Gold: a temporary correction or the end of a bull cycle?

"While nature essentially controls the quantity of gold in existence, it is men who assign it values in terms of dollars and pounds and rubles." "When we look at the alternations between inflation and deflation in our history, men seem to have done a poor job of regulating the supply of money." (Peter Bernstein)

These two quotes from Peter Bernstein, economist and author of numerous books including "The Power of Gold: The History of an Obsession "*, are a good summary of the problem facing investors interested in gold:

- gold has no intrinsic value so it is impossible to say at any given moment whether it is overvalued or undervalued or if the fall (or rise) in its price is excessive.

- the demand for gold (and hence its price) has in the past generally increased during periods when the monetary policies of the central banks ceased to inspire confidence.

Gold cannot be compared to a traditional investment

These two factors also explain why Warren Buffett's opinion on gold, often cited by people who are not keen on it, is interesting but bypasses the essential point about it. Buffett basically says that "gold doesn't create anything and in 100 years' time, the world's gold stock of 170,000 metric tons of gold will still be 170,000 metric tons" (whereas an investment in companies will have produced dividends, an investment in bonds, interest, an investment in property, rent, and so on). This is true, but buying gold can't be compared to a traditional investment. Instead, gold should be considered more like a currency but, unlike paper money, it cannot just be created by the monetary authorities (its advantage) and does not produce interest (its drawback). In periods when confidence in the monetary authorities is high, gold's advantage is small and its drawback significant, but in periods when confidence in the authorities is low, gold's advantage is strong and its drawbacks negligible (especially as during these periods, interest rates are generally low or even negative in real terms). And compared to the dollar (and most other currencies) which has lost around 85% of its purchasing power in the last 40 years, gold has performed rather well.

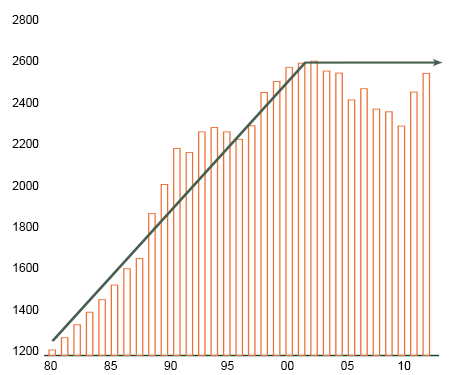

Between 1980 and 2000: a 60% decline

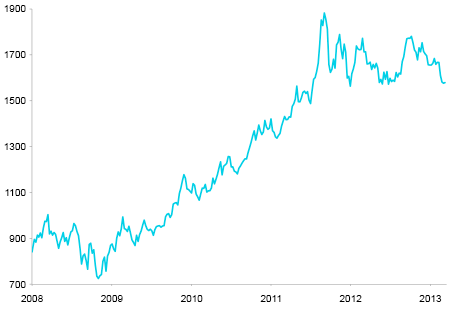

It is in this context that the rise in the gold price over the last 12 years and its correction since September 2011 should be interpreted. In 2000, the price of gold was very low. Between 1980 and 2000, the gold price dropped by more than 60%. During this period, the credibility of the American monetary and political authorities was very high, particularly due to the anti-inflationary policy conducted by the Federal Reserve under the chairmanship of Paul Volcker and the strong-dollar policy pursued by the Clinton administration. The advantage of gold (a safe haven against flawed monetary policies) was very weak and its disadvantage (opportunity cost related to the fact that it does not yield interest) high. Furthermore, the massive hike in the gold price in the 1970s led, with a bit of a delay, to a huge increase in production from gold-mining companies over the next two decades. In the early 2000s, the gold price fell below $300/ounce, a price which often failed to justify the necessary investments to maintain production at a number of mines. The central banks started to sell their gold reserves and gold mining companies engaged in massive forward-selling to hedge their future production. Gold sentiment was at its lowest.

Between 2000 and 2011: a very bullish trend despite some corrections

After 2000, gold's environment changed completely. Gold mining companies gradually stopped forward-selling. The demand for gold from emerging countries increased in parallel with their economic development. The terrorist attacks in September 2011 added a political component. Lastly, the flaws in the United States' monetary and economic policies (copied by most other industrialised countries) became increasingly apparent. Since 2000, the bullish trend for gold was thus well established despite temporary corrections of differing degrees: for example, the near-30% decline between March and November 2008, largely due to a wave of panic selling prompted by the financial crisis. Given that investor enthusiasm had actually become a little too extreme by 2010 and 2011, the current correction can only be welcomed.

And now?

But is it really only a correction? Ultimately those who think that the bull cycle for gold is over are those who think that the economic crisis is being resolved and that the world economy is on the road to sustainable recovery. If that really were the case, the monetary policies in the main industrialised countries would gradually normalise and gold would lose its attraction as a safe haven and an insurance against systemic risk.

Gold price in USD

Source: Bloomberg

I continue to think that the factors in favour of gold remain valid:

- in the current environment of excessive debt and deflationary risks, the central banks will continue to conduct expansive monetary policies, leading to the devaluation of paper money through negative real interest rates;

- these policies favour recourse to debt and will lead to poor capital allocation, unproductive investments and the risk of speculative bubbles;

- the idea that the central banks will be able when necessary to rapidly withdraw the excess liquidity that they are creating and normalise interest rates is not credible in a context of excessive debt;

- the need to make structural reforms to sustainably improve the public finances in industrialised countriesis being challenged by the realities of the democratic process;

- generally, confidence in the integrity of governments and central banks is constantly diminishing. At the same time the need for a safe haven is only becoming greater.

The gold price is essentially determined by the demand for gold for investment purposes, compared with its demand for industrial purposes, which is relatively stable. The above factors influence this demand. On the supply side, having increased considerably in the 1990s, gold production has stagnated since 2000. The priority of gold mining companies is increasingly geared towards maximising their free cash flow rather than their production. This does not augur well for a big increase in supply in the coming years.

Gold production (in tonnes)

Source: Gluskin Sheff

For now, the situation is calm. Equity markets are going up and their rise seems to be convincing increasing numbers of observers that the global economy is on the way to sustainable recovery. Even the eurozone crisis does not seem to have overly concerned investors since the declarations by the President of the European Central Bank, Mario Draghi, that "whatever it takes" would be done to save the euro. While this calmness persists, gold will hold little attraction. We could even see continuing capital outflows from tracker funds invested in gold. These funds would then be obliged to sell physical gold to cover these outflows, creating a sort of vicious circle.

An environment still favourable to gold

The risk of a further fall in the gold price can therefore certainly not be ruled out. Those versed in technical analysis will point out that there is a critical support threshold at around $1,550 which, if crossed, risks triggering heavy sales. However, it makes no sense to base an investment strategy on temporary capital flows that may or may not materialise. The macroeconomic environment continues to favour gold and the prevailing pessimism surrounding it (and gold-mining companies) is relatively encouraging. During the last major gold rally in the 1970s, the gold price lost around 45% between February 1975 and August 1976. Many observers were of the opinion that the economic conditions which led to the increase in the gold price in 1973 and 1974 had disappeared and that the bull cycle was over. In the next three years, gold gained around 700%.

* Peter Bernstein. The Power of Gold: The History of an Obsession

(John Wiley & Sons. ISBN 0-471-25210-7)