The relative attraction of domestic debt: Turkey provides an illustration

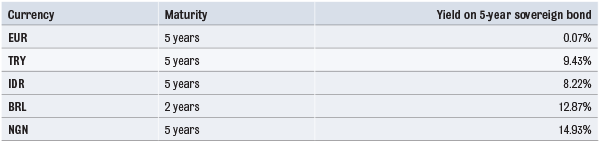

Any investor with a portfolio of fixed-income securities might reasonably wonder whether it would be a wise move to invest in securities denominated in a different currency. This would be especially useful if it could help generate higher yields. The case in point concerns investors in the eurozone where the yield on short and medium-term notes is often close to zero while other currencies may offer much higher yields.

Zero returns in the eurozone

The quest for yield can often go hand in hand with the idea of benefiting from a potential appreciation of the currency. For example, in the first six months of the year, a currency like the Indian rupee appreciated by nearly 8% against the euro. On top of this, the interest accrued on a bond denominated in local currency, e.g. the IFC 8% 20/10/2019 (issued by the International Finance Corporation), would give a total return of 12% assuming an unchanged bond price. (1). An investment in euros in the German sovereign bond DBR 3.5% 04/07/2019 could only offer the return of interest accrued on its 3.5% coupon, i.e. 1.75%, all other things being equal.

Source: Bloomberg (BRL extrapolated data)

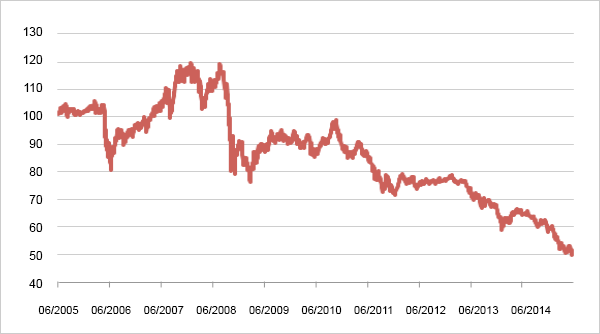

The Turkish lira on a base of 100

Source: Bloomberg

Investing in domestic debt

Exposure to a foreign currency can be gained via a range of assets (from property to equities) In many cases, the first port of entry is domestic debt denominated in the country's currency. First of all, it must be possible to invest in this market. This is the case if, for example, the target domestic instruments are settled via an international agent like Euroclear (as for Mexican sovereign issues) or if it is a eurobond (e.g. the IFC issue mentioned above).

The question of investing in a currency other than one's own crops up regularly without always taking into account the fundamentals that explain the relative attractiveness of local debt. Different considerations guide governments in the management of their borrowing and the range of domestic paper they offer:

- a national market bond to finance the development of local assets (such as schools and hospitals); this may eventually cause domestic interest rates to rise;

- an external market bond to limit the offer of paper on the domestic market; hence the rise in interest rates locally;

- increased external public debt servicing. Debt servicing can get out of control if the inflow of foreign currencies dries up (e.g. when there is a fall in base commodity prices for countries whose national income largely depends on them).

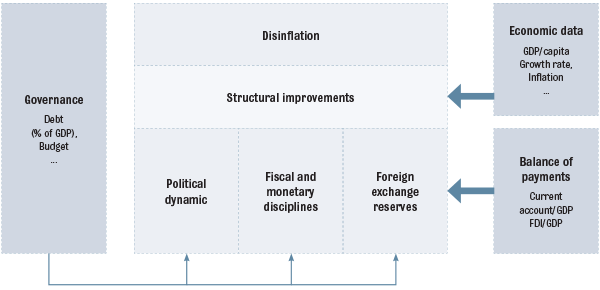

It is therefore essential that the investor understands the real reasons for high yields on domestic debt. A qualitative analysis focusing on observing a country's balance of payments contributes to assessing the real attraction of an investment. The following questions can help support an investment in a foreign currency: is there a current account deficit that is worsening because of over-high debt servicing in foreign currencies? Is the capital sufficiently productive to allow foreign lending to generate significant internal income to meet the domestic debt service? Does the country enjoy a stable political framework which fosters good governance and virtuous economic policies?

Higher yield means higher risk...

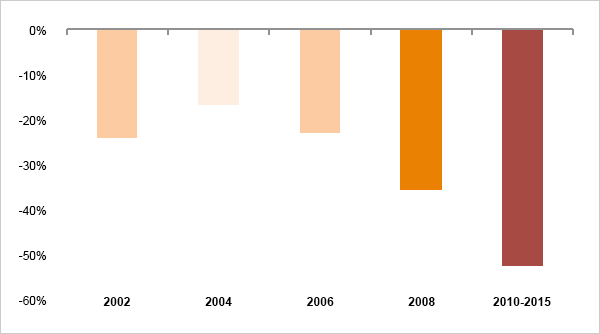

Turkey offers a good illustration of these various considerations. Back in 2005, when the US dollar was worth 1.35 million Turkish lira, Turkey's sovereign bonds offered a yield of around 18%. During the same period, the yield to maturity of the benchmark German 5-year bond fluctuated between 3% and 3.5%. At the beginning of 2005, the Turkish government replaced its currency by a new Turkish lira, a million times smaller. Despite this adjustment which was really just a façade, the lira continued to see regular periods of high volatility interspersed with episodes (of varying duration) of substantial depreciations as shown in the graph below. The reasons behind this volatility were both endogenous (internal causes: crisis of secularism, attempt to ban the AKP from power since 2002, power struggle between Erdogan's government and the army, accumulation of foreign currency denting the lira's exchange rate, loss of the AKP's absolute majority in parliament and further risks of political instability since June) and exogenous (Lehman Brothers in 2008, Greece in 2011, the announcement of the normalisation of US monetary policy in 2013 with the anticipated impact on the future of the dollar).

Various depreciations of the Turkish lira over these periods

Source: Bloomberg

Turkey is an extreme case where the dynamism of the economy and the yield offered by local debt are continually challenged by political events.

Nothing more practical than a good theory

Replacing a fixed income investment in its reference currency by an investment in another currency if the latter offers a higher yield is no guarantee of an easy capital gain. We always stress the importance of understanding the target economy before deciding to invest in its currency. As investors, we base our decisions on observing the direction of its economic policy. Building on our convictions, we enter into an investment process that looks at different financial instruments in our sphere:

- debt denominated in hard currencies,

- selecting a maturity in this currency,

- then the debt expressed in local currency, again selecting optimal exposure on the domestic yield curve.

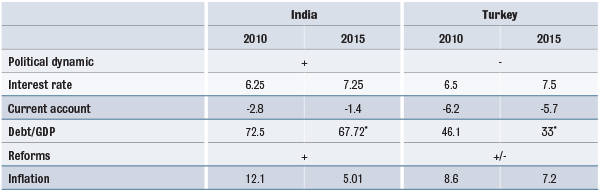

The above structure summarises some of the aspects that we take into consideration and the way we integrate them into our process.

Equilibrium between the balance of payments (between current account transactions and the financial account) and purchasing power parity will interact with the exchange rate over the medium to long term. In particular, based on the theory of purchasing power parity, high inflation will cause the currency to depreciate. It will require, for example, greater use of the country's own currency to acquire a foreign good at the same price, entailing additional supply of the local currency and hence a drop in the price of this currency against another. Monetary policy plays a stabilising role as, by raising their interest rate, central banks can try to make their domestic securities more attractive and therefore stimulate demand for their currency. We can therefore see the importance of economic policy and the impact of the degree of relationship between the monetary authorities and the government of a country, as well as the need for their independence in determining monetary policy.

Coherence and virtue

Here too, Turkey distinguished itself with the pressure regularly applied by Recep Tayyip Erdogan on Turkey's central bank In 2014, in the midst of a period of economic defiance regarding the national currency and preparations for the legislative elections in 2015, Erdogan tried to get Turkey's central bank to cut its interest rates. This was done with an initial cut on 22 May 2014, from 10% to 9.5% (2).

For investors in bonds, the notions of an economy's inflation and real interest rates are of prime importance. If there is a virtuous dynamic at this level, we think it is logical that the currency will perform well.

Source: Bloomberg, Trading Economics

* most recent data

(1) In reality, the bond price fell by 3.73% over the period, thus wiping out part of the capital gain. The total return on this bond was therefore around 8.27% in the first half of the year. Over the same period, the total return on the DBR 3.5% 04/07/2019 bond in euros only came to 0.25%.

(2) A t the end of June, the key interest rate was 7.5% with inflation ending lower, from 9.16% in June 2014 to 7.2% a year later.