The crisis that world economies, including the US economy, are facing is unprecedented in its causes and the many uncertainties that arise from it. However, looking back at past recessions may provide us with some keys to a better understanding of the current recession.

Facing the uncertainties of an exceptional crisis

Investors will probably remember March 2020 as the month of extremes, whether in terms of economic, social, financial or stock market aspects.

On the stock market level, March should be the month in which the U.S. stock market recorded its biggest decline since the Great Depression of 1932.

Then, on March 24, the announcement by the U.S. Congress of the launch of nearly $2 trillion in tax measures gave new hope to the market. On that single day of March 24, the Dow Jones Industrial Average rose by more than 11% to record one of its strongest daily historical gains, while the S&P 500 experienced its strongest increase in 12 years.

On the economic data front, the picture is not much better. Key US manufacturing and services indicators have begun to decline sharply, underscoring the scale of the current pandemic and the resulting crisis.

We can already say that the current economic contraction will be intense and last at least a quarter, perhaps more...

Natural epidemics, such as the one we are currently experiencing, are not integrated into any macroeconomic model. It is therefore difficult to anticipate; growth could resume rapidly after the end of the health crisis, or the contraction could continue for some time yet, no one can say at present.

A crucial variable for an economic recovery and the dynamics of world trade will be the extent of the damage caused by the containment measures on the companies’ balance sheets; another crucial factor will be the ability of public authorities to prevent lasting damage to the labour market.

Less and less violent recessions?

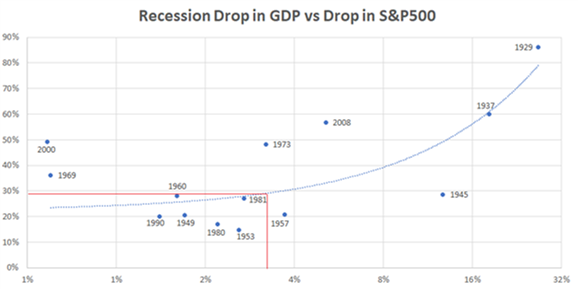

Rather than trying to anticipate the extent of the decline in US GDP for 2020, why not examine the impact on the markets of the historical declines in GDP? This might give us a better market perspective.

Tracing GDP contractions from the peak to the trough of the last 14 recessions relative to the S&P500 decline offers us some food for thought.

The correlation coefficient of this statistical series is 72%, which is not perfect but is nonetheless relevant. The red line shows how a 30% drop in the S&P500 translates into a 3-4% drop in US real GDP.

Source: Robert W Baird Limited.

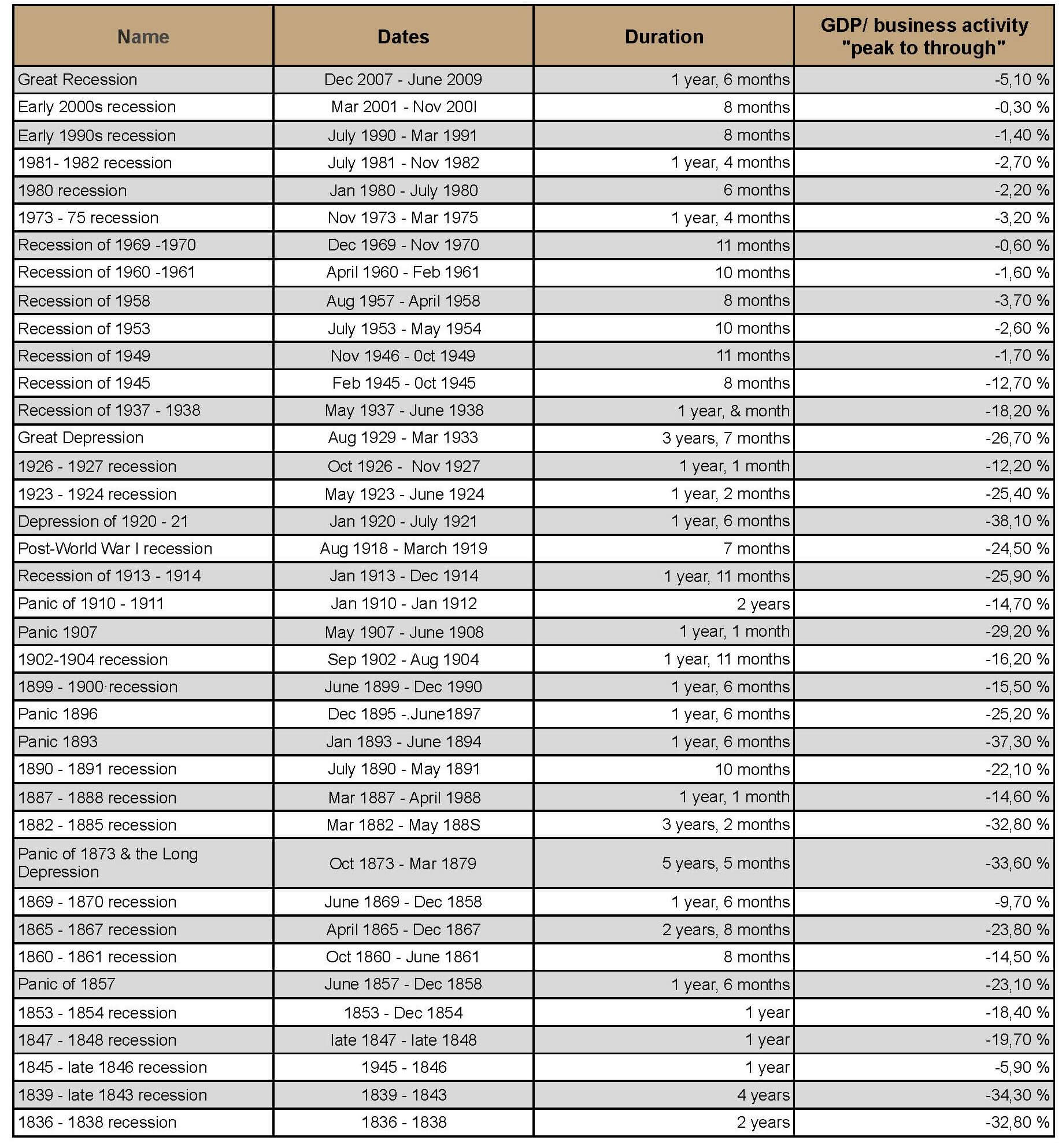

The table below details for each period of U.S. recession since 1836, its duration and the resulting drop in GDP

Source: Wikipedia and Robert W Baird Limited

Over the past 75 years, there have been 11 recessions; the one related to the 2008 financial crisis was the most severe, with a 5.1% decline in real GDP in the United States.

From 1882 to 1945, we had 18 recessions, all of them resulting in double-digit declines in real GDP, with half of them exceeding a 25% drop in GDP!

But the reality is that, since the end of the Second World War, the effect of recessions on GDP has been relatively moderate. This is largely due to the intervention of the Central Banks, notably the FED, but also to the effects of globalisation, technological advances, and increasingly powerful fiscal and monetary tools.

Of course, the extent of the current recession will depend above all on when we will be able to stem the spread of the COVID-19 virus and thus ease the restrictive measures weighing on our economies.

Can the decline be as large as that of 2008 (-5.1% drop in GDP)? Yes, particularly since the current level of GDP is higher than in 2008.

Will it be as severe as this systemic banking crisis that left us with the slowest economic recovery ever recorded? Probably not, especially given the current determination of central banks.

Or will we see a short-term recession with a rapid recovery (8 months) like the one that marked the year 1945?

Many questions with few answers...

Focus on companies with strong fundamentals…

While it is difficult to properly assess the extent of the decline or the pace of recovery, we can control part of the risks we take by being selective in our investments. That is why I think it is more important than ever to focus our investments in quality companies with strong balance sheets, low debt and high liquidity.

In recent weeks, many highly leveraged companies have been slaughtered on the stock market. The importance of having sufficient liquidity to withstand a crisis is becoming clear. And yet some companies (such as supermarket chain Kohl's or clothing distributors GAP and Nordstrom) have only 8 to 10 weeks of liquidity (assuming no sales and stable fixed costs), which makes them vulnerable in a context of uncertainty as to the duration of the crisis.

In this context, I would like to refer to what John Donahoe, CEO of Nike, said when he published the latest quarterly results of the company on March 24: “We know in times like these that STRONG BRANDS GET EVEN STRONGER and I truly believe that no one is better equipped than NIKE to navigate the current climate."

As a long-term investor, this is a statement that makes a lot of sense and one that we should always remember. Indeed, numerous studies show that the existence of a strong competitive advantage (in the specific case of Nike, it is a loyal customer base and a strong affinity for the brand) is a strong guarantee for the creation of long-term shareholder value.

From a financial standpoint, we expect these so-called "quality" companies to exhibit all of the following characteristics: high profitability and return on investment ratios, strong free cash flow generation and steady earnings growth over economic cycles.

These are strict investment criteria that have guided our investment strategy for many years and will continue to guide us in the coming weeks.