From Third World to Frontier Markets

As a credit analyst, one of my first experiences in emerging markets was the Argentinian debt crisis that began in 2001. I had only just started in the business when I had to get to grips with what would turn out to be the biggest default in financial history.

As a credit analyst, one of my first experiences in emerging markets was the Argentinian debt crisis that began in 2001. I had only just started in the business when I had to get to grips with what would turn out to be the biggest default in financial history. One thing was for sure: investors were still traumatised by the successive crises that had affected this asset class in the previous two decades. The latest crises of that era were by no means minor: the Tequila Crisis in Mexico in 1994, the Asian Financial Crisis in 1997, and the Rouble Crisis in 1998 which ended in Russian debt default. At that time, all these countries – Russia, Argentina, South Korea, Mexico and Brazil among others – were the very essence of the group that we now tend to call emerging markets. Today, barely twenty years on, the youngest among us will find it difficult to imagine that Mexico and Brazil were suffering from hyperinflation in the 1980s and even the 1990s. But maybe they have read about it, as I did, in economics text books or even history books?

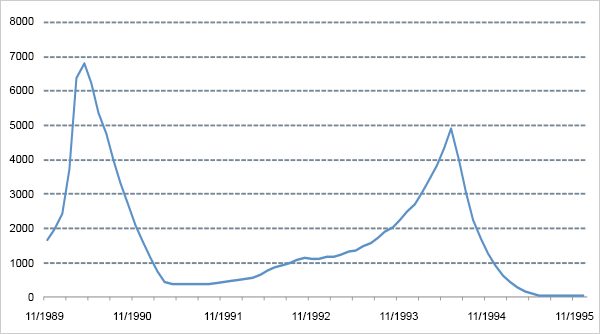

Inflation in Brazil

Source: Bloomberg, IBGE

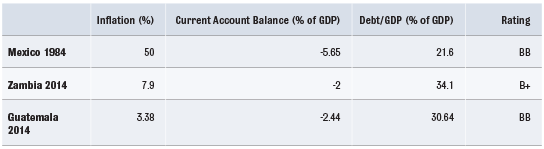

For a long time, from a financial point of view, Mexico continued to be linked to the term Tequila Crisis, while the mere mention of the bond market for issuers such as Brazil, Argentina, Ecuador or even Poland made us think of "Brady Bonds" (1). In 1996, Poland was only rated BB by S&P and South Korea only B+ in 1998. Southern countries, third-world countries, under-developed countries, LDCs (2) and perhaps even BRICs (3), are terms that now belong to the past. The term "Emerging Markets" started to be used by the World Bank in 1980. Different institutions, e.g. JP Morgan, Morgan Stanley and the IMF, have different views of the grouping's composition.

In the 1990s, the International Finance Corporation introduced the concept of frontier markets to identify a category of countries whose stock markets were still too small to be properly considered as emerging markets. Later, this concept of frontier markets was extended to bond markets. In December 2011, JP Morgan's NEXGEM index was launched (4) and included around thirty countries with an average rating of B+. Mongolia (B+), Vietnam (BB-), Zambia (B+), Bolivia (B) and Senegal (B) are all issuers included in this new index which is used by bond managers who are looking to target countries that are still some way upstream of the process of developing their capital markets. The index provides statistics from December 2001.

Today, the great majority of the emerging markets mentioned above have attained "Investment Grade" issuer status. It is interesting to note that many of the frontier markets benefiting from ratings equivalent to those posted in the 1990s by countries like Mexico, Brazil and South Korea, present fundamentals at least equivalent to if not better than theirs: a low inflation rate for the type of economy, similar debt levels, and sometimes a better current account balance and budget deficit. At the same time, just like emerging markets, the universe of frontier markets includes a great diversity of economies. Among them are commodity-exporting countries like Mongolia and Gabon as well as more diversified economies or ones based on exploiting natural resources like Guatemala or Vietnam.

Source : Trading Economics

(1) Financial instruments resulting from restructuring developed by Nicholas Brady, former US Secretary of the Treasury under Ronald Reagan in the 1980s.

(2) Least developed countries

(3) Acronym designating the main economic powers among emerging markets: Brazil, Russia, India and China.

(4) Next Generation Market Index