BL-Global Flexible EUR: Performance since beginning of the year

BL-Global Flexible has not performed well since the start of the year. I briefly outlined the reasons for this in my 24 January post, but I feel that it is worthwhile further exploring the reasons behind this disappointing performance.

Everyone should be made aware of the insanity of it all, and that preserving their capital and growing it slowly and prudently is a totally appropriate strategy for this radical money easing environment. This type of policy breeds speculative and dubious rallies, but what they inevitably trigger are boom-bust cycles such as the ones we saw in 1999-2002, 2006-2009, and the current one we are in today. This is no time for short memories. (David A. Rosenberg, Chief Economist & Strategist, Gluskin Sheff)

BL-Global Flexible is characterised by a high conviction management style. By definition, this involves anactive approach to management, not dictated by benchmark indices and based on our fundamental convictions and analysis of the economic and financial situation. In an ideal world, our convictions would always lead us to the 'right' decisions, but we know by experience that this is not the case. In the short term, notably, market fluctuations may go against our views. (It's important to point out that we are not the only ones in this situation. A study by Tweedy, Browne, the investment management company, shows that fund managers who have widely outperformed their benchmark index in the long term have experienced many years of underperformance. These periods were usually characterised by strong bull runs where caution was penalised.)

That said, amongst the various factors that are currently penalising BL-Global Flexible (and Banque de Luxembourg's funds on the whole), the following stand out:

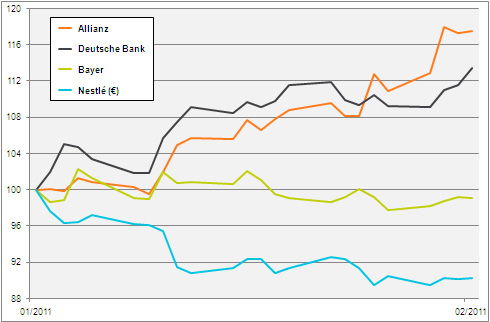

- BL-Global Flexible does not invest in banking stocks or insurance companies from the industrialised countries. Yet since the start of the year, these sectors have progressed the most in Europe. At the other extreme, the more defensive sectors, in which the fund tends to invest, are lagging;

- In this context, the fund's strategy to hedge part of its equity exposure through the sale of futures has an additional adverse impact on performance;

- The emerging stock markets have been underperforming in the past few weeks due to the resurgence of inflationary pressures. However, this does not make them less attractive from a medium- to long-term point of view;

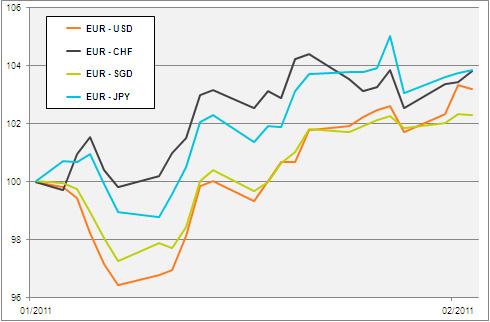

- The fund's reference currency, the euro, has risen against most other currencies. Only 40% of BL-Global Flexible's assets are denominated in euros;

- The bond weighting was sharply lowered in the third quarter 2010 and the rise in long-term interest ratessince September has not put the fund at too much of a disadvantage. With around 10% of its investments in bonds, the weighting nevertheless had a negative impact.

A poor performance of a fund in January is not particularly wonderful in a field in which a fund's performance tends to be presented since the start of the year. We believe that the factors that have weighed on the performance of our funds are temporary, however. Most of these are linked to the perceptions of investors that the world economy is on the road to a strong sustainable recovery and that the European crisis is being resolved - two opinions we do not share. In light of these developments, we plan to continue with our current investment strategy and not make any significant changes to the composition of the BL-Global Flexible portfolio.