How do large caps and multinationals fit into a sustainable portfolio?

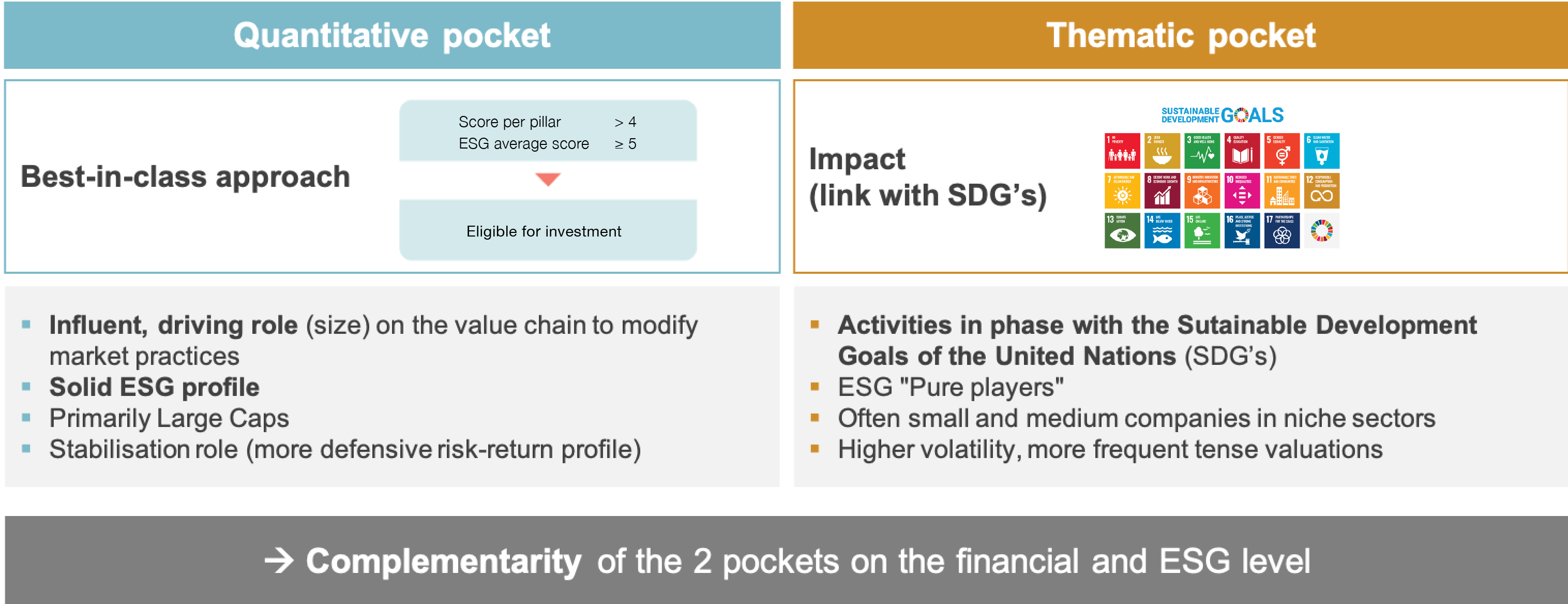

After the success of our last article, highlighting the thinking behind the impact-oriented thematic pocket of the BL Sustainable Horizon fund, it is only fitting to put its ESG-optimised counterpart in the spotlight in this installment of the series.

The so-called quantitative pocket won its place in the fund for two reasons that both relates to wider sustainability considerations in their own respective ways:

- The applied best-in-class approach is particularly appropriate for screening large cap companies that are not always intuitively viewed as particularly sustainable or impactful. While large caps generally benefit from higher third-party ESG ratings, which tend to be based on transparency and processes related to the management of ESG risks, they also face greater media scrutiny if things go wrong. The more complex and diversified nature of their business models and value chains can obscure the positive impact these behemoths can have on the overall economy. Thus, filtering for the ESG leaders within a universe ensures the inclusion of quality companies with a solid sustainability profile in the fund. In terms of the sustainability profile, the chosen companies are either enablers of change thanks to their sheer scale, reach and thus influence across the whole value chain or provide essential products used globally by millions every day all the while presenting best ESG practices in their own operations.

Our reasoning is that, having the necessary capital and resources available to prioritise sustainable operations throughout the value chain, they can act as drivers of change: these companies have the power and weight to shift market practices given their size, reach and influence up-and downstream.Annick Drui, fund manager at BLI - Banque de Luxembourg Investments

- The second benefit is linked to the fund’s risk-return profile and the complementarity the quant pocket can offer next to the thematic pocket. Sustainability goes hand in hand with longevity and moral behavior towards all stakeholders including clients and as such the protection of our investor’s capital. We deem it sensible for the long term to offer a fund that looks to diversify across sectors, geographies, market caps and sustainability profiles in order to avoid a loss of diversification, incur increased volatility or risks from sectoral biases for example.

What good looks like - Enablers of change & essentials

How are these large companies driving large-scale change today for a more sustainable future? In order to give a tangible view let’s look at some examples from the current portfolio across the 3 categories Environment, Social and Governance.

On the environmental side we are for example going to find companies that assist their clients in the energy management & efficiency departments. Via their product and service offerings they allow their customers to operate using fewer resources and in turn abate emissions. Naturally we tend to find companies fitting this description in sectors such as industrials and materials.

Let’s illustrate with Air Liquide. When we say Air Liquide, we certainly think about large industrial gas production sites, heavy trucks and cylinders serving large industries such as chemicals, refining, metallurgy. But Air Liquide does much more behind the scenes and is active in the production of hydrogen in order to facilitate the energy transition and also in the fields of health and electronics. Indeed, semiconductors, cells for solar panels and our flat screens depend on industrial gases supplied by Air Liquide, which is also a supplier of medical gases for hospitals and at home care. The enabling quality of the company is coming from the contribution it provides to the upgrade of critical infrastructure and the retrofit of various industries to make them more sustainable i.e. increasing resource use efficiency and adopting cleaner and more environmentally friendly technologies across industrial processes. Specifically, Air Liquide together with its clients have saved 11 million tons of CO2 [1] equivalent emissions. Industrial gases reduce the sulfur content of fuels and lighten heavy hydrocarbons for refining customers, improve energy performance for metallurgy customers and enable advances in mobility and connectivity for electro customers.

The enabler of change can also catalyse a positive shift from a social point of view, namely by providing access to healthcare. An example here would be Novo Nordisk, the Danish healthcare company, focuses on the management of diabetes through various insulin delivery systems, obesity and other serious chronic diseases. In addition to the evident health and well-being benefits its products provide, the company launched the Base of the Pyramid Programme in 2010 which seeks to identify innovative and sustainable solutions to support the diagnosis, treatment and control of diabetes for the working poor living at the base of the economic pyramid. The programme has been extended to many countries over the years to include 76 low- and middle-income countries and lowered the price ceiling of human insulin to USD 3.00 per human insulin vial [2]. In addition, the company is transparent on its strategic targets and measures progress in this regard as well as linking exec compensation to the Defeat Insulin and long term social objectives.

Lastly, companies providing access to data and developing software and tools used at board and management level, enable strategic decisions to be made with sustainability considerations in mind. Technology related sectors make up the bulk of this segment. A company that fits this narrative is for example SAP. Digital technologies and modern enterprise software enable organizations and corporates to build resilient operations and sustain their supply chains. SAP develops integrated management software enabling its customers to manage all their activities, from accounting and human resources management to logistics. The company enables its customers to transform their data into actionable E, S and G measures. On the environmental front, SAP offers data collection and analysis solutions that enable companies to calculate and reduce their environmental footprint, particularly with regard to energy consumption, water use, waste, and thus promoting circularity. On the social front, SAP helps to ensure employee safety, measure employee satisfaction, and promote ethical sourcing throughout the value chain. On the governance front, SAP helps mitigate fraud risk and ensure business continuity by quickly identifying anomalies, screening business partners and verifying compliance with regulatory standards.

On the other hand, we have companies providing essential products related to consumer staples & discretionary stock picks.

The consumer staples & discretionary sector may be somewhat more controversial as media coverage of controversies is undeniably greater and the brands/products are simply more recognizable as they are present in our homes. Several main topics that come to mind, are deforestation and reliance on palm oil, or child labor on cocoa fields and the like, exploitation of local communities for water wells or of smallholder farmers, unnecessary amounts of plastic packaging and the list goes on. These are all serious issues and we are committed through our investments and dialogues to at best avoid bad apples and alleviate problems or at a minimum not exasperate the situation. As a society we cannot and will not stop consuming these products and with a growing population and ever more people gaining purchasing power we cannot even reasonably expect demand for essentials to go down, hence companies that look at their own production processes and reduce, reuse, recycle where possible and treat employees with care will come out as winners in the long term and are precisely the companies we are looking to invest in.

These companies need to be role-models and pave the way. Their size is both an opportunity (if they do not have the resources and tenacity to make sustainable development work on a global scale in a interconnected world, who will?) and a hindrance at the same time, as it may take longer to steer a big company in a sustainable direction. Yet for those willing to make a meaningful transition, we are willing to support them on their journey.

How do we then separate eligible from ineligible candidates? By screening for involvement in controversies, performance on fund’s impact indicators [3], but also more qualitative aspects such as the culture and how genuine sustainability is seemingly integrated in the business-as-usual. By reading the reports and listening to interviews, we get the view of the company in their own words. The latter should not be taken lightly, communication can be a strong indicator of a company’s culture, vision and sustainability profile. We distil where possible what percentage of revenues can be attributed to sustainable activities and if on the contrary detrimental business lines exist that face reputational and financial risks long term.

A good indication could also come from the revenue portion of B Corp [4] brands within a company. Danone in the portfolio stands out in this regard, having over 50% of global net sales B Corp certified, one of which being the world’s biggest B Corp namely Danone North America. Former CEO Emmanuel Faber was a big proponent of aligning the business interests with those the company ultimately serves and said that the B Corp certification is a way for Danone as a company to be closer to what they aspire to be as individuals. Under the new leadership the ambition to be the first multinational to be certified as a global entity by 2025 remains. The integration of sustainability in the culture is evident at Danone, one reason why it occupies a leading position in the access to nutrition [5] global index, scoring highest on the health and nutritional quality of its products by having 90% of sales stem from healthy products, 81% of volumes are without added sugars or 88% of volumes within Nutri-Score A or B [6].

In the end

From our experience there is more ambiguity and room for discussion when it comes to the sustainability profiles of the selected companies in the quant pocket as these big names evoke personal experiences and feelings (positive or negative) in each one of us. We have all read negative or sensational news coverage relative to these companies and harnessed our own preferences when it comes to branded products we use in our day-to-day lives. Therefore, one first helpful element in the analysis is to have recourse to third party ESG scores and define minimum thresholds for inclusion. Secondly, understanding the ins and outs of a company’s business and applying the Business-Like Investing mentality to include sustainability, we can determine the edge a company has over its competitors when it comes to its sustainability practices. This edge can stem from various sources as we have discussed and we find companies that benefit a more sustainable future in all sectors, as they are enablers of change across the supply chain or companies that provide essential products.

If you are curious about other parts of the series, please follow the links below:

- Investing with the Sustainable Development Goals in mind – BL Sustainable Horizon perspective

- SRI Activity Report 2021

- Video dual approach

______________

[1] https://www.airliquide.com/sustainable-development/environmental-data

[2] https://accesstomedicinefoundation.org

[3] Emissions intensity, SBTi target, severe HR controversies, independent & female board members.

[4] The B Corp Certification measures a company’s entire social and environmental performance. The B Impact Assessment evaluates how a company’s operations and business model impact its workers, community, environment, and customers. From the supply chain and input materials to charitable giving and employee benefits, B Corp Certification proves a business is meeting the highest standards using business as a force for good.

[5] https://accesstonutrition.org

This document is an advertising communication and intended generally for qualified institutions, financial intermediaries and professional investors. It refers directly or indirectly to one or more financial products (the "Financial Product"). The economic and financial information contained in this publication is provided for information purposes only on the basis of information known at the date of publication. This information does not constitute investment advice, an investment recommendation or a solicitation to invest and should not be understood as legal or tax advice. No warranty is given as to the accuracy, reliability, timeliness or completeness of this information.

BLI - Banque de Luxembourg Investments ("BLI") draws the attention of any recipient of this document on the need to use with the utmost caution all information relating to a Financial Product, in particular that relating to the performance of such Financial Product:

- Where applicable, any scenarios relating to future performance presented in this document are an estimate of such future performance based on past data relating to the values of the Financial Product and/or current conditions. They are not an exact indicator and other factors relating to market developments and the length of time the Financial Product has been held should be taken into account.

- Conversely, the past performance of the Financial Product does not prejudge the future performance of this Financial Product.

BLI does not assume any responsibility for the future performance of these Financial Products and will not be liable for this information or for any decision that an investor may make on the basis of this information. Interested persons should ensure that they understand all the risks inherent in their investment decisions and should refrain from investing until they have carefully assessed, in collaboration with their own advisors, the suitability of their investments to their specific financial situation, in particular with regard to legal, tax and accounting aspects. They must, moreover, take into account all the characteristics and objectives of the Financial Product, in particular where it refers to sustainability aspects in accordance with Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability reporting in the financial services sector. Subscriptions are only permitted on the basis of the current prospectus, the latest annual or semi-annual report and the Key Investor Information Document (KIID) (the "Documents"). The Documents are available free of charge from BLI at any time. All of the Documents, including the sustainability information, are available on BLI's website at www.bli.lu.

Any reproduction of this document is subject to the prior written consent of BLI.

Author

Annick Drui, Fund Manager, info@bli.lu; 11 April 2022, 15:00

The author of this document is employed by BLI - Banque de Luxembourg Investments, a management company authorised by the Commission de Surveillance du Secteur Financier Luxembourg (CSSF).