Emerging markets - a look beneath the surface

« If your goal is anything but profitability – if it’s to be big, or to grow fast, or to become a technology leader – you’ll hit problems. » (Michael Porter)

The first thing that comes to an investor’s mind regarding emerging markets is probably growth. Hardly surprising when one considers that since 2001, the emerging countries have been the lead growth engine in world GDP and have increased their contribution to it ever since.

Growth may not equal return

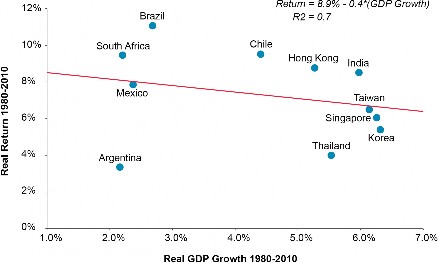

For this reason, emerging markets are sometimes perceived, or rather promoted, as an indispensable asset class in an investment portfolio. Growing faster and independently of the global macro-economic situation, the famous ‘decoupling’ from the developed world, is a very tempting and easy to communicate concept to justify investing in these markets. Unfortunately, the ‘marketing’ of emerging market equities often does not go beyond that single argument. Worse, data shows that there is no particular relationship between GDP growth and stock market returns, indeed the relationship may even be slightly negative.

Contribution of Emerging Countries in World Growth

Source: Morgan Stanley

Stock Market Returns and GDP Growth for Emerging Markets, 1980-2010

Source: GMO, MSCI, S&P, Datastream au 31/12/2010

Investors should therefore move away from the belief that GDP growth is synonymous with good returns. Far more important for stock market performance is company earnings. Inherently, growth is good, but only if it is profitable and sustainable. Unfortunately, profitability and sustainability often take second place, especially in fast growing economies.

Growth (good or bad) as a leitmotif for emerging markets might further encourage investors to simply buy into an emerging markets equity index to participate in the economic rise of this region. Doing so is perfectly legitimate, but investors should be aware of what they get when they buy the index. Many companies located in emerging countries are heavily geared to global growth rather than domestic growth and others are not very profitable.

Index investing in emerging markets: The Good, the Bad and the Ugly

To illustrate this point, let’s take a closer look at the composition of the MSCI Emerging Markets index, the most common benchmark for emerging market equity investments. This capitalisation-weighted index is heavily exposed (25%) to energy and commodity stocks. Companies like Gazprom (Russian gas company), CNOOC (Chinese oil & gas company) and Vale (Brazilian mining company) are major players in these sectors. The very nature of their businesses makes them more correlated to the industrialised economies than to the domestic growth story. Furthermore, these companies are highly cyclical and capital intensive as they incur high costs when exploring and accessing new oil reserves or excavating metals. Added to the high fixed costs is their weak individual pricing power.

Another 25% of the index is invested in the financial sector, mainly large banks from China and Brazil. Although banks are correlated to the domestic economy, we tend to avoid mega banks as they have many off-balance sheet items and are therefore difficult to value.

20% of the index is represented by industrial companies and companies operating in the IT sector. In the latter, Samsung Electronics and Taiwan Semiconductor Manufacturing Company are the heavyweights by far. While those two companies are very profitable due to clear competitive advantages such as leading technology, brand recognition or sheer size, they are exceptions rather than the rule.

Not limited to these sectors, companies from the emerging markets too often compete solely on price. In the past decade, lower labour costs have helped them to win market share, but things are starting to change. Minimum wages in China are on the rise and some labour-intensive and low value-adding companies already have to migrate to cheaper production countries like Vietnam or Bangladesh. This will not be a viable business strategy in the long term. In the absence of more sustainable competitive advantages, these companies will see their margins squeezed by higher operating costs as they do not have the pricing power to pass on these additional costs to the customer.

Some 15% of the index is represented by the telecommunication and utility sectors. While barriers to entry are generally high in these sectors, companies and profits are nevertheless at the whim of politicians. China Mobile and America Movil, the two largest telecommunication companies in the index, have experienced or are experiencing political willingness to open up the market thereby challenging their supremacy. Their competitive advantage may therefore not be sustainable.

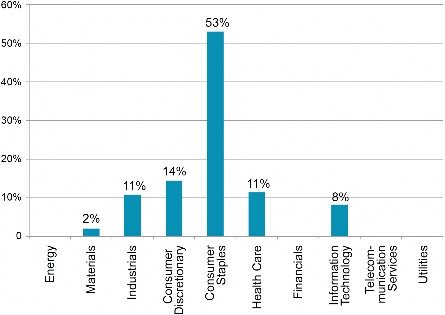

Finally, only around 15% of the MSCI Emerging Markets index is invested in the consumer (discretionary and staples) sectors, and thus linked to the secular theme of the rising middle class in the emerging markets. This rather low allocation contrasts with our BL-Emerging Markets fund’s (ISIN: LU0309192036) current 67% exposure to those sectors within the equity portion.

While not all companies from the consumer sector are worthwhile investments, there are many that meet our investment criteria.

In defense of active management

At BLI, we adopt a long-term investment approach and consider ourselves owners of the companies we invest in. Emphasis is therefore put on the quality and the viability of each firm. Before investing, we ask questions like: Does the company have the necessary competitive advantages to remain profitable and defend its margins? Is this a business I would be comfortable to hold for the next five to ten years? What is the cash generation capability of the firm? And finally what is the company worth? Because even the best quality business can be too expensive – in accordance with Warren Buffett’s famous quote: “Price is what you pay. Value is what you get.”

Consumer companies like Natura Cosmeticos, a Brazilian cosmetics company, have a very strong local brand that ensures them customer loyalty and pricing power. Anadolu Efes, a Turkish brewery, has a dominant market share of over 80% in Turkey allowing the company to fend off new entrants into the beer industry and defend its margins. Want Want China, a Chinese packaged food producer, caters adored niche products to local consumer tastes. Deep-rooted companies like these have been operating locally for decades via far-reaching and efficient distribution networks. They are highly profitable due to their competitive advantages.

Sector Allocation for the Equity Portion of BL-Emerging Markets

Source: BLI as of 31/05/2013

These companies are not only profitable, but also enjoy strong growth. They are directly exposed to local consumers and are the immediate beneficiaries of a rising middle class. As consumption for various goods tends to accelerate after disposable household income reaches a certain level (Engel curves), quality consumer companies are ideally positioned for the years to come. Indeed, many emerging countries have just entered this acceleration phase.

| Share Class | A | B | C |

| Currency | EUR | EUR | USD |

| Acc/Dis | Dis | Acc | Acc |

| ISIN | LU0309191905 | LU0309192036 | LU0887931029 |

At BLI, we believe that stock-picking is the way to add value in every geographic region and emerging markets are no different from the US, Europe or Japan. In the end, it is not GDP growth that will determine investment returns, but the success or failure of the individual companies that make up the portfolio. Index investing might be an option, but you run the risk of not getting what you are looking for.