Brazil: an economic success story

In the past few years Brazil has experienced undeniable economic success. In 2010, growth exceeded 7% and current analyst projections for this year place the figure at above 4%. The country is the eighth largest economy in the world and accounts for 36% of Latin America's gross domestic product.

The reforms behind the country's economic success

The reforms behind the country's economic success were implemented at the end of the 1990s under the Cardoso administration and consolidated at the start of the 2000s by the Lula administration. The reforms focus on two main institutional measures:

- The first was the budget responsibility law. This law, which came into force in 2000, enshrined in the constitution financial, budgetary and administrative restrictions imposed since 1995 by the federal government on the states. It basically prevents the federal government from lending to states and increases the legal and financial responsibility of governors.

- The second measure was the adoption of an inflation-targeting framework for conducting monetary policy. This involved setting an inflation target (currently 4.5% +/- 2%) that the central bank would be responsible for achieving using interest rates as its main policy tool. After a period of hyperinflation in the 1980s and the start of the 1990s, Brazil has experienced moderate inflation in recent years.

To improve its financial health

Both measures have enabled the country to improve its financial health. Over the past few years, Brazil has consistently posted a primary surplus (i.e. a budget surplus prior to interest payments on public debt), which has helped to stabilise the public debt / GDP ratio. The challenge for the coming years will be to improve the quality of this budgetary consolidation by lowering the tax burden and implementing reforms to reduce mandatory public spending, which today accounts for more than 70% of public spending. As far as the fight against inflation is concerned, it is important to note that Brazil's central bank is still not independent and that its monetary policy is vulnerable to political decisions.

The rise in commodities prices

In addition to the reforms mentioned above, there is another extremely favourable factor for Brazil - the rise in commodities prices. Brazil is one of the major exporters of agricultural commodities, base metals and metal products. The surge in commodities prices has enabled Brazil to significantly improve its terms of trade(export prices / import prices) and boosted its trade balance as well as its exchange reserves. Whereas in the past, most of Brazil's debt was denominated in USD, the country is today a net creditor in USD which makes it much less vulnerable to changes in foreign investor attitudes.

Facing a certain number of challenges

While Brazil's economic success is based on relatively solid fundamentals, the country is nevertheless facing a certain number of challenges, the most important of which is infrastructure development. Despite its heavy tax burden, public spending in terms of investment is very low, as the major share of tax revenue is spent on current expenditure and social transfers, which safeguard the social peace and are usually required under the Constitution. Private investment is often discouraged due to the lack of credit, high intermediation costs and regulatory uncertainties. Moreover, using the private sector to develop infrastructure is often difficult to reconcile with an ideology that favours the continued control of the state. The World Cup in 2014 and the Olympic Games in 2016 should result in an increase in the investment component in Brazil's GDP. Currently this component is low compared to the other emerging countries, particularly China. On the other hand, theshare of private consumption is much higher in Brazil and in this respect the country is more like an industrialised country.

The potential for non-inflationary growth

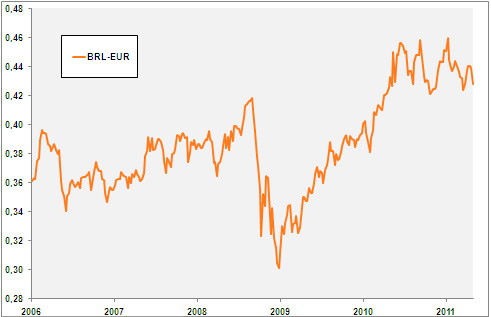

The lack of infrastructure and shortage of qualified labour are limiting the potential for non-inflationary growth, particularly as the high proportion of the private and public consumption component in GDP puts Brazil in a chronic situation of excess demand. With capacity utilisation rates close to their peaks and unemployment around 6% (which, taking into consideration the high proportion of undeclared activities, corresponds practically to a situation of full employment), the country runs the risk of overheating. In light of this situation, inflation could exceed 6.5%, which is the upper band of the range set by the central bank in 2011. The shortage of qualified labour is all the more problematic at the present time given that the country would need productivity gains to face up to the appreciation in the real. The real has been boosted by large capital inflows in the form of direct and financial investments, the latter in part attracted by high interest rates, both in nominal and real terms (adjusted for inflation). In a bid to combat the strength of its currency, the government has started raising taxes on equity and domestic bond purchases (2% and 6% respectively).

BRL/EUR exchange rate

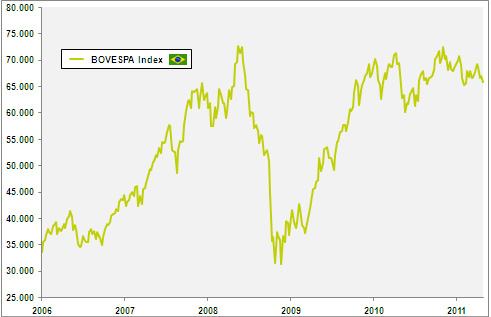

The evolution of the Brazilian stock market and interest rates

After a strong run between 2004 and 2007, the Brazilian stock market slumped by around 50% between May and November 2008, before staging a sharp recovery in March last year, which brought it back close to pre-crisis levels. Since then the index has lost around 10%. Three notable factors weighed on the market in 2010: the presidential elections, Petrobras' capital raising effort (the biggest rights issue ever) and monetary tightening by the Brazil Central Bank. While the impact of the first two factors has since disappeared,monetary tightening is still an issue as seen in the recent decision of the BCB to raise its key interest rate again. Since April 2010, the rate has risen from 8.75% to 12%. With real rates close to 6%, there is little incentive for local institutional investors to invest in equities.

BOVESPA index over 5 years

However, at 11 times estimated 2011 earnings and 1.7 times book value, the valuation of the Brazilian stock market is today relatively attractive in absolute and relative terms (i.e. compared to other emerging markets). As with most of the emerging markets, domestic opportunities are not really reflected in Brazilian indices as these are dominated by stocks such as Petrobras and Vale. In our BL-Emerging Markets fund, we are invested in four Brazilian companies: Lojas Renner (retail), M Dias Branco (food), Natura Cosmeticos (beauty products) and Weg (industry).