Investing in the “Sweet Spot” of the US market

The market for smaller companies in the US is roughly the same size as the entire European equity market. Yet, it is often falsely overlooked by investors although mid-caps show the best historical risk-adjusted return profile. We believe they deserve to play a more significant role in investors’ portfolios.

In this article, we will explain why it is important to invest in this interesting area of the market.

We will then show how investors can take advantage of this asset class, by investing in the BL-American Smaller Companies Fund, currently celebrating his two years of existence.

Why should you invest in American Smaller Companies?

Whether you are one, have one, or know one, chances are you have heard the term “middle child syndrome.” And whether it is a true phenomenon or not, middle children can often see themselves as ignored and without a clearly defined place in the family. Mid-cap stocks tend to suffer the same condition, with their large-cap older siblings and small-cap younger ones often garnering the bulk of investor attention.

US Mid-Cap companies showing an attractive risk-adjusted return profile

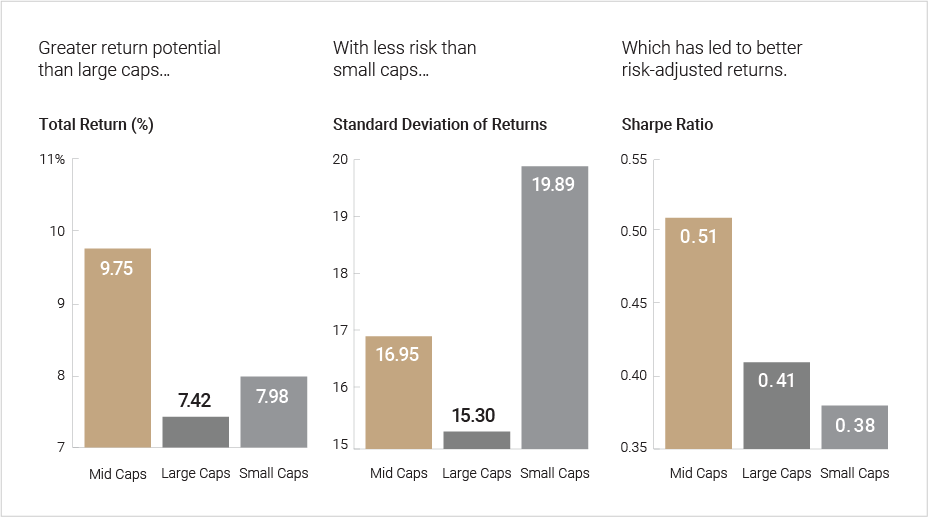

In the equities family, mid-caps may very well be the middle child, but their performance has been anything but middle of the road. While small-cap stocks have a reputation for delivering some of the best returns in the stock market, in fact mid-cap stocks have outperformed both small- and large-caps over the long term. And, mid-caps have produced this superior return with less risk than that of small-cap stocks.

Mid-caps have not just outperformed large caps in positive markets, but offered nearly the same degree of downside protection during negative periods. This can be explained by the better earnings resilience, compared to small- and large-caps in recession periods.

The balance between the risk and reward offered by an investment vehicle is encapsulated in a statistical measure called the Sharpe ratio. Historically, mid-cap stocks produced the highest Sharpe ratio.

Mid caps have shown better risk-adjusted returns than large or small caps over the past 20 years (as of 30/06/2017)

Source: Morningstar, 30/06/2017

“Compound interest is the 8th wonder of the world” (Albert Einstein)

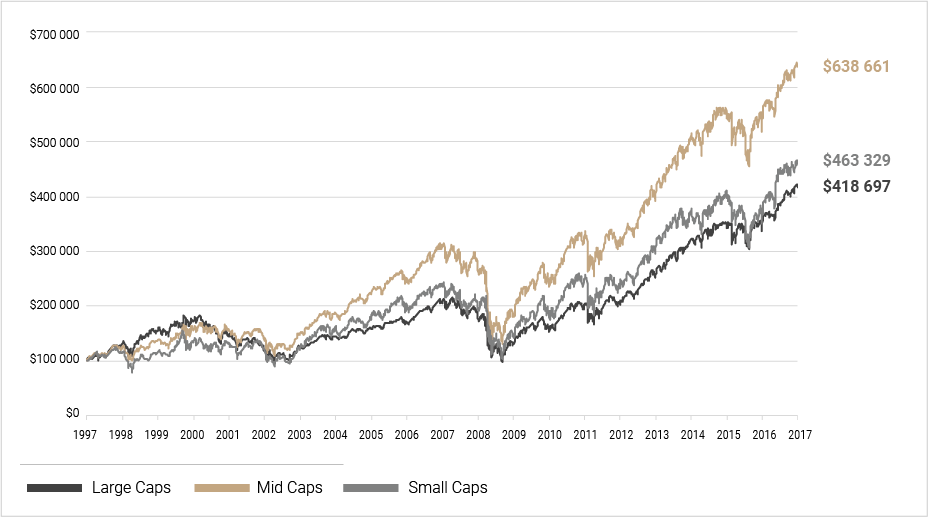

A hypothetical $ 100 000 investment in mid-caps stocks would have yielded the highest return over the 20-year period-worth nearly $ 639 000, 38% higher than the returns of small caps and 53% higher than returns of large caps. A higher annual return, not just adds up to a superior total return over time, but also the more quickly the compound interest effect becomes significant. The compound interest effect begins to take off the further you go out in time.

The outperformance over the past 20 years occurred in several different market environments, including the 1998-2001 internet bubble, the period between 2003-2007, a time which saw interest rate, housing, and commodity cycles, and the post global financial crises period of 2009-2016.

Growth of hypothetical $ 100 000 investment measured by index performance (30 June 1997 - 30 June 2017)

Source: Bloomberg, 30/06/2017

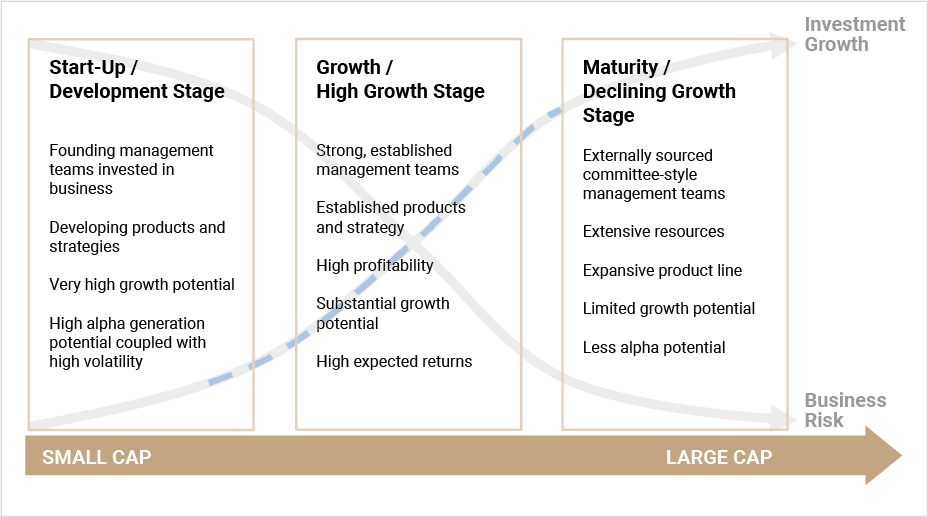

Companies in the most attractive stage of their life cycle

Once through the difficult start-up phase, small and mid-cap companies enter the phase where they can deploy all their growth potential. With respect to large caps, the key reason for higher growth is mathematics – it is simple easier to grow from a smaller base than a larger one. Mid-caps have an advantage over small caps, as they are typically more mature, therefore offer better cash flows, more stable balance sheets, more experienced management teams, better established brands, market positions, products and relationships. Mid-caps find themselves in the business life cycle where they can generate stable profitable growth and therefore strong shareholder returns.

Market capitalization ranges and the business life cycle

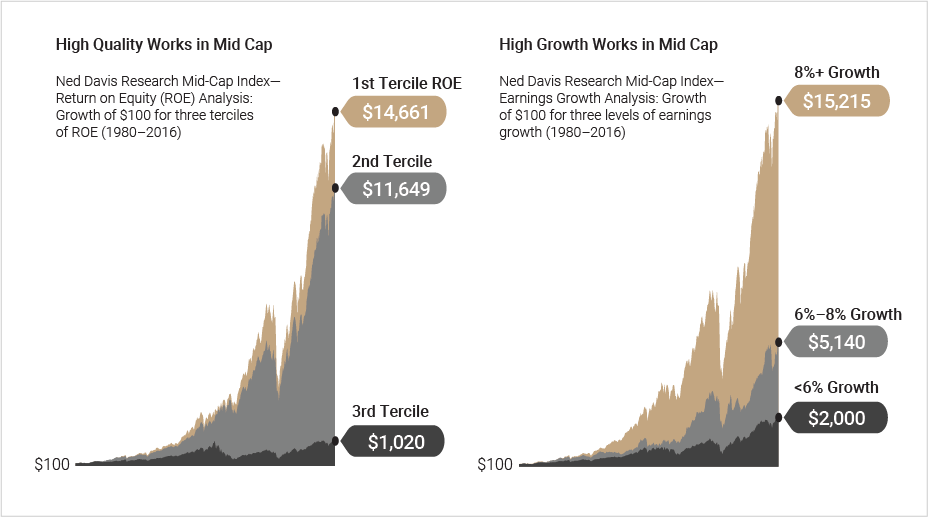

A high quality and growth approach has led to strong historical performance in mid-caps

The quality premium is well documented among large cap stocks and is also applicable to mid-cap companies, with high-quality mid-caps enjoying long-term performance advantages versus their low-quality peers. High-quality mid-caps have been consistent outperformers versus low-quality mid-caps across most time periods and market conditions.

A combination of deep capital markets and entrepreneurial zeal makes the US a uniquely supportive environment for growth companies. Growth is a large determinant of long term returns. Generating above average growth in the mid-cap space has led to strong performance advantages compared to slower growing companies.

Source: Ned Davis Research (NDR), 31/12/2016

Investors are often underexposed to Mid-caps

Mid-cap stocks tend to be under-owned by investors, with assets invested in mid-cap equities being significantly smaller than relative market capitalization analysis would suggest. Mid-caps make up 26% of U.S. equity market cap but only 13% of U.S. mutual and exchange-traded funds’ assets. This phenomenon makes mid-caps structurally undervalued.

American small and mid-cap companies provide a higher exposure to the world’s largest and most dynamic economy

Small and mid-caps derive more of their revenue and profit from a domestic economy that has less risk than the global economy upon which multinational large caps depend. They benefit more directly from the economic dynamism of the US economy. Periods of US dollar strength can also cause challenges for multi-national companies with global sales.

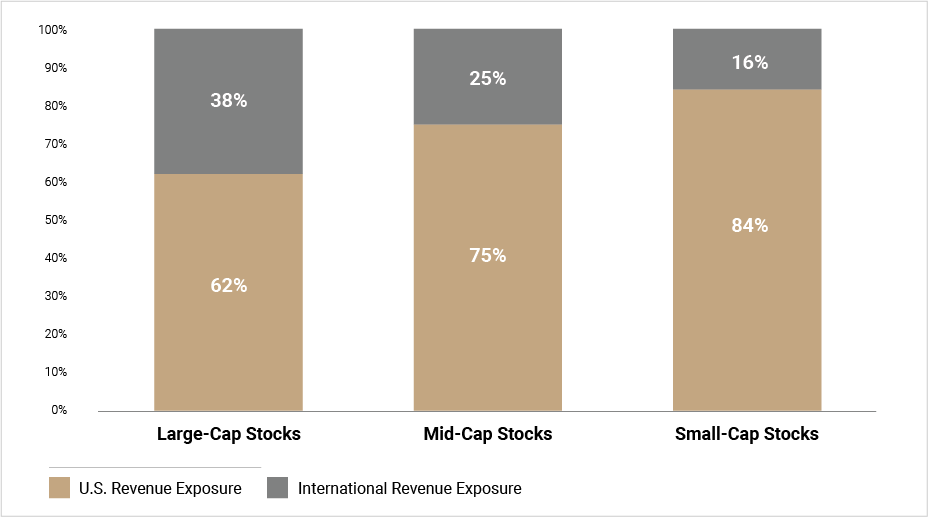

SMID-Caps have lower exposure to international sales

Source: Bloomberg, 30/09/2017

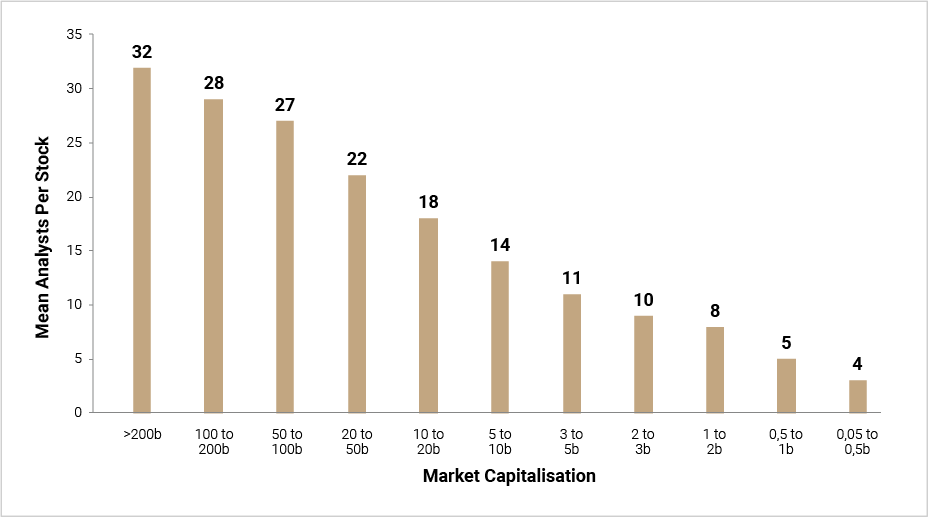

Smaller Cap universe is less well researched than large indices and therefore offers ample opportunities for active managers

The lack of analyst coverage results in the market taking longer to appreciate the value of mid-cap companies. Large-cap companies today have much more analyst recommendations on average resulting in strong market efficiency, where company information is reflected quickly into its share price. By contrast, companies in the small and mid-cap range have much fewer analyst recommendations on average which results in slower dissemination of market information and can create alpha opportunities for portfolio managers.

Mean analyst coverage by capitalisation range

Source: Bloomberg, 30/09/2017

>>> Put simply, if you’ve been ignoring smaller cap companies (especially mid-caps), you’ve been missing out on tremendous opportunities!

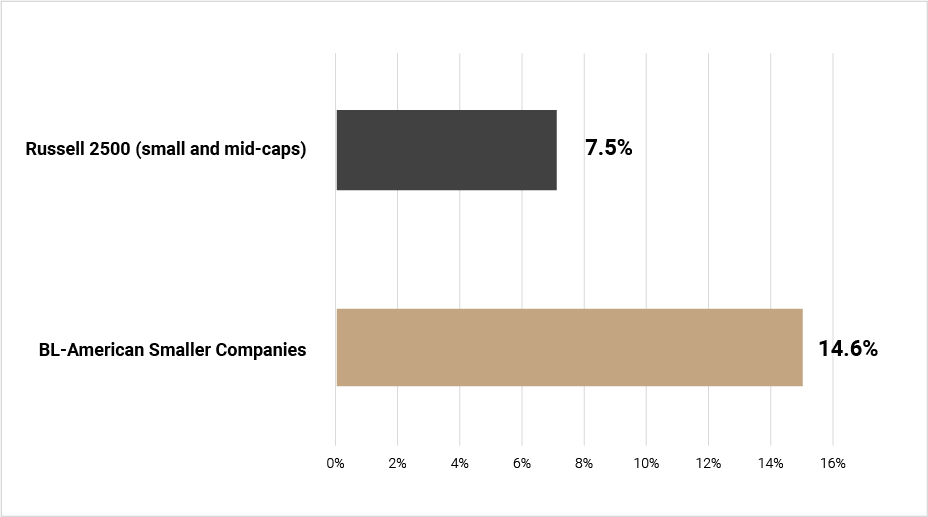

Investing in the BL-American Smaller Companies Fund, means to take advantage of the “Sweet Spot” of the market

The fund BL-American Smaller Companies was launched in November 2015 and is celebrating his two years of existence. The fund was launched with the goal to profit of the “sweet spot” mentioned above – investing in fast growing, high quality, and predominantly mid-cap companies that we expect to compound value over time.

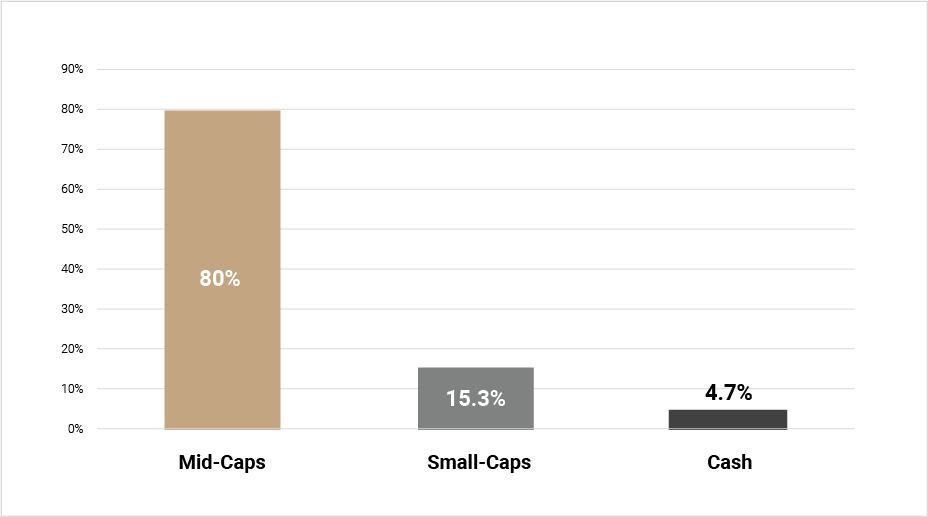

Focus on Mid-Caps

The fund has a strong bias towards mid-caps, but also has some exposure to small caps. This permits the fund to benefit from interesting companies, passing our quality criteria, already at an earlier stage and to take advantage from a broader opportunity set of companies.

Market cap allocation BL-American Smaller Companies

Source: BLI; Market Capitalisation: Mid-Caps (5-20b$) and small Caps (0.5-5b$). BL-American Smaller Companies weighted average market cap at 9.4b$ as of 16/11/2017

Less-efficient markets, such as small and mid-caps, require active management

The majority of our work is devoted to identifying high quality companies with a sustainable competitive advantage and a strong investment thesis. By taking an active approach to stock selection, we can eliminate from consideration low-quality companies that are competitively disadvantaged, too capital intensive, expensively valued, have too much debt, or generate poor returns on capital. We believe that careful selection of reasonable priced high-quality companies enables an active manager to create value.

Return on capital employed BL-American Smaller Companies vs Russell 2500*

Source: Bloomberg, BLI; *Russell 2500: excluding companies showing negative earnings and therefore not paying taxes, financials, real estate and companies where not all information is available

Companies of the BL-American Smaller Companies fund

The fund consists of a focused portfolio (currently 53 stocks) of our best investment ideas. The companies often find themselves in attractive niche markets or benefit from long-term trends, such as the aging population, automation, healthier living, digitalisation etc. To give the reader a better understanding in what kind of companies the fund invests, we will have a look at its current top holding.

ResMed – Changing lives with every breath

ResMed is the leading provider of solutions for sleep apnea (sleep disordered breathing). The company develops, manufactures and distributes medical devices such as airflow generators and masks to treat breathing disorders. These tools help patients breathe easier and avoid complications associated with sleep apnea, including exhaustion and hypertension. ResMed profits from a highly profitable recurring revenue stream through their masks and pillows. It operates in a niche, oligopolistic, large, underpenetrated and underdiagnosed market. 26% of adults have some form of obstructive sleep apnea and the US, one of the most penetrated markets in the world, has just 10-15% of patients in therapy. Greater awareness (e.g. smart watches) and more convenient testing options (at home vs sleep laboratory) should lead to increased penetration. Long term drivers like the demographic trends and the aging of the population (sleep disordered breathing is linked to obesity, diabetes, and cardiovascular disease) increases the potential size of the market further. ResMed has additional opportunities in respiratory care, with 380 million people worldwide estimated to have a Chronic Obstructive Pulmonary Disease, as it is expected to be the third leading cause of death by 2020. Their products reduce healthcare costs by shifting care from hospital to home. The company is a global leader in connected care, with already more than 4 million costumers monitored from distance every day, what makes patients and doctors stickier to ResMeds products.

Attractive acquisition targets

The financial strength and growth characteristics of some small and mid-cap stocks make them attractive acquisition targets. Since launching the fund four companies have been acquired (Valspar, Whitewave, Mead Johnson Nutrition and CR Bard).

>>> We believe our BL-American Smaller Companies fund is perfectly positioned to benefit from the “sweet spot” of the market and will create strong risk-adjusted returns for the investor over the long term.