Oil and its repercussions

Recent events have reminded investors of the fragility of many countries that belies their appearance. At the time of the emerging markets' correction in the early weeks of December 2014, the JPMorgan emerging markets sovereign debt index in dollars fell by 5.6% while the index denominated in local currency plummeted by nearly 8%.

Strong demand...

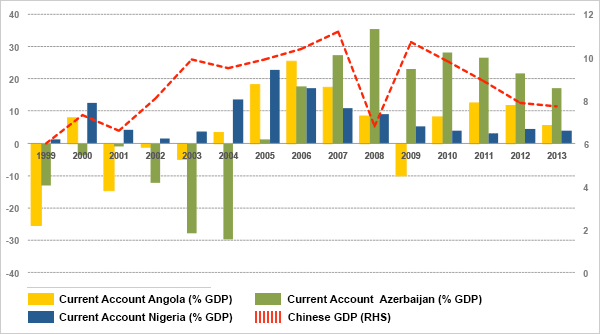

Recent events have reminded investors of the fragility of many countries that belies their appearance. At the time of the emerging markets' correction in the early weeks of December 2014, the JPMorgan emerging markets sovereign debt index in dollars fell by 5.6% while the index denominated in local currency plummeted by nearly 8%. Oil-producing countries were particularly hard hit. Back in March 1986, the WTI crude price in New York traded at around 10 dollars per barrel. Since the beginning of the 2000s, with the emergence of China, the oil price – in common with other commodities – rose to ever higher levels. Between 2003 and 2013, China saw its oil consumption almost double to 10.7 mb/d. Initially, as the following graph shows, the producing countries saw a sharp improvement in their public accounts and the various powers in place managed to maintain their position without embarking on the necessary reforms for their continued development. During these years of strong demand, global consumption of oil increased from 80 mb/d in 2003 to 91 mb/d in 2013. From Africa to the Middle East, massive projects saw the light of day: in Dubai, the Burj Khalifa was inaugurated in January 2010, hot on the heels of the Palm Islands project. In Baku, the Flame Towers were completed in 2012 – the physical embodiment of Azerbaijan's grand urban ambitions for its capital. Meanwhile, in Africa, China's oil diplomacy has stamped its mark throughout the continent with major infrastructure projects from Nigeria to Angola: rehabilitating the 1,300 km railway linking the port of Lobito in Angola to the city of Lubumbashi in the Democratic Republic of the Congo, financing oil pipeline projects in Sudan, etc. In Brazil, the public companyPetrobras, now in the dock for corruption issues, is engaged in further exploration particularly for ultra-deepwater pre-salt reserves. Its objective to double its production by 2020 requires massive capital expenditures and considerable debt.

China's growth vs. current accounts

Source: Bloomberg

... followed by an inevitable fall

But since the beginning of 2014, the foundations of this unprecedented increase in oil prices have started to erode. Even before then, in May 2013, Ben Bernanke announced the tapering of the Federal Reserve's quantitative easing policy that had been put in place in the wake of the collapse of Lehman Brothers. The markets then started to anticipate an interest rate hike in the US. Capital repatriation began and the currencies of emerging markets started to depreciate. In January 2014, Argentina devalued its currency, followed by Kazakhstan in February. More recently, in November, it was Nigeria's turn to try and stabilise the naira. All these economies are facing a haemorrhage of their foreign exchange reserves. At the same time, there is also a question hanging over a support for commodity prices to increase, i.e. Chinese growth. The oil price has been tumbling since the middle of 2014. At its last meeting on 27 November, Opec lit the fuse by refusing to cut production and maintaining its output quota of 30 million barrels per day. On 6 January this year, for the first time since April 2009, West Texas Intermediate (WTI) closed below $50. Remember that its all-time high was $145.29 in July 2008...