Sustainable and Responsible Investing at BLI 2.0

In 2008, when BLI launched its first sustainable investment fund, the industry was not yet focused on sustainable and responsible investment thematic in the same way that it is today. An increased awareness of climate change and social inequalities has certainly contributed to the change of mind amongst institutional investors, asset managers and society at large. Moreover, the Paris Agreement, alongside the European regulatory action plan, proves the importance that is placed on taking into consideration the needs of multiple stakeholders when investing today.

In 2020, assets in sustainable funds hit a record high with global inflows up 14% in the third quarter [1]. Current events, led by the global health crisis, racial protests as well as this year’s wildfires in the Amazon, California and Australia have accelerated the momentum, showcasing the importance of environmental and social challenges we are facing as well as of the need for strong governance frameworks at country and company level. Naturally, the level of sophistication in the reporting and inclusion of non-financial data varies between geographies, sectors, size and asset classes, but a common awareness for the urgency to act can be witnessed on a global scale. Extensive non-financial reporting, including the alignment of a company’s business model with the Sustainable Development Goals (SDG), is slowly but surely becoming the norm. The same holds true for investment strategies combining financial and extra-financial factors, which are placing the focus on companies ready for tomorrow’s challenges.

The learning curve

Concentrating on the long term has always been at the heart of BLI’s investment philosophy. In that respect, we focus on companies and bond issuers committed to the creation of sustainable long term returns and that respect not only the financial interests of shareholders (or creditors in the case of a bond investment) but also those of employees, suppliers, customers, communities and the environment.

When our first general ESG policy was published in 2017, ESG analysis was primarily a way to mitigate the risks of our portfolios. The focus was on identifying and avoiding the ‘bad apples’, mainly through the exclusion of the most controversial companies. This global approach was coupled with specific sustainable investments such as microfinance or via the BL Sustainable Horizon, BLI’s flagship SRI equity fund.

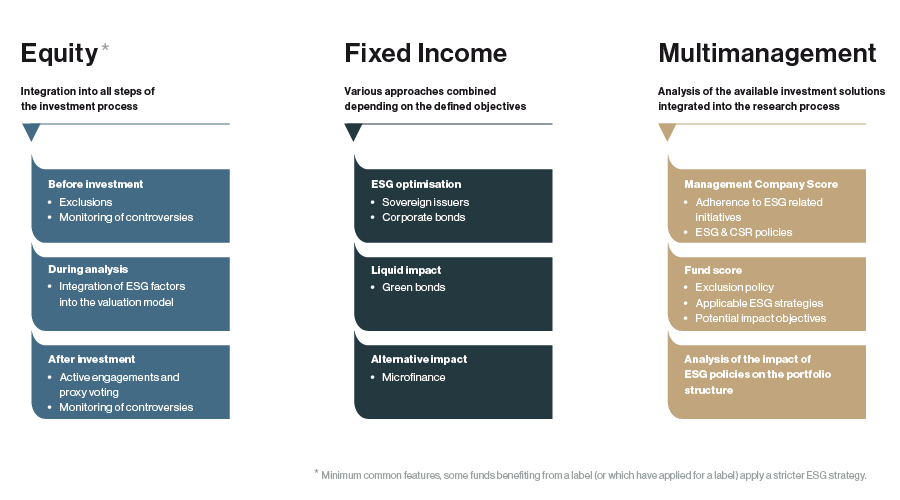

Since then, we have expanded our scope to every asset class managed by BLI. The approaches are specific to each of the asset classes and have been implemented in a progressive manner. Therefore, the ESG dimension now takes a more valuable role, from the pre- to the post investment stage. This constitutes a logical next step to our long-term oriented, conviction-based investment principles.

New developments

The new sustainable and responsible investing policy is anchored around all 3 asset classes and encompasses different levels of implementation in line with our long-standing investment principles:

I. Equities - Business-Like Investing means adopting an entrepreneurial view when taking an active, long-term stake in a company

Before a position is initiated, investment candidates are analysed in accordance with the various international conventions, and all companies active in the production of controversial weapons are excluded from the investment universe. Furthermore, BLI performs a qualitative in-house analysis on issuers subject to severe controversies, i.e. substantial ESG-related events that could affect a company’s business model, reputation and thus BLI’s investment case.

The fundamental analysis is of utmost importance in identifying and quantifying the strength of a company's competitive advantage and assessing its long-term potential. The systematic ESG integration takes place at the level of the valuation model via an adjustment to the cost of equity. In practice, this means that a company with a solid ESG profile will be attributed a lower cost of equity, which in turn leads to a higher fair value whereas an ESG laggard will be penalized with a proportionately higher cost of equity and hence a lower intrinsic value.

Being active owners, we enhanced our engagement efforts through a gradual move towards a more formalised process. Engagement consists of a constructive dialogue between institutional investors and investee companies to discuss how they manage ESG risks and assess business opportunities associated with sustainability challenges. In addition, we vote on sustainability subjects at our investees AGMs.

This integration of ESG factors into the core of the valuation process underlines the gravitas given to the sustainability dimension.

II. Fixed income - Search for issuers engaged in a virtuous circle of stable or improving quality and lower cost of debt

Bonds are often considered a better asset class to generate impact. Sustainability criteria can be taken into account in different ways within a bond investment strategy, i.e. on a stand-alone basis or in combination.

A first step is what we call “ESG optimisation”, whereby ESG factors are taken into account when analysing and selecting individual issuers. This approach can be applied to both sovereign and private issuers. For the sovereign part, BLI has developed its own in-house score to optimise the portfolio, looking to achieve a better ESG score when compared to a representative index.

A second step concerns the so-called “Impact investments”, i.e. investments made with the goal to generate a positive social and/or environmental impact in addition to the financial return. We distinguish two kinds of impact investments:

- Green bonds are debt securities whose sole purpose is to finance projects with an impact on climate change adaptation and mitigation, as well as other sustainability-generating projects.

- Microfinance investments’ objective is to provide people, communities or small businesses with access to financing – mostly in less developed countries in order to reach the poor and excluded and offer them a way to finance their projects.

III. Multi-management - Identifying third party funds corresponding to quantitative and qualitative requirements

A large spectrum of ESG investing strategies exists, with asset managers considering ESG to varying degrees because of different investment styles or their level of experience and of resources dedicated to this area. Our ambition is thus to analyse these asset managers and their respective funds in their own right. The multi-management team has created a questionnaire that serves as a reference point to showcase how the asset manager is positioned in terms of sustainable investing, what its philosophy entails and which concrete actions it has put in place in the investment and decision making process. The answers to the questionnaire will also determine whether a fund is eligible for investment in the newly launched fund, the BL-Fund Selection Smart Evolution.

Acknowledging the challenges

Evidently, the consideration of extra-financial data in the investment process is not free from challenges. As a small asset manager, we apply a best-effort approach. As many before us have noted, the industry is still lacking overall consistency in data and reporting, leading to gaps in the availability and quality of metrics reported. This gap will be partly addressed by the EU regulation and is as such not something we as asset manager can address alone apart from encouraging companies to disclose relevant metrics via our active ownership efforts. However, we also believe that not all shortcomings can be blamed on the data. Notable, meaningful progress is nonetheless possible.

ESG remains a subjective area when making investment decisions. For example exclusions, whereby one prevents the securities of a company from being included in a portfolio because its business activities are deemed unethical and detrimental to the company and community at large, depend among other on country specific contexts as well as someone’s upbringing and values. In this regard, we do not pretend to have all the right answers at hand, which is why we chose to apply exclusions in line with international standards, while leaving further exclusions at the discretion of each fund manager.

ESG in its current state constitutes an exercise of learning by doing, demanding new competencies from financial professionals. Strategies are subject to change as we gain further insight.

Lastly, we note that new trends weigh heavily on the industry and in some cases lead to a certain trend-following behavior or worse greenwashing. As such, a notable increase in valuations of so-called prime ESG securities has been observed in the market. We therefore continue to apply our proven principles whereby the price paid determines the return.

Concluding thoughts

It is evident that the state of the world cannot radically be changed at once. Sustainable and responsible investment practices are useful to take incremental important measures in the right direction. That means looking for companies whose business model differs from others in so far as to reduce negative environmental and social externalities and enable positive ripple effects. Good intentions are not enough; measures should be based on solid foundations, clear principles, as well as explicit and achievable objectives both by the companies we invest in and ourselves as investors.

By signing the United Nations Principles for Responsible Investment (UN PRI) in 2017, BLI has made a long-term commitment. Three years later, we are convinced that we have taken the right direction and are continuing our efforts in this regard. However, we do not aim or claim to become a “green investor” par excellence. By trying to be everything to everyone we would most likely miss the mark, not take valuable actions and weaken what we do best. Instead, we are taking a step-by-step approach by building on our strong framework.

Sustainable and responsible investment is in constant evolution, still trying to find out what it wants to be – an additional layer of risk management, a tool to save the world or something in between? We are in the midst of the discussion and look to contribute to answering the question.

Link to BLI SRI Activity Report 2020

_________________

[1] Global Sustainable Fund Flows: Q3 2020 in Review, Morningstar