A changing environment

What are the structural trends that might impact financial markets over the coming years?

It is clear that the future holds great opportunities. It also holds pitfalls. The trick will be to avoid the pitfalls, seize the opportunities, and get back home by six o’clock. Woody Allen

There is currently a confluence of factors that could gradually become very challenging for financial markets, as they may lead to a change of regime on several fronts.

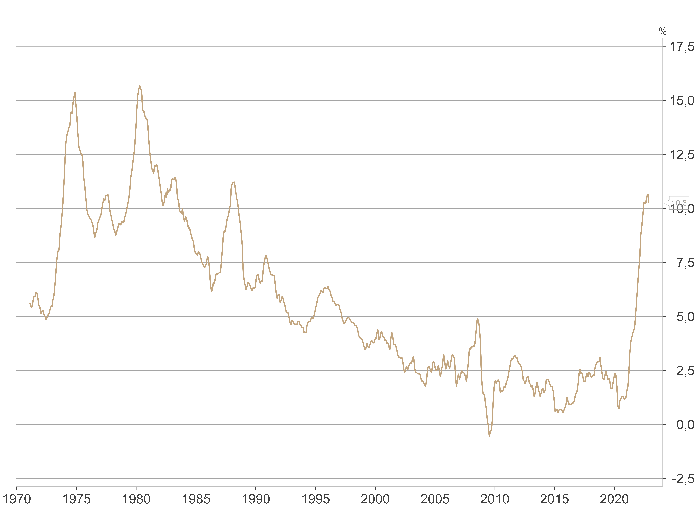

First, after more than a decade of moderate inflation, inflation in the industrialised world is currently at its highest level in 40 years. The rise in inflation is not the result of a boom in demand due to strong economic activity. Rather, it is due to generous aid packages and a massive increase in the supply of money during the pandemic, as well as to supply bottlenecks and to the rise in energy prices. How persistent it will be and whether it can sustainably establish itself significantly above the central banks’ target of 2% depends to a large degree on changes in income and wages. Unless offset by rising productivity, rising wages could lead to inflation becoming permanently established, as they increase nominal consumer purchasing power and enable consumers to pay higher prices. If central banks want to prevent a wage-price spiral, they will therefore need to keep inflation expectations low, so that they do not become established in people’s minds and lead to correspondingly high wage demands. If economic weakness or the risk of collateral damage going far beyond a normal recession would lead to central banks abandoning their fight against inflation too early, the risk of inflation expectations becoming unanchored would rise, leading to trade unions asking for high wage increases. On the other hand, as the rise in inflation is due to a large degree to supply-side factors that a tightening of monetary policy cannot remedy, the only way for the central banks to bring it down is by engineering a sharp fall in demand, with the ensuing risk of triggering a worldwide recession.

Inflation rate in the OECD countries

Source: OECD, Macrobond

The world economy seems to have entered a new regime in which both deflationary and inflationary forces co-exist. On the one hand, the deflationary drag of debt servicing and the financial fragility associated with over-leverage argue against a period of prolonged high inflation in the major economies. Growth will remain constrained by excessive debt burdens, demographics and the retreat of globalisation. On the other hand, slower growth of demand will only partially relieve the upward pressures on costs that are emerging. A lot of the disinflationary trends of the past years seem to reverse, as will be seen in the following paragraphs: supply chains have shifted from efficiency to resiliency and conditions in markets of labour, products and commodities have become less responsive in terms of supply. At the very least, this should prevent the return of the low inflation regime of what used to be called the great moderation, leading to unstable price regimes. Put differently, we are moving away from a world of low inflation and easy financial conditions to one with two-way inflation risk.

From a political point of view, a higher rate of inflation might be seen as a means to reduce the debt level. The debt ratio is calculated on a nominal basis. The numerator is the nominal debt, the denumerator the nominal GDP. In an era of high inflation, nominal GBP can grow strongly, even though real GDP growth is weak. Thus, if high inflation causes GDP to rise more than debt, the debt ratio improves. This only works however if the benefits of higher inflation are not being taken away by higher interest rates. It would therefore need some kind of financial repression to work. What is more, entitlements are to a larger degree indexed on inflation.

Second, the relative certainties of the globalisation era are eroding fast and the possibility of deglobalization and fragmentation must be taken seriously. The term de-globalisation is being embraced by consensus thinking, but its precise interpretation remains controversial. At the very least, the newfound determination of countries to become self-sufficient in strategically important areas implies major reshoring, however. Investment decisions must therefore be scrutinised through a geopolitical lens now, and with an assumption that pure economic logic may no longer be enough. By extension, the investment prospects of individual companies and even individual countries must be judged by their capacity to navigate distinct spheres. Some markets might also be considered un-investable for Western investors. Deglobalisation of financial flows could also mean that emerging markets savings will stay in emerging markets, making them less dependent on foreign flows.

Third, the retreat of liberalism in the West and the challenge to the world order represented by authoritarian regimes are combining to produce a re-ordering of social and economic priorities.

We are transitioning from a unipolar to a multipolar world order and nearing the end of Western domination. Countries that feel that their development has been adversely impacted by the rules-based order since 1945, are increasingly challenging this Western-led liberal order. Whether or not China surpasses the United States, the centre of the world power is likely to creep away from the established democracies. The unipolar world order, where the U.S. has been the undisputed global hegemon with no rivals and has guaranteed security for everybody, has been good for financial markets. A multipolar world might prove less friendly.

At the same time, there are enormous political divisions within the Western countries. No major Western country can claim to enjoy strong or popular political leadership at this time. The imbalances that led to the financial crisis in 2008 have been replaced by new imbalances, chief among them being the social inequalities. These social and political trends have tended to weaken social cohesion. The result could be a severe political crisis.

With regard to Europe, the inherent flaws in the construction of the European single currency have still not been addressed. It remains to be seen whether the political and economic pressures will become so great that the European monetary union falls apart. In order for a currency union to work, interests have to be aligned. The unity in Europe on economic sanctions of Russia is already fraying. For the euro, the fundamental challenge thus remains that it is a global currency built on an unstable foundation.

Fourth, there are structural supply deficits in a lot of commodities linked to the lack of investment and ESG considerations. Nowhere is this more true than in the energy sector where talk about “peak oil” has resurfaced, meaning that OPEC+ has never had more power. At the same time, the security case for renewables is overwhelming as renewable energy sources add security to energy supplies. Despite all the progress made, renewables are still far from becoming the dominant technology for energy supply, however. One could say that Europe decided to become green, before being ready to become green.

Oil is also critical in the debate about inflation since all the big inflation episodes of the past 50 years have been oil-price driven, starting with the quadrupling of oil prices in 1973. In the short run, both supply and demand for energy are price inelastic. All this adds to the challenges of central banks in controlling inflation.

Fifth, rising long-term interest rates threaten a sovereign-debt crisis. Public debt levels have increased massively since the financial crisis. The U.S. fiscal deficit is currently estimated at $1.4 to $1.5 trillion. That number would rise significantly in a recession. Net interest costs of the federal debt are increasing strongly. The Congressional Budget Office estimates interest costs of $1.2 trillion in 2032, but these estimates are based on numbers that are already out of date.

At the same time, sizable political constituencies continue to insist that governments should use debt to finance all manner of social and economic programmes. The need to finance the energy transition, higher spending on defence, entitlements, … will continue to weigh on public finances. Who will be the buyer of government bonds, when inflation stays high? The current bout of monetary deflation (central banks tightening their monetary policy and reducing their balance sheets) could therefore quickly be over. Central banks might even have to play a bigger and bigger role in the financial system to both backstop it and to basically pay for increasing amounts of government debt in the system. Western sovereign debt does not seem to be sustainable without sustained significantly negative real interest rates.

If it became apparent that monetary policy is reaching its limits in a phase of high debt, leveraged markets and persistent inflation, there could be a loss of confidence in the value of fiat currencies. With declining faith in G-7 nations, government bonds of these nations could lose their safe haven status and the volatility of these assets might increase sharply.

Sixth, the world’s adult-working population is entering the greatest retirement in financial history. This will give labour more power than it has had since the 1970s. The evolution of wages is linked to the supply of labour. Most of the world’s major economies are currently experiencing an acute labour shortage affecting both the low-wage and the more highly skilled sectors: declining rates of labour participation and the fading of the China effect are making themselves felt. Part of that shortage should prove to be temporary as it is linked to the effects of the COVID-19 pandemic, the generous transfer payments that resulted in discouraging people from looking to work and the generous short-time working rules for employers and employees. As these have come / are coming to an end, the situation on the labour markets should improve. Longer term, demographics will lead to a sharp decrease in the working-age population in many countries, however.

Demographics could also become a headwind for financial assets if people gradually sell their financial assets to pay for their retirement.

Seventh, the USA has declared economic war on China with its restrictions on semiconductors and key semiconductor technology. The idea is to restrict Chinese access to U.S. leading technology, thus slowing its progress towards self-sufficiency in high-performance chips. It is a fight for global technology supremacy, with advanced chips and the factories making them having become a substitute for armies because they are a critical component of our modern lives. The fight over chips is also a proxy for a geopolitical confrontation between an old and a new superpower. Since Europe is dependent on China for its green energy transition, it is caught in the middle.

Eighth, the weaponization of the dollar means that more and more countries are trying to get away from the $ hegemony. The USD and U.S. monetary policy remain tremendously important for the rest of the world, as every country has $-denominated liabilities and needs $ swap lines. Yet, the U.S., dollar network has started to contract recently, and this contraction is set to accelerate. Over the past years, several countries have started to shift their trade from USD to other currencies. China in particular is trying to shift its commodity imports to the renminbi. Even though there are no currencies capable of replacing the $ as the global reserve currency as of yet and even though the $ system has up to now only gotten stronger after each crisis, an alternative monetary system backed by commodities and controlled by the producers is starting to emerge in certain parts of the world, adding to the fragmentation of the world economy.

Ninth, the expansionary economic policy response to Covid-19 has delivered the knockout blow to liberal economic policies. The perceived absence of financial constraints upon spending programmes that claim to promote important social purposes and the inability to resist the pressure of social and political discontent have allowed the return of government interventionism in the developed world. The snowball effect of the unrestrained spending of 2020-2021 will be difficult to undo now that governments have shown that rules can be broken and that money can be created in unlimited quantities when it is expedient. At the same time, economic liberalism has become discredited by its association with capital subsidisation, where profits are privatised but losses are socialised. The intellectual acceptance of market-friendly policies in the major economies is gradually declining. Agendas of redistribution of incomes and wealth are starting to be embraced across the political spectrum.

High rates of innovation and investment alongside properly regulated capitalism with the impartial rule of law are essential to increase the growth potential of the economy. Strong economic growth is more than ever needed to deal with historically high debt levels. But economic policy in the major economies falls short of these requirements. The appropriate response to a surge of inflation largely created by constrained supply would be an expansion of supply. However, there is discouragement of investment in many areas through over-regulation, taxation and policy uncertainty. Supply-side economics appears to have lost all political appeal. The evidence of the last quarter century indicates clearly that the accumulation of debt and the inflation of asset values induced by excessive central bank liquidity do not promote the growth of productive investment. Yet, there is an unwillingness to acknowledge this reality.

Tenth, investors should brace for much lower returns in the years to come. In addition, volatility should be expected to increase significantly.

The past decades have generally been very good for financial markets. The fall in inflation rates has led to much lower interest rates. The end of the cold war has lowered the risk premium demanded by investors. Globalisation and an environment of economic liberalism have resulted in a decline of the bargaining power of labour in developed economies, and to a corresponding increase in corporate profitability and in the share of capital in national incomes. All these developments have allowed a re-rating of financial assets.

U.S. 10-year bond yield

Source: U.S. Department of Treasury, Macrobond

Some or all of these tailwinds might slowly transform into headwinds. The demise of a regime of low and stable inflation is the principal macro-economic development of the beginning of this decade, the acceleration of the transition from a unipolar to a multipolar world order being the principal geopolitical one. When combined with the effects of de-globalisation, the consequence should be a decline in the risk appetite of investors and a deterioration in corporate profitability. Taxation will tend to increase, together with regulation. The argument for a secular turning point in the regime of company profitability in the developed world seems particularly persuasive, if only because that profitability is currently abnormally high from a historical perspective. Few governments seem to be aware that the profitability of their leading companies is threatened now with both cyclical and structural decline.

In conclusion, the possibility of a re-configuration of the investment landscape of historic significance is real. In this environment, active management is poised for a strong comeback.

BLI - Banque de Luxembourg Investments ("BLI") has prepared this document with the greatest care and attention. The views and opinions expressed in this publication are those of the authors and in no way bind BLI. The economic and financial information included in this publication is provided for information purposes only on the basis of information known at the time of publishing. This information neither constitutes investment advice nor a recommendation or inducement to invest, nor should it be construed as legal or fiscal advice. Any information should be used with the utmost care. BLI makes no warranty as to the accuracy, fiability, recency or completeness of this information. BLI shall not be liable for the provision of such information or as a result of any decision made by any person, whether a BLI client or not, based on such information, such person remaining solely responsible for his or her own decisions. Persons intending to invest should ensure that they understand the risks involved in their investment decisions and should refrain from investing until they have carefully assessed, in consultation with their own professional advisers, the suitability of their investments to their specific financial situation, in particular with regard to legal, fiscal and accounting aspects. It is also reminded that the past performance of a financial product does not prejudge future performance.