Investment strategy 2018

As the saying goes: “To know where you're going, you need to know where you are.” So where exactly are the financial markets as we start this new year? To say the least, equity markets enjoyed an excellent performance in 2017. It is hard to think of an index that did not increase by at least 10% in local currency. Expressed in euros, their performance was less spectacular because of the single currency’s appreciation against most other currencies. Few observers predicted this kind of performance a year ago but, with hindsight, the economic and financial environment proved virtually perfect for equities.

Firstly, the global economy gathered pace and reached its fastest growth rate since the crisis. Furthermore, global economic growth became more synchronised, with amongst others a notable improvement in economic activity in the eurozone. Secondly, the growth spurt has not bumped up inflation. In practically all industrialised countries, inflation has remained below the central banks’ targets (but at the same time remained high enough to keep fresh worries about deflation at bay). Lastly, and despite the US Federal Reserve’s monetary policy tightening, the central banks have persevered with their accommodative policies and liquidity has remained plentiful. Contained inflation and very low short-term interest rates have staved off a rise in bond yields, helped by the ongoing asset-purchase programmes of a number of central banks. To sum up, global growth is accelerating with an upward revision of estimates for corporate profits but no rise in interest rates. While the structural risks related to unprecedented debt levels have certainly not disappeared, 2017 demonstrated once again that investors are prepared to temporarily ignore the risks and view them through the prism of their prevailing mood and how the markets are performing. Markets make opinions.

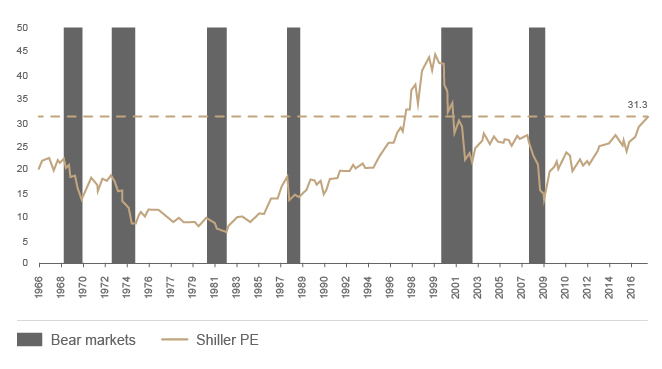

Equity valuations are high

In 2017, on the whole, share prices rose more than corporate earnings. Valuation multiples, which were already high a year ago, increased further. This was especially the case on the American market. In fact, around two-thirds of the rise in the S&P 500 index since February 2016 can be explained by the increase in valuation multiples. What’s more, this increase in multiples took place in a context of the Federal Reserve’s monetary tightening whereas, in the past, multiples tended to decrease whenever the US central bank raised its interest rates.

Equity valuations are now among the highest ever recorded. History shows that there is a close link between valuations and equity returns. The returns that an investor could realistically expect when investing at current levels are therefore very low. But we should point out that the link between the price paid (i.e. the multiples) and the subsequent return only plays out over the long term. The fact that shares are now expensive certainly increases the downside risk in the event of a correction but says nothing about their performance in 2018. An expensive market can become even more expensive.

S&P500: valuation multiples and bear markets

Source: CLSA

What drives stock prices?

The favourable environment which boosted the financial markets last year is still in place at the moment. Economic growth is not showing any signs of slowing down, inflation is under control, and the central banks’ monetary policies have never been quite so transparent. So, it is not surprising that, as we start this new year, the equity markets are continuing to behave well. But for share prices to continue to rise, one of the following scenarios needs to occur:

- Corporate earnings and the multiples paid for them increase.

- Earnings increase and multiples fall, but the rise in earnings is higher than the fall in multiples.

- Inversely, earnings fall and multiples increase, but the rise in multiples is higher than the fall in earnings.

The share price rise would obviously be significant in the first of these scenarios (the scenario which prevailed in 2017 and for a large part of the post-financial-crisis period) and rather more moderate in the other two. Bear markets are characterised by the opposite conditions, with the strongest bear markets occurring when earnings and multiples decline.

As regards the first of the constituent elements, corporate earnings, we could expect them, in general, to benefit from a continuing improvement in the global economy. However, a large part of this improvement has already been factored into current forecasts. But if equity markets only reflected the growth in corporate earnings, share price fluctuations would be much more moderate.

The fact that share prices fluctuate so much is explained by the second of the above elements, a change in valuation multiples. Major bull markets are characterised by an increase in multiples, while major bear markets see a decline in multiples.

What then are the factors that determine these valuation multiples? Simplifying somewhat, we could say that among the factors involved, one is tangible and the other intangible. The tangible factor is the level of interest rates. A company's share price is deemed to be the present value of its future profits (or cash flows or dividends). The higher the interest rate used to discount those profits, the lower its present value will be. Inversely, when interest rates are low, investors tend to use lower discounting rates and the present value of a company’s profits will be higher, thus justifying a higher share price. Interest rates also play an important role in the valuation of shares since fixed-income investments are a natural alternative to equities. If the remuneration offered by money market investments or bonds is attractive, there will be less temptation to invest in equity markets.

The intangible element is more psychological and concerns the way investors evaluate the opportunities and risks that always exist at any given time. Investors go from periods when their aversion to risk is low to periods of acute risk aversion and vice-versa, without it always being clear what exactly has prompted their change of mood.

Can the environment for financial markets become even better?

Coming back to today’s situation, we could expect that, for the multiples to continue to increase, we would need an environment that has so far been exceptionally favourable to multiple expansion to become even more so. Interest rates are at historically low levels and it is hard to imagine them declining further. The central banks have either already started to normalise their monetary policy (United States, Canada), or are expected to do so sooner or later. Bond yields may have reached their lowest point in the middle of 2016. Although there is nothing at present to predict the kind of sharp rise in interest rates that would cause equity valuation multiples to collapse, obviously, as far as interest rates are concerned, the situation could hardly be more favourable. Meanwhile, investors’ aversion to risk is exceptionally low at present. Their experience in recent years has been that, even events that are theoretically considered dangerous for the markets – like Brexit or the election of Donald Trump – have not halted the equity markets’ advance. In this context, any correction in share prices is seen as an opportunity to buy. The result is that corrections have become increasingly few and far between.

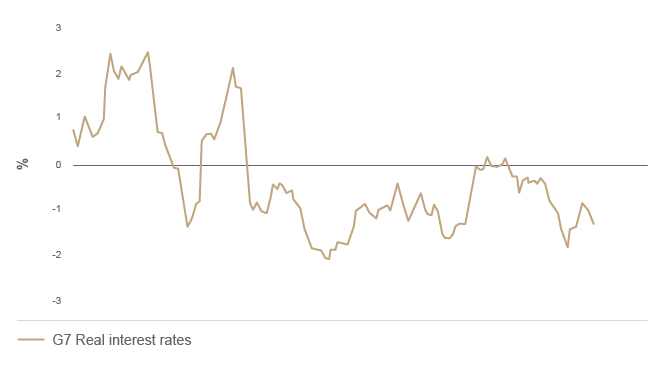

An extraordinary period of easy money

Source: BCA Research

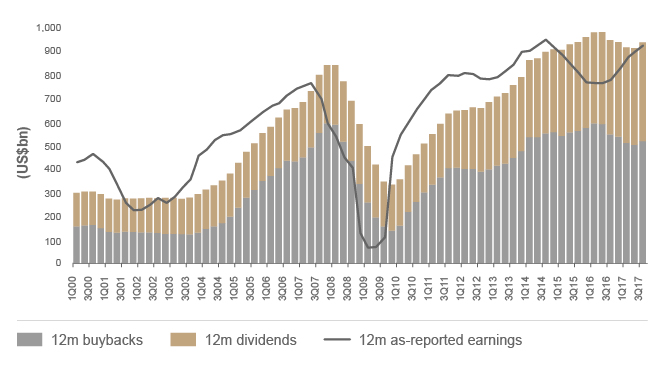

The current multiples could be justified by the confluence of various elements that are all very favourable to equities: low economic volatility, growth picking up, contained inflation and low interest rates. To these elements could be added the importance placed on the treatment of shareholders, which has for example encouraged many companies to take on debt to buy back their shares or increase their dividend. It would be wrong to think that these elements will always be present, or that they could become even more favourable. This trend is in play and it is no coincidence that the last phase of a bull market or the start of a speculative bubble can be described by the acronym EFEE - Excellent Fundamentals Extrapolated Enthusiastically.

S&P500 share buybacks

Source: S&P Dow Jones Indices

No reason to think that multiples should fall precipitously

At the risk of being reproached every which way, we would add that we do not expect any sharp fall in valuation multiples, at least in the short term. Firstly, as we said above, investors have become used to viewing a price correction as a buying opportunity. It will take time for this mentality to change, especially while an index-tracking management style is increasingly replacing active management. Secondly, the central banks have invested too much in stimulating risk-taking to tolerate too big a drop in the price of financial assets.

Another positive factor for the equity markets remains the lack of alternatives. Given the yields currently on offer, by and large the bond markets hold very little attraction for a long-term investor. Yields on investment-grade government bonds are negative in real terms (adjusted for inflation), and even, in some cases, in nominal terms. Over time, this destroys investors’ purchasing power. As for lesser quality bonds, the desperate search for yield in a zero-interest-rate environment has reduced yields to levels that bear no relation to the risk incurred.

That leaves money market investments. In a context of most financial assets being over-valued, it could be tempting to keep a significant cash portion, ready to pounce on any correction that might arise. But given the lack of return on the money markets (at least for a European investor), this only makes sense if the correction comes soon and the investor can use it well to reinvest at the right time. In practice, few investors have the necessary discipline to bide their time and profit from a correction.

As an investor, it is hard to escape the reality that, through their monetary policies, the central banks have generated an increase in financial assets, which has substantially exceeded anything that could be justified simply by an improvement in the fundamentals. In so doing, they have created a situation in which the medium- and long-term returns to be expected from these assets, equities and bonds, are very low and in which the risk of a slump in the event of a downturn, could prove very severe. Whereas, for many years, investors have enjoyed the wind in their sails, they could in future be up against stiff headwinds.

In short, the economic and financial environment remains favourable to equity markets for now, but the risks are increasing. The fear of missing out is replacing the scepticism with which a lot of investors have until recently viewed this bull market. It is important to be very vigilant to detect any deterioration in the pillars underpinning the rise in share prices. Apart from geopolitical threats, the risks include a potential slowdown in economic growth, a sharper-than-expected rise in inflation, a faster-than-anticipated change in the central banks’ monetary policies, and rising bond yields. None of these risks appears particularly menacing in the short term, but that does not mean they should be taken lightly. Potentially surprising, for example, is the considerable flattening of the yield curve (narrowing of the gap between long and short yields) in the United States, knowing that in the past, such a flattening generally preceded a slowdown in growth (a slowdown which should not, by the way, be so surprising for an economy in its ninth year of expansion). It is also noteworthy perhaps that a number of US companies are mentioning that they are having trouble finding workers, which could lead to pressure on wages. In the eurozone, there is evident divergence in economic momentum between the different countries and this begs the question as to which way the European Central Bank will go in the event of Germany seeing a sharper increase in inflation. Ultimately, for investors, the situation can be summed up as trying to find a balance between the potential for further short-term gains versus very real long-term risks.

What to do?

What should we do in this context? Investors have basically three options:

- Keep a significant portion of cash ready for a possible correction. For this strategy to win out in the long term, it is not sufficient to wait for markets to decline. One needs to have a battle plan and employ the necessary discipline to put it into practice. This means not giving in to impatience if the correction takes a while to materialise or if share prices continue to rise, and having the courage to buy if prices drop significantly, knowing that, at that point, the news is likely to be less positive. As noted above, few investors are capable of this. Markets make opinions.

- Invest passively, significantly lowering your expectations for future returns.

- Invest actively, trying to find companies with the best growth prospects and most attractive valuations. Here again, the risks should not be underestimated. Apart from the obvious risk of being wrong in one’s stock picks, there is the key risk of seeing them underperform the indexes over a period of time. For professional investors, this means quite a big risk for their career, especially if the underperformance persists.

Reflections on active management

For investors who, in spite of everything, want to take an active approach, there are several possibilities:

- Regional considerations based on the fact that the outperformance or underperformance cycles of certain regions versus others generally extend over several years. Investors might thus note that the US market has just enjoyed a long period of outperformance versus the Asian and European markets or that the emerging markets’ performance was well below that of industrialised countries between 2011 and 2016, but that they managed to reverse this trend last year.

- Recognise that there may be special cases from time to time. The Japanese market is thus currently benefiting from a favourable environment marked by a cyclical upturn in economic activity and a structural increase in corporate profitability.

- Forget about these kinds of ‘top-down’ considerations and focus on stock selection. Now more than ever, such a selection should place particular emphasis on quality companies with a sustainable competitive advantage and a sound financial structure. In a context in which the long-term return on equities would seem, on the whole, to be below the historic average, it goes without saying that extra importance should be assigned to the ‘dividend’ aspect.

At BLI - Banque de Luxembourg Investments, we favour the third course of action.