Glass half full or glass half empty

How should we view the stock markets at the moment – optimistically (glass half full) or pessimistically (glass half empty)?

Glass half empty

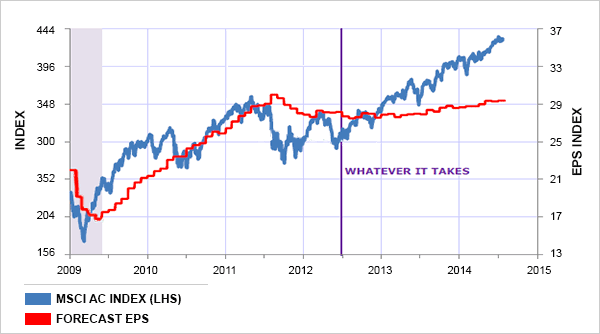

The stock market rise over the last two years has not been supported by an increase in company earnings. In Europe, these have even fallen, which means that valuation multiples have gone up significantly. The fact that these multiples do not yet seem excessive is partly because companies' profit margins are very high, bumping up earnings and reducing the price/earnings ratio (P/E), generally used as the primary valuation tool. Economic history suggests that this situation can't last. Based on normalised profits, some markets are trading well above their historic average. This is particularly the case for the American market.

Stock prices and earnings

Source: MSCI, IBES/Datastream

Speculative excesses are starting to appear. In the United States, margin debt (equities purchased on credit) is close to a new record. The biotech stocks index has more than doubled since the beginning of last year. In little over a year, Facebook's stock market capitalisation increased from $70bn to $200bn. Successive IPOs have generally been over-subscribed.

The economic situation remains a concern. The policies conducted by the central banks have helped the financial sphere by stimulating financial and property prices (and increasing social inequalities along the way) but have done nothing for the real economy. On the other hand, they have helped avoid making the necessary adjustments, made the economy increasingly dependent on low interest rates, and created new imbalances, thus precluding a solid springboard for new growth. In this process, the very principle of a market economy is increasingly being called into question.

Geopolitical risks are increasing.

Glass half full

Interest rates will stay very low for a long time to come. Short rates are directly controlled by the central banks who have already let it be known that they will keep them at historically low levels. Long rates are theoretically determined by the market but in practice they are increasingly influenced by the actions of the monetary authorities. In any case, the high level of debt in most industrial countries has led to economic activity becoming dependent on low interest rates, such that any hike in interest rates would only be temporary.

Low interest rates justify higher valuations, all other things being equal. Multiples have increased considerably over the last two years but are not absurdly high. Despite the appearance of speculative excesses in certain areas, many investors still vividly remember the two major bear markets in the noughties and are cautious when it comes to equities.

High profit margins have been helped by low interest and corporate tax rates, as well as contained wage costs, partly due to technology. None of these factors looks likely to be reversed anytime soon. Companies' capital expenditure (in terms of new investments) remains moderate so they can use their cash flow to buy back their shares (thereby boosting their earnings per share) and increase their dividend.

A correction is always possible but the authorities will do their utmost to avoid too heavy a slump in share prices.

How can we reconcile these two views?

1. Buy companies, not indices

The fact that the indices have gone up so much and corporate profits as a whole have not doesn't make it impossible to find individual opportunities. Focus on high quality companies with competitive advantages as these will be less affected by a difficult economic environment.

2. Have realistic expectations about the potential return from a stock market investment

The price paid determines the return. The low level of interest rates may explain higher valuation multiples but the fact of paying above-average multiples means that the return to be expected from a stock market investment is likely to be below-average.

3. Put a stronger emphasis on the dividend

The dividend will be the dominant driver of future equity returns

4. Have an appropriate investment horizon for a stock market investment and accept the inherent volatility in such an investment

For example

The Swiss pharmaceutical company, Roche Holding, is one of the shares we hold in Europe. It trades at around 17 times forecast earnings for 2015 and pays a dividend of around CHF 8. Based on its current share price (CHF 274), this represents a dividend yield of 2.9% (gross, i.e. before tax).

Given these figures, I don't think you can call an investment in Roche at the current price irrational. (I am using the word 'irrational' because it is the term often used to describe the way the markets are currently behaving.) With a P/E ratio of 17, Roche is certainly not particularly cheap. Obviously we would prefer to buy it at a lower multiple. But if we wait for a correction that would bring down Roche's P/E to 15, 12 or 10, we might find we can never buy it – and to reiterate Peter Lynch's famous saying: "Far more money has been lost by investors waiting for corrections, than has been lost in corrections themselves."

At the same time, Roche's dividend yield of 2.9% compares very favourably with that offered by a good quality fixed-income investment (term deposit or bond). This comparison will be all the more favourable if Roche can continue to increase its dividend and interest rates stay low.

For quality companies such as Roche we would consider the glass as half full.