The power of dividends

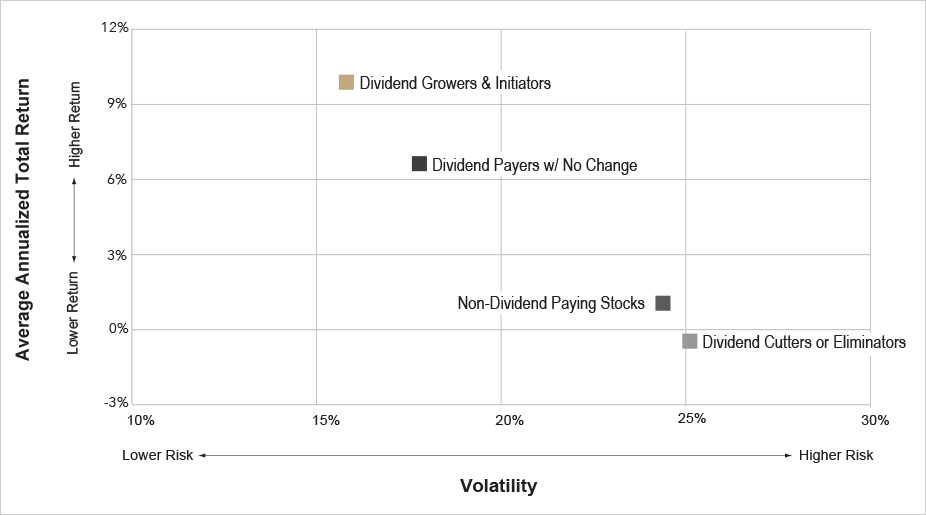

Over the last 45 years, shares of dividend-paying companies have generated a much higher average total return (price change and dividends reinvestment) than non-payers. In addition, they have been significantly less volatile.

Volatility and average annualised total return of S&P 500 shares between 1972 and 2016, according to their distribution policy

Source: Ned Davis Research, 2017

In this article, we intend to highlight the key factors that lie at the root of these better results.

We will then identify what leads us to believe that the dividend strategy, always important, is now more critical than ever for investors in equities.

Lastly, we will describe how this strategy is deployed within our fund, BL-Equities Dividend.

Reasons for success

N'Golo Kanté

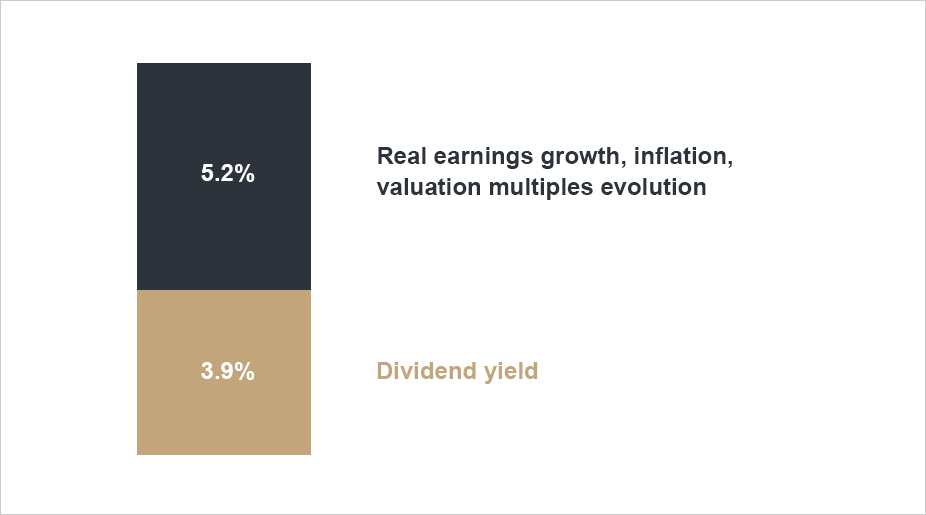

Between 1930 and 2016, on the US market, the dividend yield alone contributed to almost half of the total return from equities.

“Really?!” In fact, the dividend is what you could call the N’Golo Kanté of the total return from equities. Newly elected as English Premier League Player of the Year by fellow players, he is the first footballer in history to be crowned champion in England for two successive seasons at two different clubs (little Leicester City FC in 2016 then Chelsea this year). Yet he is considerably less well known among the general public than the flamboyant Ronaldo or Neymar. He may not be the element who first comes to mind but is nevertheless the one you can count on, season after season, solid, working in the shade, unfailingly delivering his decisive contribution to the team’s performance, the one you turn to when things are going badly.

S&P 500 total return breakdown between 1930 and 2016

Source: Ned Davis Research, 2017

“Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1.” Warren Buffett

The dividend becomes critical in difficult market conditions.

Historically, when markets took a serious tumble, the shock was a lot more contained for shares offering an attractive dividend yield. In fact, a decent yield from a sustainable dividend represents a safety net in difficult markets. This constitutes a psychological advantage that reassures investors and a mathematical advantage given the asymmetry between loss and gain: if a share’s price plummets by 50%, it has to “regain” 100% – not just 50% – to get back to its initial price, hence the importance of better absorbing market falls.

In the midst of the current stock market euphoria, we should bear in mind that the S&P 500 has seen 25 bear markets (falls of over 20%) since 1929, an average of one every three and a half years.

“Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn’t... pays it.” Albert Einstein

Dividend-paying shares combine several advantages: a potential capital gain that is theoretically unlimited as it is linked to the fundamentals of the underlying company (unlike bonds which, if held to maturity, are repaid at par), on top of which there is income from the dividend.

As there is also potential for the dividend to grow (unlike the fixed coupon on a bond), the potential for compounding through reinvestment is all the greater.

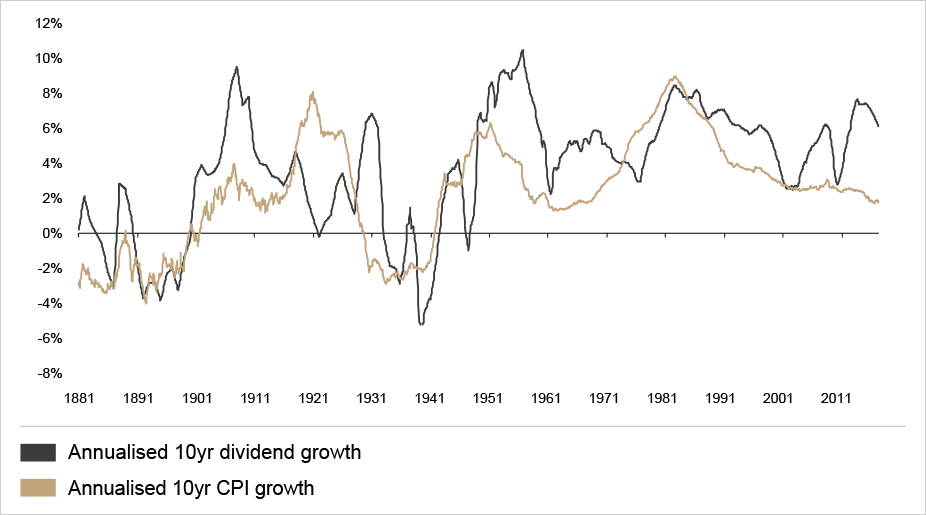

Historically, therefore, the dividend has tended to offer some protection against inflation.

Dividend growth and inflation in the United States

Source: Société Générale

“It is better to have a permanent income than to be fascinating.” Oscar Wilde

Better results from dividend-paying shares are also undoubtedly helped by the fact that a long uninterrupted history of dividend payments reflects not only a company's wish but also its capacity to reward its shareholders, especially as confidence is a crucial element on the financial markets. Indeed, paying a regular, attractive and increasing dividend requires strong cash flow generation and the capacity to grow profitably.

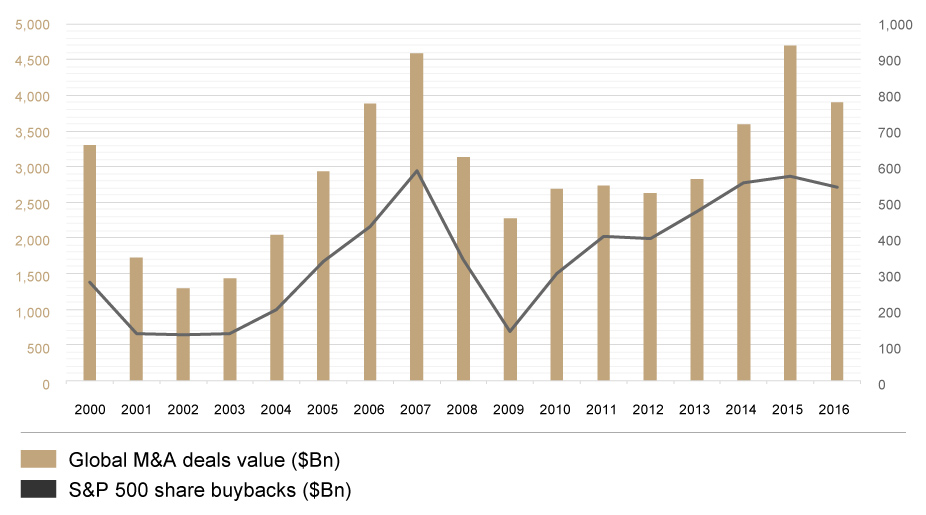

Moreover, a regular dividend payment policy (publicly reported) requires the directors to demonstrate rigour and discipline in the company’s management, debt control and capital allocation (i.e. avoiding projects with weak economic profitability, acquisitions that destroy value or share buybacks that are too highly priced and which only benefit shareholders who are jumping ship). Any cut or elimination of the dividend amounts to publicly admitting problems to investors, competitors, the media, etc.

Questionable timing of companies regarding M&As and share buybacks, mainly conducted at market peaks, which could build the case for dividend distribution

Source: Dealogic, Standard & Poor's, BLI

Dividends and prophesies

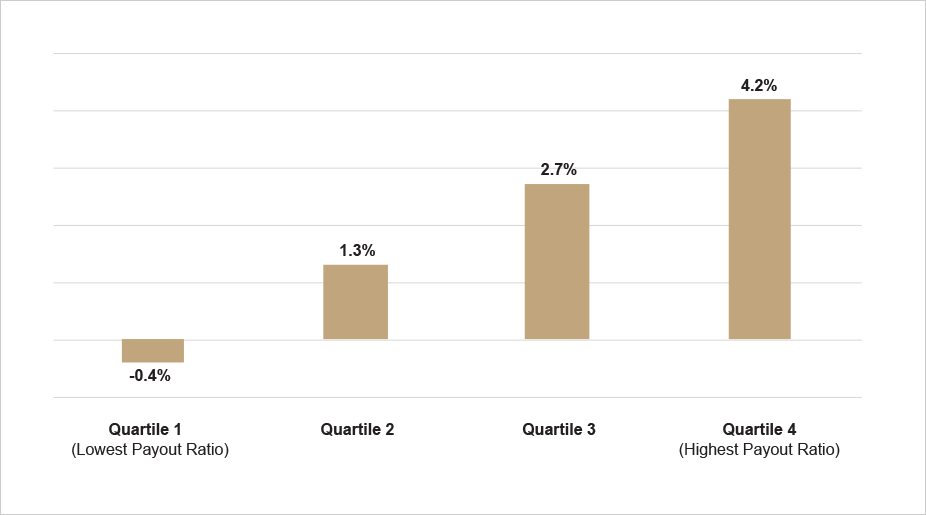

More strongly still, the dividend distribution policy provides key indicators for the company’s future health. A survey by Robert D. Arnott and Clifford S. Asness on the companies comprising the S&P 500 proves that the higher the payout ratio (the proportion of earnings paid out as dividends to shareholders), the greater their real growth in earnings will be in the coming years (and vice versa). This can be explained by the directors’ level of confidence as, having detailed inside information, they model the payout ratio according to future prospects.

This survey invalidates the widely held view that an extremely high reinvestment of earnings (and therefore a low payout ratio) necessarily leads to higher future growth.

Payout ratio and real earnings growth in the next 10 years for S&P 500 companies, based on their distribution policy

Source: Surprise! Higher Dividends = Higher Earnings Growth. Robert D. Arnott and Clifford S. Asness. 1946 - 1991

Each to their own

The dividend also offers institutional or private investors the freedom to reinvest it how they want without having to sell shares. They can put it back into the company from which it came, into other companies, or hold it as cash for prudence or any other reason.

Dividends do not lie

Although investors always look closely at net income, it is a much less reliable indicator than the dividend. Apart from “creative accounting” at some companies (e.g. Enron, Tyco, Parmalat, Lehman Brothers, Olympus, Autonomy, Tesco, …), net income can sometimes be contaminated by other factors that do not necessarily reflect the company’s fundamentals (an evolution in its amortisation and depreciation policy, a change in the level of debt or the cost of debt, a new corporate tax rate, exceptional income, or a plethora of new accounting standards), whereas the dividend represents an outflow of real cash into the pockets of shareholders (large and small alike, which helps aligning their interests).

Given the structural nature of all these factors, the higher risk-adjusted performance of shares paying attractive and sustainable dividends should persist.

"Gimme Shelter!" The Rolling Stones

Unless they have been living on another planet in the last few years, all investors have to face the difficulties of the quest for yield. Indeed, the risks incurred no longer tend to be remunerated on the bond markets as they have hit the buffers after over 30 years of rising prices. In this environment, carefully selected dividend-paying equities can be a safe haven.

In addition, global equity markets still offer quite attractive dividend yields, despite generally high valuations leading to an expected return below the historical average. Accordingly, the dividend contribution should automatically be greater in future years.

What’s more, as noted above, the lower volatility and the relatively defensive nature of dividend-paying shares should constitute an advantage in this environment.

At the same time, with an ageing global population, the popularity of dividend-paying stocks should hold up given the fact that older people generally have a higher need for income coupled with a lower risk tolerance.

BL-Equities Dividend, Great Companies, Quality Dividends

“There are two times in a man's life when he should not speculate: when he can't afford it, and when he can.” Mark Twain

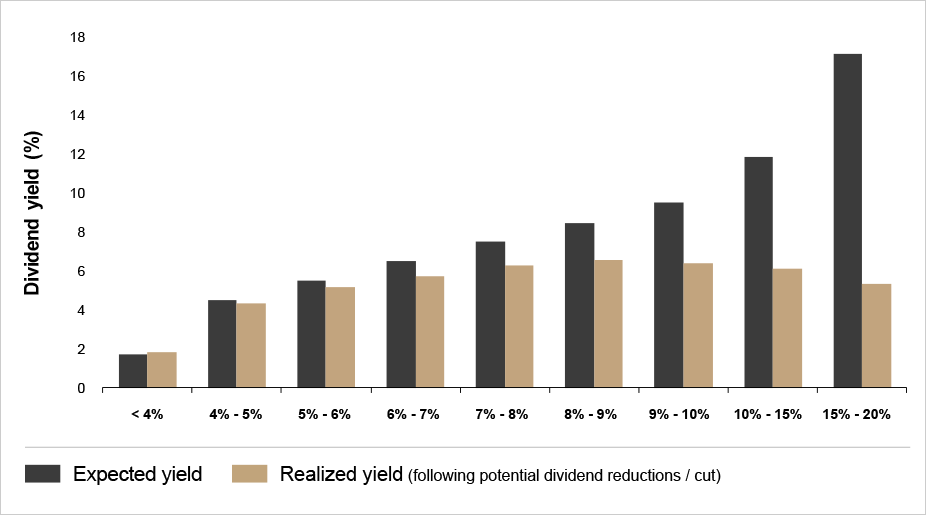

In BL-Equities Dividend, we start by looking for high-quality companies, then we pick those that offer attractive and sustainable dividend yields. We do not look for the highest yields posted in the major equity indices and then subsequently try to pinpoint the merits of the companies in question (which often fail to deliver the expected yield in the end).

We do not echo the sectors or geographic splits of indices, nor do we diversify into lesser quality; we simply try to hold for the long term the companies that we consider to be the best in the world, at reasonable prices.

Expected dividend yield VS actual dividend yield in the FTSE World (January 1995 - April 2017)

Source: Société Générale

“Quality is not an act. It is a habit.” Aristotle

By “quality”, we refer to companies which successfully escape the gravity of competition: companies whose competitive advantages / entry barriers are so powerful that they enable very high profitability and cash flows to be generated over long periods. This allows them to reinvest to extend their advantages over their rivals and continue to grow very profitably (the value of compound interest again) as well as pay attractive and sustainable dividends in a virtuous circle.

On average, the companies currently held in our fund were founded in 1949 and many of them have increased their dividend year after year for several decades, which gives some idea of the robustness of their business models…

Although we cannot tell where the market will be tomorrow or the day after tomorrow, we remain convinced that selecting high-quality companies and then applying our strict dividend filter should lead to an attractive risk-adjusted performance over the long term.

Return on capital employed

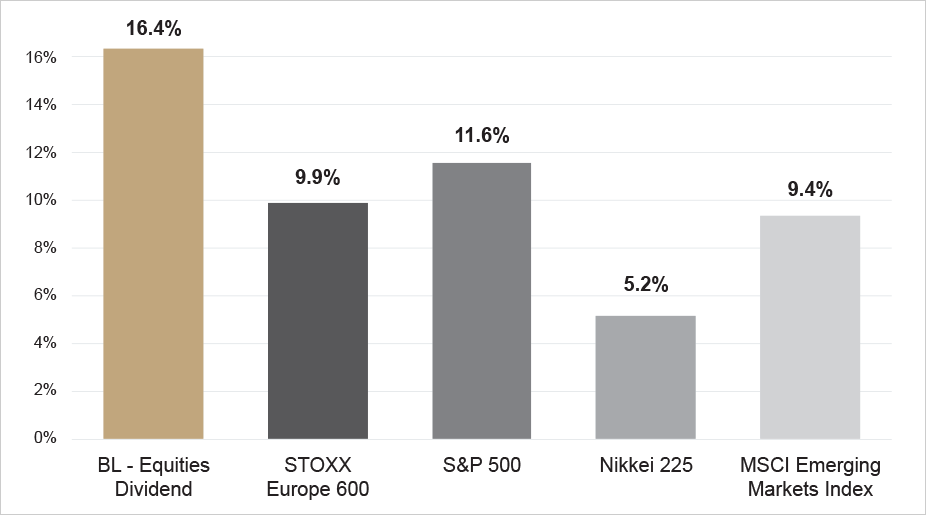

BL-Equities Dividend VS main equity indices

Source: Bloomberg, BLI