Corporate Bond Prospects

The coronavirus pandemic has led to cyclical and structural instability, the effects of which will be felt in the global economy for several years yet. Despite this, at the end of 2020, the excess return on Investment Grade (IG) [1] corporate bonds over the so-called ‘risk-free’ sovereign yield curve was unchanged, at pre-crisis levels. This paradox comes at a time when corporate earnings and balance sheets have been fundamentally altered by the current economic crisis and many companies are facing an unprecedented situation.

Review of 2020

At the peak of the pandemic, corporate bond yield spreads soared to an average of over three times their normal level. By the end of December 2020, these spreads had returned to levels below those seen at the beginning of the year (excluding the real estate sector). The massive liquidity provided by the central banks had enabled some companies to refinance their debt over the short and medium term at historically low rates. Currently, more than 25% of euro-denominated Investment Grade corporate bonds have a negative yield.

In 2020, the performance of euro-denominated IG corporate bonds came to over 1.3% for 3- to 5-year maturities and nearly 2.5% for an average maturity of 8 years.

However, behind these positive figures, another reality can be seen: the extreme dispersion of yield spreads within the IG corporate bond universe. In assessing an issuer's interest rate, the quality and the sector concerned make all the difference.

Looking at new issues, despite sluggish revenues and rising debt, by the end of the year many large IG companies had done very well as they managed to finance their debt at very favourable (sometimes negative) rates. The paradox can be explained partly by central bank interventions (low interest rates and their purchase of corporate bonds in particular) and partly by the arrival of Covid-19 vaccines which herald the prospect of light at the end of the tunnel. Meanwhile, many investors in search of yield are resigned to taking on additional risk to obtain a less negative yield than that available on risk-free sovereign debt, where yields have continued to fall. These elements are contributing to the current price inflation across all financial assets.

However, the overwhelming optimism of the markets should be seen in perspective as the future remains uncertain for many economic agents. The damage the pandemic has wreaked on the economic and social fabric will continue to be felt over the longer term: the level of company debt will have to be supplanted by rigorous financial management (reducing debt will be critical) while the lack of investment will weigh on future growth. The companies most affected by this crisis will undoubtedly include SMEs, which have more difficulty accessing financing, as well as businesses that depend on physical contact with the consumer. Often considered as ‘too big to fail’, many large companies have been propped up by the actions of governments and central banks. In return, this could lead to formalising the societal duties of companies that have benefited from public funds and potentially to stricter regulation in terms of financial management.

Outlook

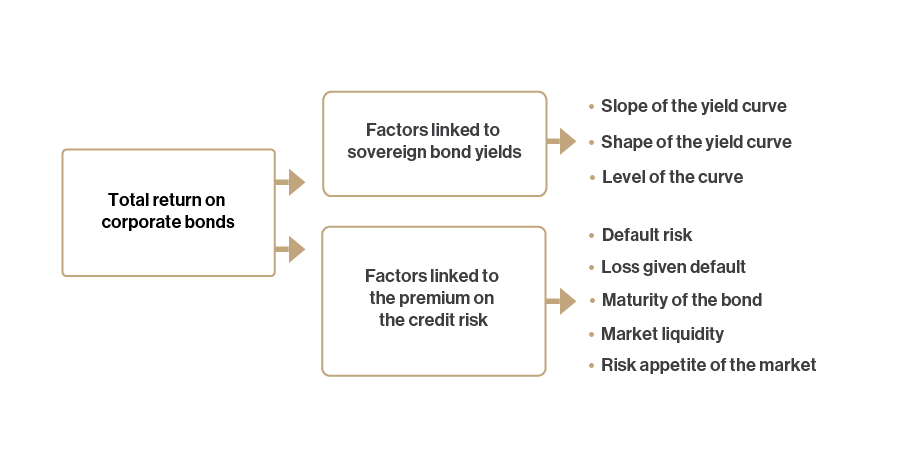

The return on corporate bonds is essentially a function of two factors embodied within them: the risk-free interest rate of the currency of the debt and the risk premium on the issue. The diagram below provides a clearer picture of the main determinants that impact the return on corporate bonds and hence their valuation. It goes without saying that the lower the risk premium, the more sensitive the value of corporate bonds will be to movements in sovereign bond yields and vice versa.

Factors influencing the total return on corporate bonds

Source: BLI

The level of sovereign bond yields is essentially influenced by macroeconomic considerations mainly dictated by public institutions such as central banks and governments. In this regard, inflation is the critical marker to monitor since it is a key indicator for many central banks (e.g. the Federal Reserve and the ECB) whose mission is to ensure price stability. Inflationary expectations, which are strongly influenced by interest rates and forward guidance from central banks, determine the levels of sovereign (and by extension also corporate) bond yields.

Given the fundamental role played by governments and central banks in managing the crisis so far, it is highly likely that they will continue their accommodative monetary and fiscal policies to allow the economy to return to growth.

This will have two impacts: on the one hand, inflationary expectations will be driven higher in the face of such support; and on the other hand, nominal sovereign yields will come under downward pressure across the yield curve as a result of massive sovereign debt buybacks and the maintenance of low interest rates.

These pressures will drive real yields (nominal yields adjusted for inflationary expectations) downwards and determine the sovereign yields across the different maturities. Given the scale of the economic crisis, it is unlikely that yields on short maturities will rise significantly in 2021. However, if the economic recovery gains traction during the course of the year, medium and long-term interest rates could rise. A distinction should be made between the United States and the European Union, and between emerging markets and developed countries. As the economic recovery is expected to be stronger in the United States than Europe, inflationary expectations there are higher, and the anticipation of monetary tightening is therefore more credible in the US. Similarly, inflationary expectations are higher in most emerging markets than in developed countries since growth forecasts are higher for emerging markets.

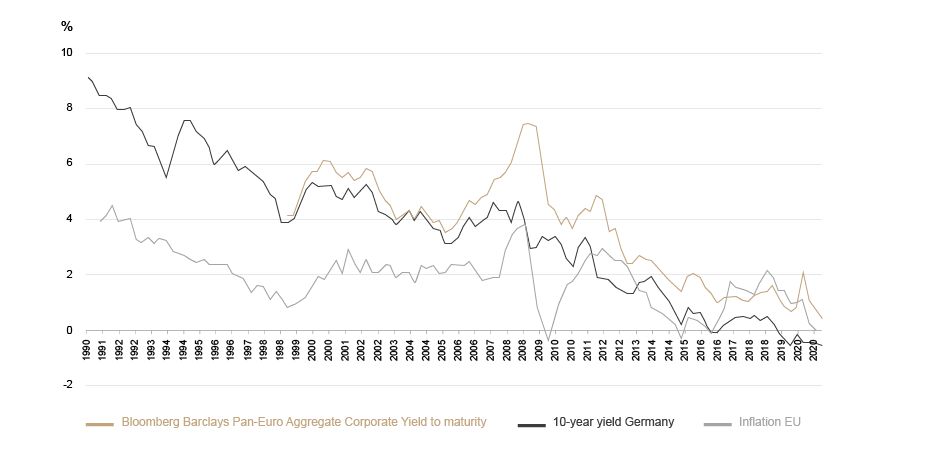

For developed countries, particularly in the European Union, the monetary policy of the last few years has clearly hindered keeping inflation close to 2% despite the arsenal of tools available to the ECB (see graph below). At present, it is in a liquidity trap, with interest rates at a low and consumption remaining sluggish. Before we can expect a sustainable rise in sovereign bond yields, we will need to see whether the economic shock and greater flexibility in monetary and fiscal policies will be followed by a sustainable economic recovery.

Source: Bloomberg

As regards the risk premium on corporate bonds, yield spreads are currently very low on high-quality issuers (the brown line in the graph above). It is therefore unlikely that we will see yield spreads narrow on these issuers.

Nevertheless, for so-called High Yield [2] issuers, there remains a possibility of narrowing from pre-crisis levels. These riskier issues are also less sensitive to movements in risk-free rates, as their yield is mainly determined by the risk premium. In the High Yield segment, however, particular attention will need to be paid to the country of issue and the evolution of financial fundamentals, otherwise the exposure taken will be subject to a higher probability of default.

In the current context of historically low yields on non-risky assets, it has become difficult to find low-risk corporate bonds offering a positive return. In addition, for longer-term debt that offers a more attractive yield, there is a high risk of interest rates rising. This exposes investors to a decrease in bond prices if yields rise. Conversely, companies with ratings below BBB+/Baa1 as well as those in emerging markets still offer attractive yields with the potential for narrowing yield spreads and lower sensitivity to risk-free rates.

Conclusion

The outlook described above points to a potential rise in long-dated sovereign bond yields and narrowing yield spreads on riskier corporate bonds. This outlook is based on the scenario of an exit from the health crisis and a return to economic growth that are both contingent on controlling the pandemic.

Despite the historically low level of interest rates, corporate bonds remain attractive. First of all, it is important to note the less volatile nature of bonds compared to assets such as equities. For example, BBB or High Yield issuers, with robust solvency and operational indicators, can provide a stable return in a diversified portfolio and reduce the interest rate risk that is present on risk-free issuers. In addition, when the bond is held to maturity, the return is usually predictable and helps ensure recurring cash flow. Lastly, and from a sustainable and responsible management perspective, a bond is an effective investment tool for targeting projects with a tangible positive impact.

________________________

[1] ‘Investment Grade’ issuers are rated BBB-/Baa3 or higher by one of the three rating agencies.

[2] Rating from one of the three rating agencies below BBB-/Baa3.