Contact

Please contact us for further information about our services. Our specialists will respond to you directly. For further information about the distribution of our funds, please contact our sales team.

Monday to Friday

8 am to 5 pm

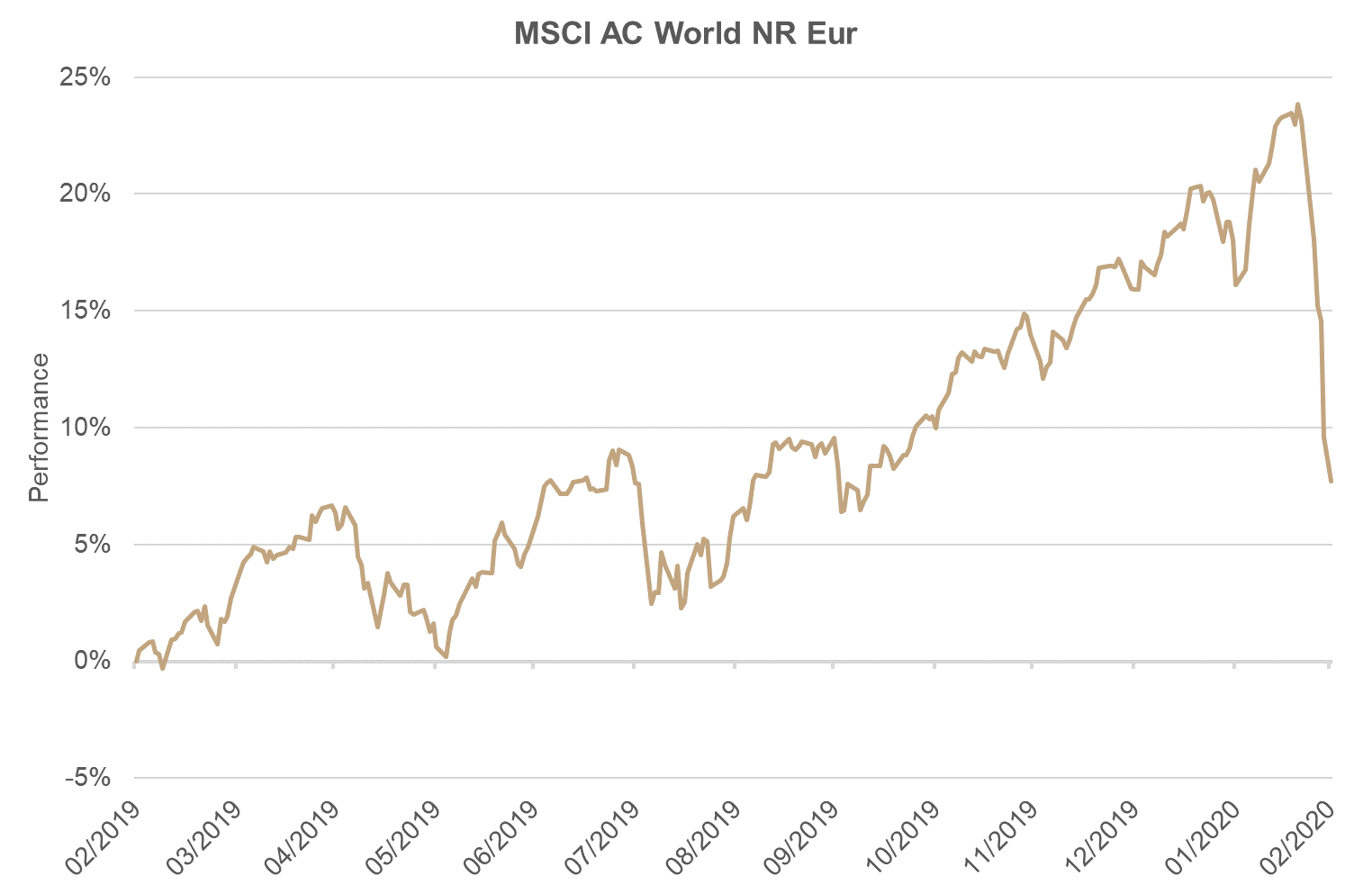

The acceleration of the Covid-19 epidemic and its expansion to all continents have led to a sudden increase of volatility on global stock markets against fears of a major slowdown in global economic growth.

- The correction has to be put in context given the strong recent performance. Markets have retreated somewhat from recent all-time highs. The U.S. market for example has only given up part of what it made in 4Q 2019.

Source: Lipper

- The main problem with the virus is not the virus but the age we live in. Social media and a ruling class who feels constantly under pressure to overreact to everything. It is this overreaction that could tip the world into some kind of recession. The general view thus seems to be that the economic impact of the virus will be worse than the pandemic itself. Also, when facing a pandemic, one would like competent leadership, trusted information systems, public confidence in governments and civic institutions and a cooperative geopolitical environment. All this is nowadays missing which might worsen the situation.

- The short - and long - term impact on global growth is currently impossible to quantify. The disruption to global supply chains could be widespread and long lasting. Central banks can do nothing to fix supply chains.

- Consensus estimates for earnings growth are too high and will have to be revised. Companies will probably use the virus as an excuse to lower expectations.

- Investors are very nervous currently. In the end, nobody has a clue how this will play out. Short-termism, the rise of passive investment, momentum-based mechanised trading, … mean that once things get going in one direction, they tend to keep going in that direction.

- On balance it seems that the impact of the Coronavirus continues to spread further from this point and that the newsflow relating to the virus and to corporate risk and economic data continues to worsen. The fall in share prices is therefore logical.

- On the positive side, it seems clear that any virus-induced downside risk to growth which would threaten continued economic expansion would induce an aggressive policy response. The Federal Reserve has already made clear that it is ready to act and countries like Hong Kong and Italy have announced some fiscal stimulus. The main question is whether the market will look through what should undoubtedly be one or two dire quarters for global economic data and corporate profits.

- Valuations have obviously improved with the joint fall in equity prices and bond yields. The implied equity risk premium which takes interest rates into consideration shows equities to be undervalued. In absolute terms, i.e. in terms of dividend yield, price/book and trailing PEs, equities trade more or less in line with their post 1990 average but there are big differences between markets and between growth and value. The question remains whether traditional PEs are misleading in a structural low rate regime. Short-term, valuations are adjusting to the prospect of lower growth. Lower interest rates should mitigate the adjustment process.

- All in all, a relief rally is possible after last week’s declines but markets might remain in risk-off mode until the data no longer shows an increase in the number of new Coronavirus cases outside China. It is therefore too early to buy. This is not a classic ‘buy-the-dip’ event.

- When it comes to our funds, we think that the best way to deal with this situation is to concentrate on what we can control and on our investment process. Given our continued focus on quality companies (i.e. companies with a lasting competitive advantage, strong free cash flow generation, solid balance sheets), we think that our funds are well prepared to weather the crisis. Also, all our balanced funds went into last week’s equity market correction with low equity allocations and/or high cash levels.

- We still believe that the best (only) way for an investor to protect his/her long-term purchasing power is to invest in shares of quality companies.