Investing with the Sustainable Development Goals in mind – BL Sustainable Horizon perspective

The United Nations launched the Sustainable Development Goals (SDGs) in 2015. They amount to 17 goals with 169 sub-targets destined to cover a range of ambitious and globally important objectives including action on climate change and global warming, but also promoting peace and justice as well as the eradication of poverty.

Many articles handling subjects related to the attractiveness, feasibility and subjectivity of investing in the SDGs[1] have been published. A lot has been said in regard to SDG-themed investments across different asset classes (targeting one specific or several interconnected SDGs), the lack of relevant and comparable data in regard to the actual impact as well as a potentially accelerated shift towards social goals in light of the COVID-19 pandemic

With this article, we aim to add value by detailing how we tackle SDGs within our flagship global equity SRI fund, BL Sustainable Horizon, who has been pursuing a responsible investment strategy since 2008. Since 2018, the approach of the fund has been 2-fold, encompassing a quantitative pocket and what we call the thematic pocket. The quantitative pocket is built relying on a more traditional best-in-class approach, i.e. requiring minimum ESG scores for inclusion provided by our third party research provider while the thematic pocket includes companies that through their activity or business model, contribute directly or indirectly to the realisation of the Sustainable Development Goals. For this pocket, we deliberately decided not to set quantitative thresholds but rather to focus on companies with a true added value in the achievement of the Goals. In addition, the fund applies exclusions which are noteworthy in that they were set in line with the “do no harm” principle[2] and as such exclude companies that from the outset are counterintuitive to the aim of the Goals: tobacco & alcohol in regard to their adverse impacts on health (SDG 3: Good Health and Well-Being), gambling as an enabler of inequalities & poverty (SDG 10: Reduced Inequalities & SDG 1: No Poverty), or fossil fuels as detractors of climate action (SDG 13: Climate Action ).

Now that this strategy has been implemented for almost three years, we have enough hindsight to identify its strengths and weaknesses, particularly in terms of the thematic pocket. Regarding the latter, we have always tried to remain pragmatic, honest and transparent in our approach. Nonetheless, questions arise as to what the pocket is and is not supposed to be, leading us to revisit the subject.

We hereby would like to further explain our thinking, where we have come from, where we are now and how our thinking may evolve in order for us as an investment team to sense-check our considerations and for you as a reader, as an investor to comprehend the vision behind the fund’s thematic pocket. We acknowledge the fallacy of SDG investing and the thematic pocket itself as the term true added value implies that there is a grey area and subjectivity at play.

Measuring the contribution to the SDGs: there is no magic formula

If we had to describe the essence and the idea behind the thematic pocket in only a few words it would be to invest in companies that have a straight-forward, universally accepted impact on the SDGs, i.e. looking to invest in companies whose business models are at their core best aligned with the SDGs. This should entail that we are able to explain the impact of a company in a single sentence so that our families and friends, understand the beneficence without leaving room for (too much) discussion. Historically, the idea was that small and mid-cap companies may be best positioned to contribute to the achievement of the Goals and have the greatest impact as they are most often pure-players and have less complex value chains, prone to fewer controversies and adverse results. However, with this come oftentimes excessive valuations as globally investors are collectively looking to invest in these niche players, interfering with BLI’s long-standing financial approach that seeks to invest in quality companies benefiting from attractive valuations. More recently, we decided to also include in the thematic pocket some bigger players with more diversified business models. Our reasoning is that, having the necessary capital and resources available to prioritize sustainable operations throughout the value chain, they can act as drivers of change: these companies the power and weight to shift market practices given their size, reach and influence.

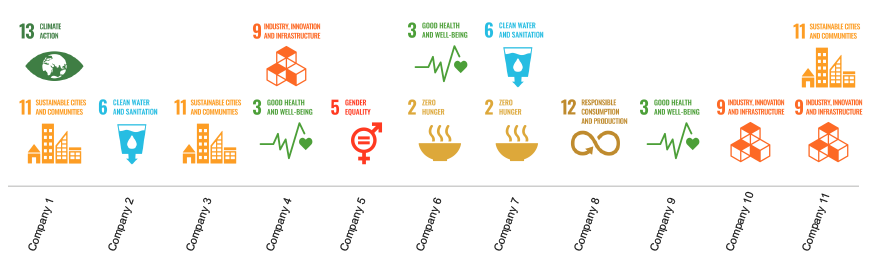

The thematic pocket at the time of writing this article counts 11 investments, ranging from USD 0.6bn to USD 86bn in market cap and spanning diverse sectors such as healthcare & life sciences, construction and building products, mobility and consumer staples. In total, when going through the integrated reports, the companies mention 58 SDGs. On average 5,3 Goals are targeted per company with 15 unique Goals being highlighted, only SDG #1: No Poverty and #15: Life on land are not mentioned.

At BLI we run our own analysis, which entails compiling relevant data from different sources into a so called ESG card and evaluating the data through our experience and common sense. Our opinion is that a company targets primarily one or two SDGs through its products and services (in the spirit of more is not always better). The added value of our in-house analysis is to make sense of the growing reporting companies produce in regard to their sustainability impact and distill the key impact areas while acknowledging that secondary impact areas can exist. We are also looking for potential ripple effects throughout the value chain, which could be the case of an industrial company’s product allowing to reduce emissions, waste or water usage of their clients, who in turn improve their own services allowing the end customer to consume in a more responsible and sustainable way.

Hence, we have determined the most poignant impact drivers, where we feel the relation of the business and SDGs is strongest and most evident and singled out 8 unique SDGs (see graph below) that seem to us to be the most relevant and easily understood.

Targeted SDGs according to BLI's analysis

Naturally, measuring contribution to the SDGs varies by market cap, sector and geography as well as depending on the whole value chain of a company. Secondly one has to acknowledge that a company who may positively contribute to one SDG could detract from the realization of another. This can be the case for a water utility who is set out to contribute to SDG 6: Clean Water & Sanitation by supplying clean water all the while having its own operations consume tremendous amount of energy thus having a high carbon intensity, detracting from SDG 13: Climate Action. Hence, it comes down to finding the right balance – keeping our approach as simple as possible and yet as complex as necessary when analysing the contribution to the Goals.

The rationale behind our analysis

Now that we have outlined the philosophy behind the thematic pocket as well as concrete outcomes and potential shortcomings, it is worth explaining why we decided to proceed with our internal analysis. Indeed, many data providers exist (from small to big international players) that offer services to measure a company’s alignment with the SDGs as part of their ESG data offering. And we do not even have to look that far, as the companies themselves report ever more transparently on their impact and contribution to the Goals.

Unfortunately, anecdotal or overreporting SDG impacts as well as misconceiving and misunderstanding indicators is more widespread than one would think, both at company and investment manager level (including ourselves). Moreover, as the methodologies of the various providers vary, the conclusions do too. Hence, we looked at several studies to better comprehend the current state of SDG reporting and combine the insights with our own experience. The below conclusions, albeit not a holistic view, give a glimpse why we deem it important to carry out our own analysis when it comes to a company’s contribution to the SDGs and thus its inclusion in the thematic pocket.

1. Studies suggest that some Goals clearly come out as being most prioritized across the board. For example, SDG 13: Climate Action and SDG 8: Decent Work and Economic Growth rank unsurprisingly on the top of the priority list for many while SDG 15: Life on Land seems to be less favored. Intuitively this does make sense in light of the current state of the world and as regulations enter into force promoting environmental objectives (i.e. European Taxonomy) while good working conditions are essential at any time in any company.

However, it does seem that there is a mismatch between the SDGs companies report on most frequently and those SDGs that they have the biggest exposure to in terms of risks-opportunities and thus impact potential[3].

Figure: Most reported: WBCSD & DNV GL 2019, GlobeScan-SustainAbility 2019, Oxfam 2019, KPMG 2018; Most SDG Exposure: Trucost. Data as of June 2019

2. Another study shows, that among the MSCI ACWI Index (consisting of 3047 at the end of March 2020) – a staggering number of 2187 (72%) publicly commit to at least one SDG.[4] While this confirms that SDG awareness amongst the business community is high and that a majority of companies have introduced SDGs in their disclosures, the definition of universally applicable key performance indicators (KPIs) is still missing.[5] With those standardized KPI’s unavailable, the in-house analysis carries a lot of weight and importance in the selection of investments.

As we look to invest in companies whose business models are at their core best aligned with the SDGs, the only way to distill clear candidates is to set our own qualitative and quantitative objectives and compare available data against them. Where necessary we enter into dialogue with the investees to discuss their thinking and impact journey in greater detail. Hearing from key personnel about the measures that are in place and execution of future plans can further help us in our decision-making process.

For some business models, contribution is quite clear…

For some of our investees, it is quite easy to, as we mentioned before, crystallize in one single sentence the sustainability lever of the company and its concrete contribution to the SDGs:

Sonova: Sonova's business model seeks to increase access to hearing care and improve the quality of life for people with hearing loss, which is crucial as consequences can range from disadvantages at work or school, to relational difficulties and social isolation.

Sweco: Sweco fits the ESG narrative as investments in infrastructure are necessary to address the challenges caused by climate change, urbanization or digitalization and to promote greener cities for a better quality of life, reduced pollution and more efficient construction models.

Chr Hansen: Chr Hansen stands for increased reliability, safety and efficiency in global crop levels and food crucial to sustain a healthy and sustainable development of a growing world population.

Waters: Waters is focused on improving human health and well-being via its technology and machines, mainly chromatographs and mass spectrometers, which are used in drug discovery and development, as well as for environmental, clinical and nutritional safety testing.

From these statements, we feel comfortable to say that these companies do indeed fulfill the triple bottom line – accounting for Profit, People and Planet.

…but there is also often a grey area…

However, as with most things in SRI[6] there is no clear black and white definition and a grey area exists. Nuances need to be well understood and compromises made at times in line with the desired impact goals. Even among our investment team, we value certain aspects differently and have our personal biases when prioritizing impact areas such that the continuous dialogue we enjoy in our team is highly appreciated.

A company we regularly discuss internally and that falls in the grey area as it presents sustainability benefits yet they are often followed by a ‘but’ is for example Canadian National Railway (CNR).

CNR: In the US, transportation accounts for 28% of GHG emissions, with only 2.1% of sector emissions driven by rail. The biggest share being attributed to passenger vehicle (58.7%) and truck (23.2%), mainly supporting the surge in e-commerce.[7] This draws a very favorable picture of Canadian National Railway, as well as diverting traffic from roads improving the quality of life and having a greater capacity than trucks. However, CNR also positions itself as the prime partner for the US coal industry, transporting an average of 45mln tons of coal every year. Together refined petroleum products, crude and coal make up roughly 1/5 of revenues.[8] This bears the question what should count more the fact that rail is less polluting than cars, trucks or air freight or the type of freight. In our opinion the first argument prevails as they do not extract the goods themselves and merely transport what has already been extracted and is still needed in the current state of global energy demand (ignoring the emissions caused during the use phase). Alongside this CNR has an action plan in place to reduce their own emission, via investments in more fuel efficient fleets as well as being the first railroad to set Science based targets (SBT)[9] back in 2017. Thus, the company deserves its position in the thematic pocket.

Final thoughts

While divergences in individual priorities will always remain, we believe a certain subjectivity and use of common sense in addition to having recourse to data, adds value to the selection of investments for the thematic pocket. As we said it is about balance and fostering dialogue between the fund managers, the analysts and SRI team as we continuously look for new opportunities to strengthen the pocket in future. Our approach is a bottom-up approach meaning that we do not set formal targets in terms of how many percent of the portfolio the thematic pocket should represent or which and how many SDGs we want to target.

We do not deem to have all the answers and our thinking naturally continues to evolve over time but a constant remains the rigor in the analysis we carry out behind every investment to determine what is financially sound, best practice in terms of ESG and where compromises need to be made when investing in a company. Indeed, it refers back to the old idea of: We can’t have our cake and eat it, but we can eat some parts of the cake.

This document is issued by BLI - Banque de Luxembourg Investments (“BLI”), with the greatest of care and to the best of its knowledge and belief.

The views and opinions published in this publication are those of the authors and shall not be binding on BLI.

Financial and economic information published in this publication are communicated for information purposes only based on information known on the date of publication. Such information does not constitute investment advice, recommendation or encouragement to invest, nor shall it be interpreted as legal or tax advice. Any information should be used with the greatest caution. BLI does not give any guarantee as to the accuracy, reliability, recency or completeness of this information. BLI’s liability cannot be invoked as a result of this information or as a result of decisions that a person, whether or not a client of BLI, may take based thereon; such persons retain control over their own decisions. Interested persons must ensure that they understand the risks involved in their investment decisions and should refrain from investing until they have carefully considered, in conjunction with their own professional advisors, the appropriateness of their investments to their specific financial situation, in particular with regard to legal, tax and accounting aspects. It is reiterated that the past performance of a financial instrument is no guarantee of future returns.

Author

Annick DRUI, Co-fund manager BL Sustainable Horizon, info@bli.lu

The author of this document is employed by BLI - Banque de Luxembourg Investments, a management company licensed by the Commission de Surveillance du Secteur Financier Luxembourg (CSSF).

2. Meant in a wider sense here compared to the “do no significant harm” principle of the EU taxonomy relative to environmental objectives

4. https://www.msci.com/who-cares-about-the-un-sustainable-development-goals

5. Maria Federica Izzo & Mirella Ciaburri & Riccardo Tiscini, 2020. "The Challenge of Sustainable Development Goal Reporting: The First Evidence from Italian Listed Companies," Sustainability, MDPI, Open Access Journal, vol. 12(8), pages 1-18, April.

6. Sustainable and responsible investing

7. Source : US Environmental Protection Agency (EPA), Bernstein Analysis

8. 2019 Annual report CN

9. https://sciencebasedtargets.org Science-based targets show companies how much and how quickly businesses need to reduce their GHG emissions to prevent the worst impacts of climate change, leading them on a clear path towards decarbonization. By guiding companies in science-based target setting, SBTi enables them to tackle climate change while seizing the benefits and boosting their competitiveness in the transition to a net-zero economy. https://www.wri.org/initiatives/science-based-targets