BL Equities Dividend, true to its ethos

The crisis we are currently experiencing is undoubtedly going to have a huge impact. No one can predict when it will end or how the markets will behave going forward. Despite this extraordinary situation, BL Equities Dividend will continue to be managed, as it has been since its launch in October 2007, with BLI's traditional armoury of discipline, prudence and patience.

Mauer-Strooss rather than Wall Street

Far from the frenzy of the ‘big’ financial centres, managing our funds from Luxembourg (Mauer-Strooss, Luxembourgish for ‘Wall Street’) offers us the luxury of a certain distance from short-term speculation, fashionable trends and other lapses of common sense.

BLI has its own unique culture, forged over many years. This relative stability over time, is a crucial point for an asset management company, as well as for the companies in which we invest.

We don't waste our time in unnecessary meetings or explaining why a particular stock ‘underperformed over the last quarter’. Time is spent on an in-depth analysis of companies, reading and reflecting, with the aim of making decisions imbued with common sense.

The equity team's fund managers have combined experience of the BLI approach – which is rigorously respected – of 149 years, equating to an average of 16 years each.

Now, more than ever, this all adds up to a critical competitive advantage.

“There are old investors, and there are bold investors, but there are no old bold investors” Howard Marks

Given the asymmetry between losses and gains and most homo sapiens' aversion to risk[1], we think that it is more important to withstand difficult markets than to capture the entirety of the upside during periods of euphoria.

BL Equities Dividend is managed with paranoid optimism. Optimism is absolutely necessary for any equity investment and also when considering the ability of our solid, high-quality companies to grow their value over the long term. The paranoid dimension reflects the discipline of being ready to question our investment theses and decisions on a daily basis, never forgetting that negative ‘black swans’ can emerge, and always applying reasonable assumptions in our valuation models, whatever the environment.

Some asset managers (especially the big ones) take the immense risk of bets focusing on a particular scenario (e.g. deep value, the election of Donald Trump, rising interest rates or commodity prices). If the scenario comes good and short-term performance follows, they hype up their success. If it doesn't work out, the fund in question is shelved, closed or ‘its strategy is modified’.

In contrast, BLI remains true to its ethos at all times, and rather than delighting at getting across a 10-lane motorway blindfolded without being killed, we prefer to use the footbridge located a little further away.

BL Equities Dividend is managed with the idea that every day the portfolio is invested as if we were going to hold it for ever without being able to modify it, despite all the possible good and bad scenarios along the way, and consequently compounding both the good and the bad performances ad infinitum. This approach makes a big difference.

Perhaps it explains why our fund tends to be differentiated by the length of time its individual positions are held, its relatively low volatility, and more importantly, its relative resistance during market corrections.

BLI's culture provides an environment conducive to the courage required to maintain very different portfolios, a demanding task that is all the more difficult in an industry obsessed with short-term performance and benchmarks.

BL Equities Dividend during global equity market falls

(Total Return EUR)

“It’s difficult to make predictions, especially about the future”

The world is divided into two types of people: those who don’t know how to time the market, and those who don’t know that they don’t know how to time the market.

People often try to find correlations that have happened in the past, predict the outcome of political events, anticipate macroeconomic data, forecast interest rate movements, interpret Donald Trump's latest tweet, predict the end of a crisis or, worse still, guess how markets and hence millions of investors will interpret it all...

It's unrealistic to hope to achieve this reliably time after time[2], and to expect to benefit from the markets’ upsides while avoiding the grief of the downsides.

Historically, we can see that a limited number of trading days have an asymmetrical impact (negative but also positive) on performance over long periods; good luck guessing which ones...

The greatest investors in history, whatever their style, agree on one point: patience to stay invested is crucial.

“The stock market is a device for transferring money from the impatient to the patient” Warren Buffett

In the 1960s, the average holding period for a share listed on the New York Stock Exchange was over 8 years. Today it is just a few months.

There are many people who can’t help falling into the trap of judging companies on short-term factors, superficial analysis, the recent performance of their share price, itself dictated by chance, interpretations[3], supposed correlations[4] and investors’ emotions, or even the algorithms of quantitative funds…

Although many ‘investors’ tend to forget this, buying a share means owning a part of the underlying company's capital.

By keeping this notion in mind, by judging the quality of a company with an emphasis on its fundamentals and by being patient, long-term investors can exploit opportunities created by emotions and the disease of short-termism.

“Selecting a marriage partner clearly requires more demanding criteria than does dating” Buffett & Munger

On the other hand, assessing the long-term compounding effect of superior cash flows is not intuitive; we think that most analysts and investors underestimate the value of high-quality companies because they focus primarily on short-term factors and the results of the next few years, rather than on the strength of competitive advantages and the long term.

Time therefore plays out in favour of quality companies.

BL Equities Dividend’s current portfolio holdings have been held for an average of five years. Several, like Unilever and Nestlé for example, have even been in the portfolio for more than a decade.

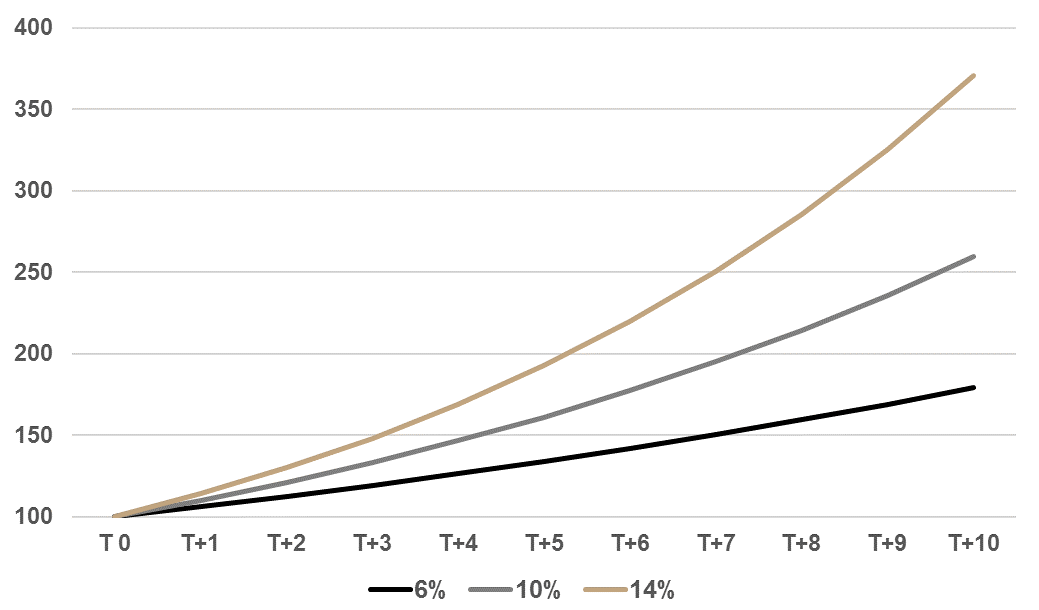

Compound interest and effects over time

Example of EUR 100 compounded with different interest rates

Rule No. 1: Quality, nothing else. Rule No. 2: Don’t forget Rule No. 1.

Despite what many analysts, investors or companies may say, the one and only measure of economic value creation is return on capital employed or ROCE.

In very simple terms, this means the return generated on the money the company needs to run its business.

Sustainable competitive advantages and barriers to entry (distribution networks, captive installed bases, brands, licences, patents, etc.) are the key to enabling quality companies to grow and maintain a superior ROCE over long periods, despite the law of competitive gravitation.

On average, the companies currently held by BL Equities Dividend have an ROCE of 18%, compared to an average of only 8% to 10% for companies in the leading global equity indices.

In concrete terms, this means that our companies need relatively little investment to generate more cash flow, which when reinvested generates more cash flow, and so on, in a virtuous circle.

This emphasis on quality is a feature shared by all our equity funds. Unlike many other fund managers, at BLI we dare to have portfolios that are very different to the indices or standards, and we refuse to invest in a raft of companies and sectors that destroy value, despite their popularity or weighting in the indices.

BL Equities Dividend's active share (the percentage of a fund's portfolio holdings that deviate from the benchmark index) is constantly above 90%.

“Ain’t nothing like the real thing” Marvin Gaye & Tammi Terrell

BLI's approach may sometimes seem too simplistic for some people, especially in times of euphoria...

Contrary to the claims of the destructive Modern Portfolio Theory, the truth is that greater risk does not lead to better performance.

We don't take the huge risks of betting that one day ‘Promising Therapeutics’ will invent a revolutionary treatment, that ‘Dream Energy’ will discover a gigantic oil reserve, or that ‘Turnaround Corp’ will hire a CEO capable of improving its structurally disastrous profitability; we invest in companies that are already proven winners.

We appreciate simple and tangible business models, ideally centred around products or services that meet critical needs, are consumed at short and regular intervals, and represent low absolute expenses for which the end-customers are often more concerned about the brand and quality than the price; activities that are relatively predictable and little subject to change, especially economic or technological change.

Around three-quarters of BL Equities Dividend’s investments involve companies with low-cyclical activities (including hygiene, home care, food, soft drinks, personal care, healthcare).

Our companies enjoy dominant positions (marketing, distribution network, lower production costs, relations with distributors) and are leaders in the majority of their categories thanks to strong franchises: Colgate, Elmex, Signal, Sensodyne, Lifebuoy, Dove, Sanex, Veet, Huggies, Kleenex, Scott, Kotex, Dettol, Lysol, Ajax, Omo, Cif, Vanish, Calgon, Finish, Cillit Bang, Air Wick, Palmolive, Domestos, Harpic, Lay’s, Doritos, KitKat, Smarties, Mövenpick, Häagen-Dazs, Magnum, Cornetto, Miko, Ben & Jerry’s, Knorr, Hellmann’s, Maggi, Herta, Buitoni, Domino’s Pizza, Enfamil, Gerber, Hill’s, Purina, Friskies, Nespresso, Nescafé, Perrier, San Pellegrino, Pepsi, Tropicana, Lipton, Gatorade, 7up, L’Oréal, Lancôme, Maybelline, La Roche-Posay, Kerastase, Garnier, Axe, Rexona, Strepsils, Gaviscon, Nurofen, Mucinex, Coloplast, Voltaren, Vaseline, Durex, and many others…

These brands are consumed every single day by millions of people, and have been for decades and in some cases even for over a century. We think it is unlikely that this would come to an abrupt halt.

“Felix qui nihil debet” Latin proverb

“Happy is he who owes nothing”. We look for companies that generate sufficient cash flow and limit the use of debt and associated risks, not just in times of crisis.

The companies held in BL Equities Dividend convert a large part of their sales revenues into cash, posting a free cash flow margin of 16%. This means that for every euro of sales made, they generate 16 cents of cash (for companies in the leading world indices, this figure is only 7% on average). Our companies also have low leverage (Net Debt / EBITDA = 1.6).

“Gimme Shelter” The Rolling Stones

To further limit the risks, we ensure a degree of diversification between the activities of our 31 companies (lest fans of MSCI freak out about the weighting of consumer staples: the sale of chips in the United States, soap in India, disinfectant in the UK, toothpaste in Brazil and coffee in China are activities with low correlation). That said, we have no intention of diluting the quality of our portfolio by including mediocre companies or ones we don’t know enough about just for the sake of diversification.

Moreover, regardless of the attractiveness of the valuation, we set maximum weightings for each position, according to the risks associated with each company, such as: the cyclicity of the business; concentration in terms of customers, offering, geography, production and suppliers; resilience of the competitive advantages and competitive intensity; liquidity of the share; ESG risks; etc.

For example, putting it simply, KONE’s theoretical maximum weighting is lower than Givaudan’s. KONE is a high-quality company, a world leader in elevators and escalators, yet the business is partly cyclical and quite dependent on China. We think that KONE is riskier than Givaudan, the world's leading flavour and fragrance company with a highly diversified business: operations in 180 countries, 74 production sites producing more than 74,000 critical products sold to thousands of customers (multinationals, SMEs, start-ups) in different sectors, mostly non-cyclical (drinks, food, hygiene, home care, personal care, fragrances).

“It is better to have a permanent income than to be fascinating” Oscar Wilde

Dividends account for a significant proportion of the total return from equities over the long term, and especially during challenging periods.

Here again, we take a different approach: we do not scour the major equity indices to find shares posting the highest yields and then try to identify what qualities these companies might have.

Instead, we look for investment opportunities solely from among our very restricted universe of high-quality companies, and then we will only invest in those that offer dividends that are attractive (in absolute and relative terms), sustainable (because they are covered by cash flow) and have real growth potential.

BL Equities Dividend currently offers a gross weighted average yield of 3.0%. The companies in our portfolio have increased their gross dividend per share by an average of 8% per year over the last five years.

“There are no secrets that time does not reveal” Jean Racine

The companies we select have already passed the test of time.

The average founding date of the companies in our portfolio is 1929. Most of them have withstood a number of recessions, crises, and even wars, and are still highly profitable today.

For example, PepsiCo has increased its dividend every year since 1972. Nestlé has paid a dividend without interruption for nearly eight decades, Kimberly-Clark since 1934, Union Pacific since 1900 and Colgate-Palmolive since 1895… Despite the selection bias, and although things could change, this gives a certain idea of the resilience of the business models in which we invest…

Keep well and stay safe.

[1] Thinking, Fast and Slow – Daniel Kahneman

[2] The Mathematics of Market Timing – Guy Metcalfe

[3] Escaping realism – Stumbling on Happiness – Malcolm Gladwell

[4] www.tylervigen.com/spurious-correlations