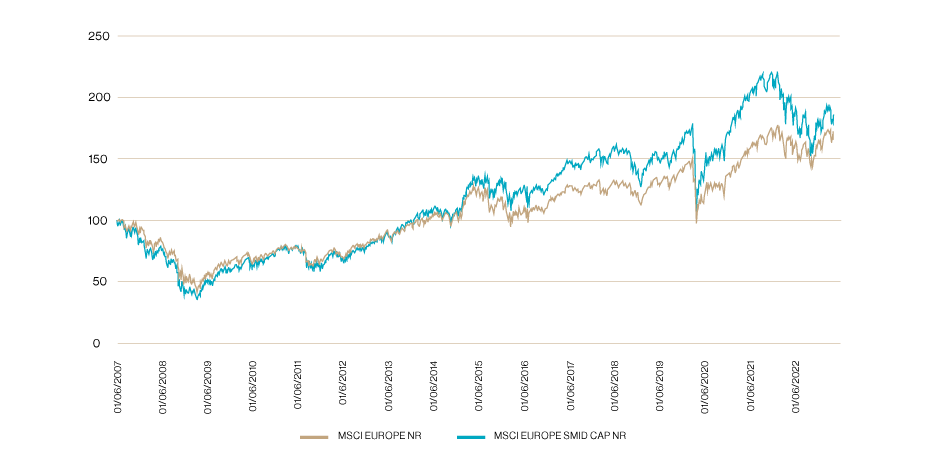

However, over a full economic cycle, small- and mid-cap companies are able to outperform the large-cap market even during crisis-hit periods (such as the health crisis in 2020 and the war in Ukraine since 2022).

This long-term outperformance can be explained by many factors, in particular by the greater flexibility of these companies, which often have a relatively flat hierarchy that allows them to adapt more quickly to fast-changing environments.

Long-term performance of European stock market compared to the European small- and mid-cap market

Note: Past performance is no guarantee of future results. Source: Bloomberg

This document is issued by BLI - Banque de Luxembourg Investments ("BLI"). It refers directly or indirectly to one or more financial products (the "Financial Product") and constitutes a marketing communication within the meaning of Regulation (EU) 2019/1156 of 20 June 2019 on facilitating cross-border distribution of collective investment undertakings. Economic and financial information contained in this publication is provided for information purposes only based on information known at the date of publication. This information does not constitute investment advice or a solicitation to invest and should not be understood as legal or tax advice. No warranty is given as to the accuracy, reliability, timeliness or completeness of this information.

BLI draws the attention of any recipient of this document on the need to use with the utmost caution all information relating to a Financial Product, in particular that relating to the performance of such Financial Product:

- Where applicable, any scenarios relating to future performance in this document are an estimate of such future performance based on evidence from the past on how the value of this Financial Product varies and/or current market conditions. They are not an exact indicator and what you will get will vary depending on how the market performs and how long you keep the Financial Product.

- Conversely, the past performance of the Financial Product does not predict its future returns.

In general, BLI does not assume any responsibility for the future performance of these Financial Products and will not be liable for any decision that an investor may make based on this information. Interested persons should ensure that they understand all the risks inherent in their investment decisions and should refrain from investing until they have carefully assessed, in collaboration with their own advisors, the suitability of their investments to their specific financial situation, in particular with regard to legal, tax and accounting aspects. They must, moreover, consider all the characteristics and objectives of the Financial Product, in particular where it refers to sustainability aspects in accordance with Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector. Subscriptions in a Financial Product are only permitted on the basis of its current prospectus, Key Information Document (KID) and the latest annual or semi-annual report (the "Documents"). The Documents are available free of charge at BLI’s registered office at regular business hours. All the Documents, including the sustainability information and the summary of investor’s rights, are available on BLI's website at www.bli.lu. Any reproduction of this document is subject to the prior written consent of BLI.

Author

Tom Michels, Fund Manager BL European Small & Mid Caps, info@bli.lu

Final date of writing: 2 May 2023

Date of publication: 2 May 2023 at 11:00.

The author of this document is employed́ by BLI - Banque de Luxembourg Investments, a management company licensed by the Commission de Surveillance du Secteur Financier Luxembourg (CSSF).