Emerging market bonds: an inherently risky choice? Or a means of portfolio diversification?

There is a widely held belief that emerging market corporate bonds necessarily imply higher risk for investors. Many investors indeed feel more comfortable investing in their country of residence or close to their home country, as Warren Buffett mentioned in an interview (1). Admittedly, the developed bond markets in North America, Western Europe and in Japan offer a more stable infrastructure: rule of law as well as a well-implemented set of regulations including competition law, company insolvency law and financial conduct supervision. It is only natural that investors have doubts on the trustworthiness of corporate issuers operating in the emerging economies (encompassing Latin America, Middle East & Africa, Central & Eastern Europe and Asia excluding Japan).

Emerging market bonds: an inherently risky choice? Or a means of portfolio diversification?

There is a widely held belief that emerging market corporate bonds necessarily imply higher risk for investors. Many investors indeed feel more comfortable investing in their country of residence or close to their home country, as Warren Buffett mentioned in an interview[1]. Admittedly, the developed bond markets in North America, Western Europe and in Japan offer a more stable infrastructure: rule of law as well as a well-implemented set of regulations including competition law, company insolvency law and financial conduct supervision. It is only natural that investors have doubts on the trustworthiness of corporate issuers operating in the emerging economies (encompassing Latin America, Middle East & Africa, Central & Eastern Europe and Asia excluding Japan).

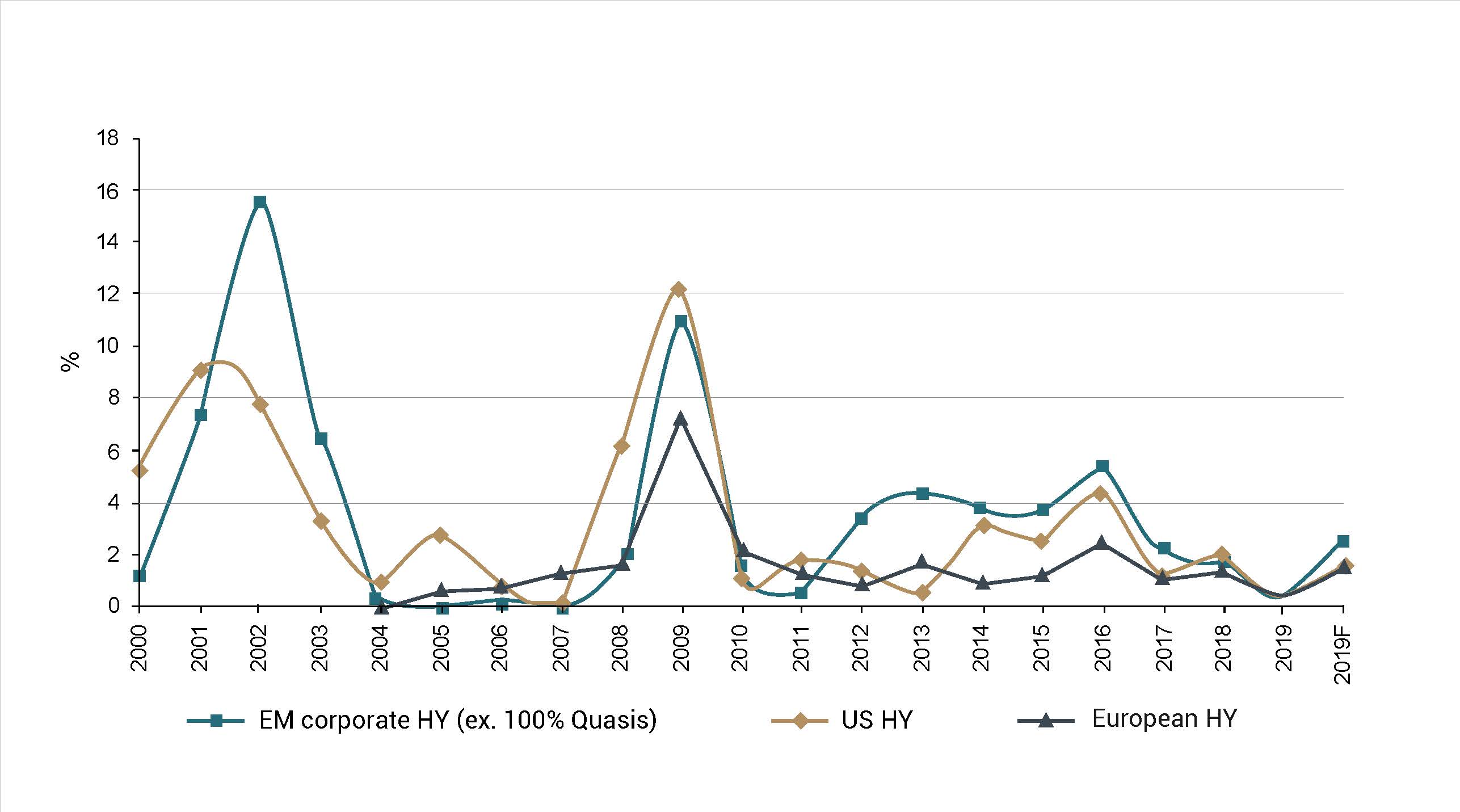

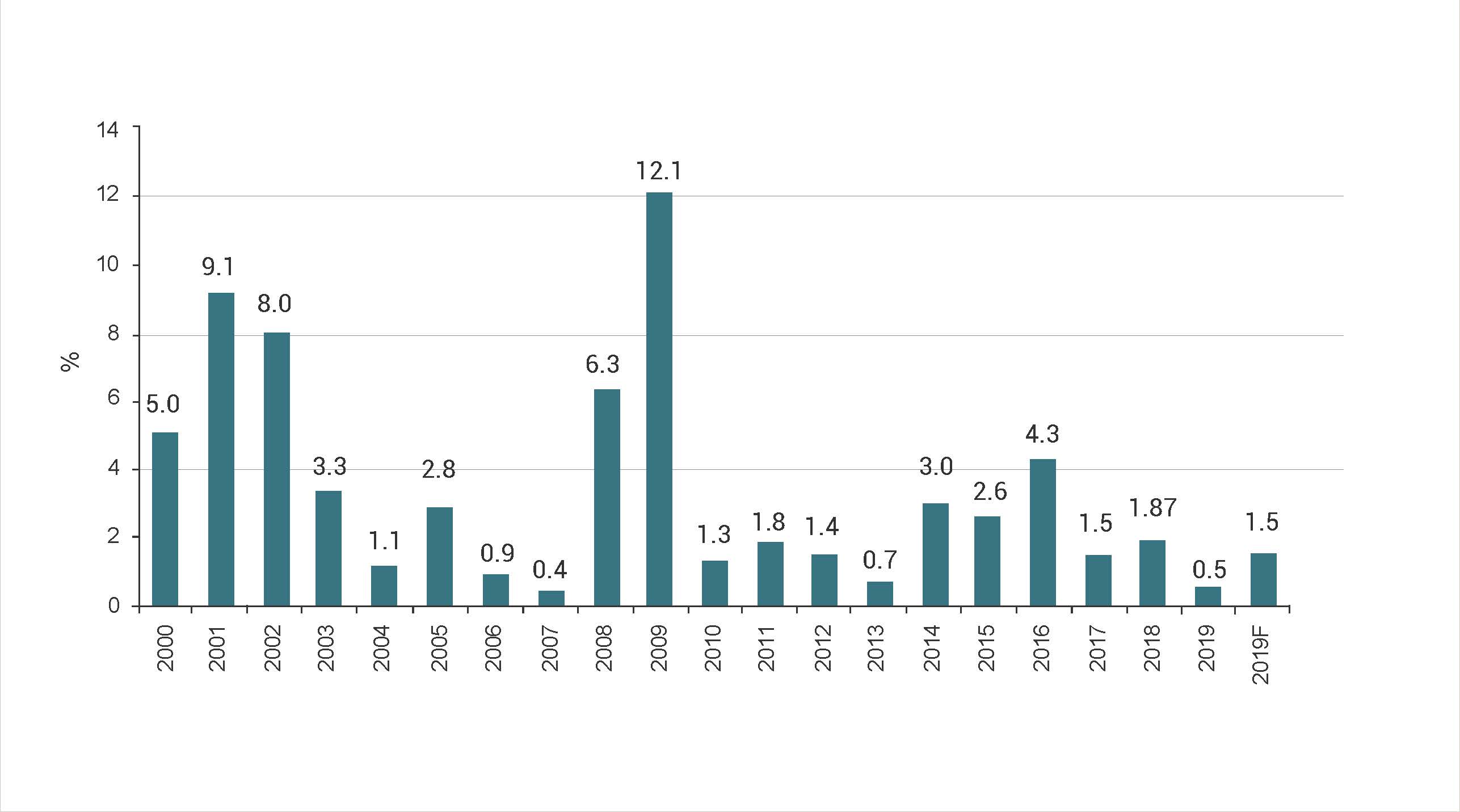

However, the capacity of these corporates to honor their debt proves to be higher than expected. The corporate default rates in the emerging economies remain lower than in the U.S.A. over the past two years: the high-yield issuer default rate was at 1.87% in the U.S. in year-end 2018, whereas it stayed at 1.6% in overall emerging countries in the same period[2]. Moreover, the default rate in Middle East & Africa fell even lower than the average, recording below 0.1%. This trend continues into the first quarter of 2019 with a record of 0.5% corporate default rate in the speculative grade debt in the emerging markets[3]. In contrast, the biggest corporate defaults in terms of volume happened in the U.S.A.; to name a few, Toys R Us filed for Chapter 11 bankruptcy in September 2017: iHeartCommunications in March 2018 and Sears Holding in October 2018. This phenomenon is due to the fact that 64.6% of corporate debt in the entire world consists of bonds and leveraged loans issued by U.S. companies[4]. In fact, more than 45% of U.S. GDP comprises corporate debt issued by non-financial sector companies[5]. According to the research report published by the BCA Research[6], the growth rate of corporate debt was the highest in the U.S.A. in 2018 and that this could pose a serious risk to the economy. The deteriorating indicators of corporate fundamentals and financial risk-taking even point to the late-cycle dynamics, failing to engage in long-term capital spending[7].

EM HY default rate versus DM

US HY corporate default rates

Source: J.P. Morgan HY Strategy

Constraints by credit ratings but company fundamentals should prove their credit quality

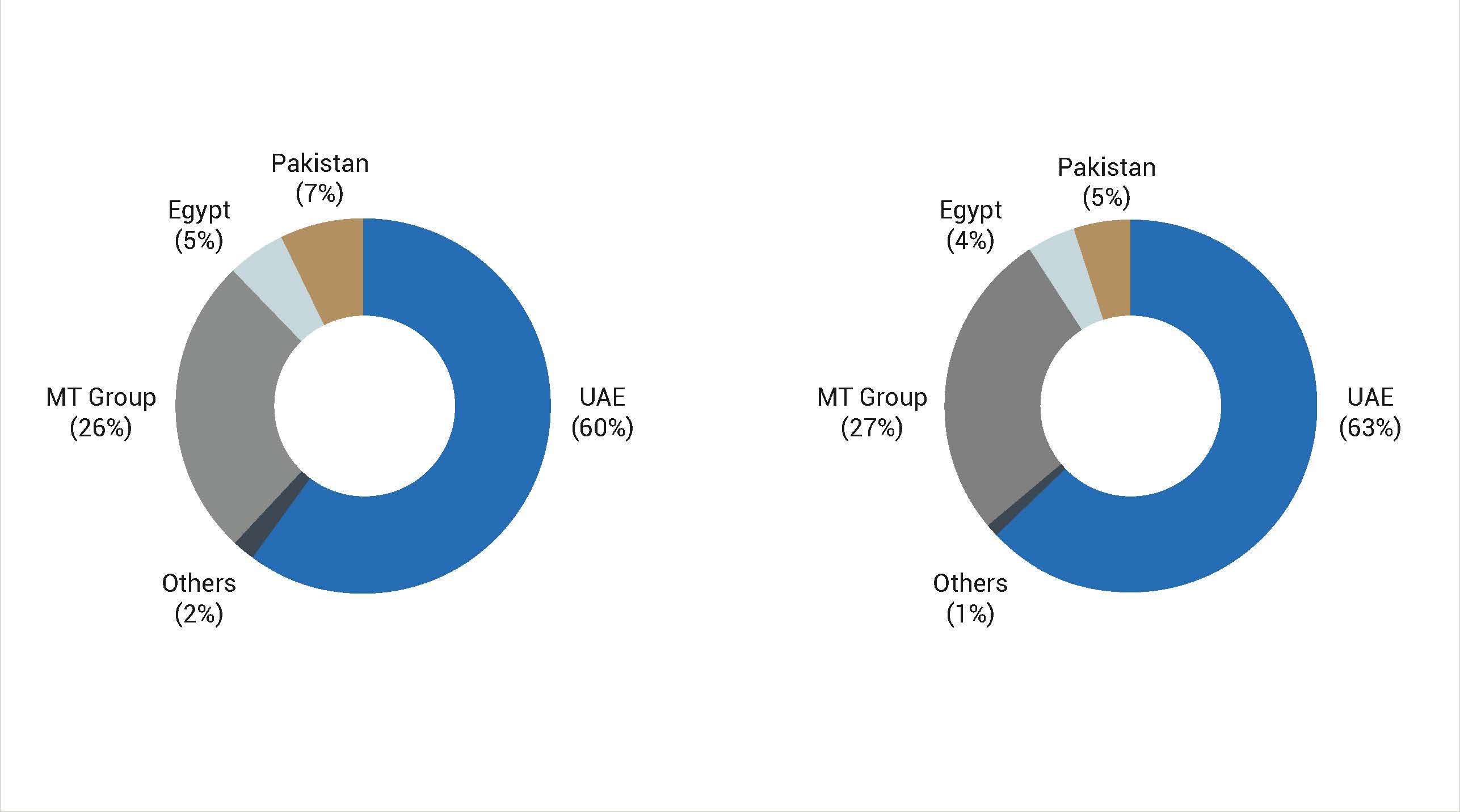

Corporate bonds issued by emerging market companies are not intrinsically riskier than those issued by sector peers in the developed part of the world. Nevertheless, the close relationship between sovereign credit rating and the credit rating of a company based in that specific country raises a question: why do the credit ratings of emerging market corporates diverge to a higher extent than their developed market peers do? The explanation is simple. They move in synchronization with the sovereign credit rating of the country of domiciliation. The sovereign credit rating determines even the scale of ratings upgrades or downgrades. For instance, more than five Turkish corporate issuers saw their ratings downgraded to BB- in the aftermath of the ratings downgrade on the Turkish sovereign. On the other hand, there are corporate issuers that received higher ratings than those of their domicile such as Emirates Telecommunications Group: its rating at AA- granted by S&P (Aa3 by Moody’s) is above the sovereign rating of the United Arab Emirates. The positive credit assessment is mostly based on the excellence of its financial metrics, especially the low leverage ratio, the ample interest coverage and significant cash on the balance sheet. Another competitive edge the group shows consists of its ability to generate positive cash flows in various countries of operations, namely Morocco, Egypt, Pakistan and Central Africa on top of its home, the UAE. This demonstrates that a company of which operations are located in the emerging economies can achieve strong financial health as much as a developed market peer can do.

Etisalat Group Revenue Breakdown Q1 2018 and Etisalat EBITDA Breakdown Q1 2018 (8)

Higher spreads – drawback of emerging market bonds

Even so, every rose has its thorn. Investors accept higher credit spreads in order to buy bonds issued by companies whose parent group is located in the emerging markets. According to a report published by J.P. Morgan credit research[9], A-rated corporate bonds from emerging market issuers tend to have 29 to 50 basis points spreads above those issued by U.S. issuers on equal footing, assuming all other things equal. This observation offers an explanation to the following: financial markets factor the emerging market liquidity issue in their pricing. In addition, the higher the credit rating, the narrower the spreads to the sector peers in the same ratings basket. This explains the significant level of spreads on high-yield debt issued by emerging market companies. The ultimate parent company’s country of domiciliation also plays a role: for instance, Russian corporates with the lowest investment grade, BBB-, display wider spreads ranging from 95 to 106 basis points to the U.S. issuers in the same sector. This takes into account the geopolitical risks on top of the counterparty credit risks: for example, the impact of the U.S. sanctions on the Russian economy. In addition, there are certain sectors such as banking & financial services sector in which emerging market issuers exhibit higher spreads (over 100 basis points) to U.S. peer groups with the same credit rating.

In conclusion, it is of little practical value to believe that the emerging market corporate bonds do not comprise a safe asset class. An exhaustive credit assessment of emerging market credit can enhance the degree of diversification in an investment portfolio.

[1] The Financial Times, Weekend Long Reads, 25/04/2019

https://www.ft.com/content/40b9b356-661e-11e9-a79d-04f350474d62

[2] J.P. Morgan Credit Research, EM Corporate Default Monitor, 04/04/2019 https://markets.jpmorgan.com/#research.publication_page&publicationId=9001430

[3] S&P Capital IQ, S&P Global Ratings, Credit Trends Report, 15/04/2019

https://www.capitaliq.com/CIQDotNet/CreditResearch/SPResearch.aspx?&DocumentId=41385845&From=SNP

[4] J.P. Morgan Credit Research, Default Monitor, 02/01/2019

[5] BCA Research, Special Report on the risk from U.S. Corporate Debt : Theory and Evidence by Ryan Swift, 23/04/2019

[6] idem.

[7] The Financial Times, Corporate America is failing to invest, Gillian Tett, 11/04/2019

https://www.ft.com/content/960ec8ec-5c36-11e9-9dde-7aedca0a081a

[8] S&P credit rating report, Emirates Telecommunications Group Company, 11/06/2018

[9] EM vs. US HG Relative Value Report, 22/04/19, by Eric Beinstein & Yang-Myung Hong https://markets.jpmorgan.com/#research.article_page&action=latest&publicationId=9000908