Solvency is a crucial element to take into account in bond investments. How to ensure the payback of your investment in corporate debt? What if the issuer company does not produce enough cash flow to honor its interest payments? Selecting bonds with a financial guarantee is often considered as a means to secure their coupons. In terms of guarantee, support of the national government tops the list. Hence, bonds issued by State-Owned Enterprises (SOE) comprise an interesting asset class.

What are State-Owned Enterprises?

State-Owned Enterprises (SOE) are companies are that are either fully owned by the state or over which the state has a significant degree of control through majority ownership or a substantial minority stake.[1] While SOEs can be found at the national, regional and local levels, SOEs operating at a national level are those that most often attract the attention of international bond investors.

What purpose to SOEs serve?

SOEs are often used to ensure that the government retains a certain degree of control over sectors that are deemed strategically important or to provide certain public services where state-intervention is deemed desirable. The degree to which governments make use of SOEs to retain control of parts of their national economy varies widely across countries depending on their political systems, and can change significantly over time depending on prevailing ideologies and various political, economic and social considerations.

What sectors do they operate in?

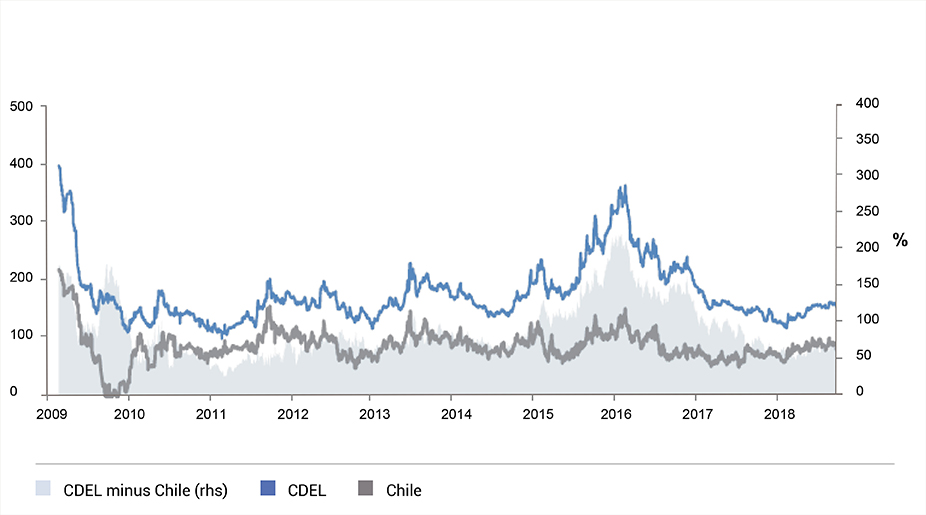

SOEs operate in sectors characterised by natural monopolies, typically the provision of various types of infrastructure. Examples are electricity, energy, water and sewerage grids – grouped as utilities –, petrochemicals and railway networks. In countries in which exports of natural resources play an important role for the national economy, SOEs are founded by governments in order to maintain control over the extraction and export of such resources. Prominent examples are the state oil companies set up in the Middle East as well as mining companies in Latin America, including the copper producer Corporación Nacional del Cobre de Chile (CDEL). In certain countries, state-owned financial institutions such as export-import banks also play a very important role.

Credit spread difference between Corp. Nacional del Cobre de Chile (CDEL) and Chile sovereign

Source: J.P. Morgan Markets, Bloomberg

Why are Emerging Market SOE bonds interesting?

Bonds of large SOEs in emerging markets that operate in relatively stable environments can be included in a fixed-income investment portfolio in a low interest-rate environment. Many large SOEs in Emerging Markets are well-established issuers on the international bond market. Due to their proximity to the state and the strategic role they tend to play for their countries, SOEs are often considered relatively low-risk investments. For defensive bond investors, SOE bonds can be an interesting alternative to government bonds, offering a range of credit spread premium while remaining in a relatively low risk sphere.

Case Study: State Grid of China

State Grid of China (SGCC) is one of the corporate issuers that have been included in our portfolio, BL-Bond Emerging Markets Euro.

China remains one of the countries with the highest number of SOEs and is home to some of the largest companies in this segment. Investors tend to increase their exposure to Chinese corporate debt, as demonstrated by J.P. Morgan’s CEMBI broad diversified index with 30,9% of its weight towards China[3]. State Grid Corporation of China epitomizes the breadth and depth of the sector. With over 1bn customers, over 900,000 employees and revenues of approximately USD 363bn, SGCC is the largest utility company worldwide. It mainly focuses on the construction and operation of large parts of China’s electricity grid. The company is considered to be of such strategic importance that its credit rating is aligned with that of the Chinese state (A+), demonstrating their close relationship. Moreover, it has better financial metrics than most of its peers, thanks to its cash generation capacity and contained leverage[4]. Taking SGCC’s stable profitability metrics also into account, its senior bonds qualify as suitable long-term investments.

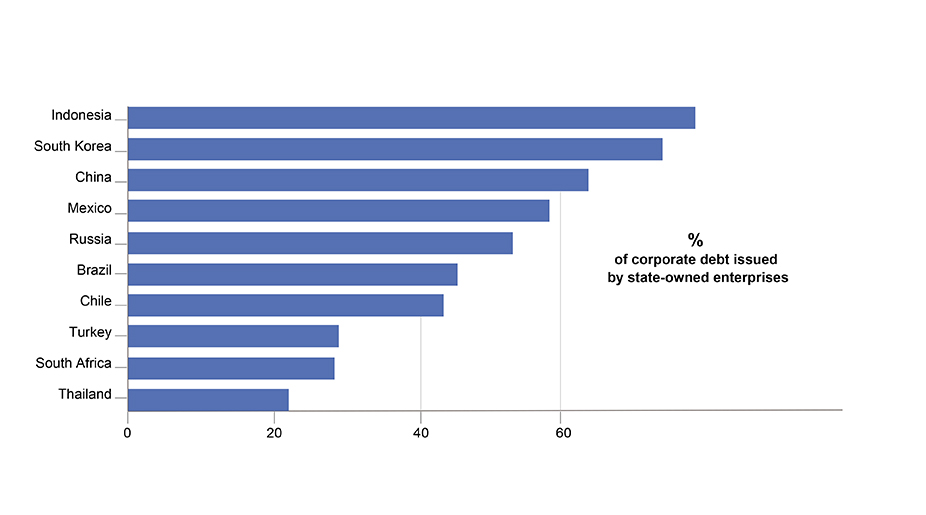

SOE far SOE good – percentage of corporate debt issued by state-owned enterprises

Source: UBS, published in Financial Times on 20/09/2018

Key factors to consider

A key factor to consider when buying bonds of SOEs is the likelihood of a government bail-out in case of financial distress. A company’s strategic importance to the country in question, the presence of a track record of government capital injection and well-established support mechanisms are some of the aspects that play a role in this assessment. Detailed assessment of regulatory advantages might also be required.

As acknowledged it is by experienced investors, political risk is a key factor that deserves their attention. On the one hand, SOEs are deemed more likely to be subsidized and at extremes even rescued by the government than regular corporates in financial distress. On the other hand, they can also be subject to higher taxes as well as other types of adverse interferences, such as initiating operations or M&A projects that are financially nonviable, putting their liquidity and solvency at risk. A prominent example of a SOE suffering from demands of the cash-strapped government is PDVSA, the Venezuelan state oil company.

These factors show that it is important to select SOEs that operate in stable political and regulatory environments. Seizing investment opportunities on a global scale based on relative value constitutes the essence of the investment philosophy of BLI - Banque de Luxembourg Investments’ fixed income team.

_______________________

[1] Definition by O.E.C.D. (Organization for Economic Co-operation and Development)

[2] www.markets.jpmorgan.com/#research.emerging_markets.index

[3] Standard & Poors RatingsDirect Report, 11/07/2018